Answered step by step

Verified Expert Solution

Question

1 Approved Answer

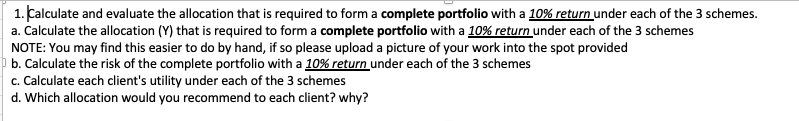

1. Calculate and evaluate the allocation that is required to form a complete portfolio with a 10% return under each of the 3 schemes. a.

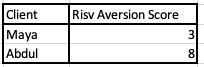

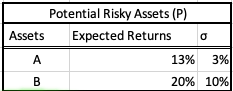

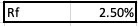

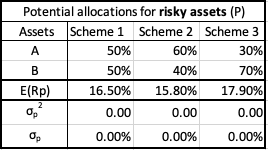

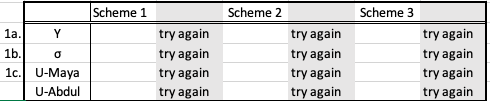

1. Calculate and evaluate the allocation that is required to form a complete portfolio with a 10% return under each of the 3 schemes. a. Calculate the allocation (Y) that is required to form a complete portfolio with a 10% return under each of the 3 schemes NOTE: You may find this easier to do by hand, if so please upload a picture of your work into the spot provided b. Calculate the risk of the complete portfolio with a 10% return under each of the 3 schemes c. Calculate each client's utility under each of the 3 schemes d. Which allocation would you recommend to each client? why? Risv Aversion Score Client Maya Abdul 3 81 Potential Risky Assets (P) Assets Expected Returns 0 A 13% 3% B 20% 10% Rf 2.50% Cov(A,B) 0.2 Potential allocations for risky assets (P) Assets Scheme 1 Scheme 2 Scheme 3 50% 60% 30% B 50% 40% 70% E(Rp) 16.50% 15.80% 17.90% 0.00 0.00 0.00 Op 0.00% 0.00% 0.00% 2 Op Scheme 1 Scheme 2 Scheme 3 la. Y 1b. o 1c. U-Maya U-Abdul try again try again try again try again try again try again try again try again try again try again try again try again Which allocation would you recommend to each client? why? 1. Calculate and evaluate the allocation that is required to form a complete portfolio with a 10% return under each of the 3 schemes. a. Calculate the allocation (Y) that is required to form a complete portfolio with a 10% return under each of the 3 schemes NOTE: You may find this easier to do by hand, if so please upload a picture of your work into the spot provided b. Calculate the risk of the complete portfolio with a 10% return under each of the 3 schemes c. Calculate each client's utility under each of the 3 schemes d. Which allocation would you recommend to each client? why? Risv Aversion Score Client Maya Abdul 3 81 Potential Risky Assets (P) Assets Expected Returns 0 A 13% 3% B 20% 10% Rf 2.50% Cov(A,B) 0.2 Potential allocations for risky assets (P) Assets Scheme 1 Scheme 2 Scheme 3 50% 60% 30% B 50% 40% 70% E(Rp) 16.50% 15.80% 17.90% 0.00 0.00 0.00 Op 0.00% 0.00% 0.00% 2 Op Scheme 1 Scheme 2 Scheme 3 la. Y 1b. o 1c. U-Maya U-Abdul try again try again try again try again try again try again try again try again try again try again try again try again Which allocation would you recommend to each client? why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started