Answered step by step

Verified Expert Solution

Question

1 Approved Answer

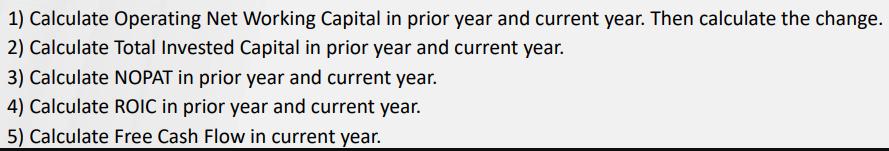

1) Calculate Operating Net Working Capital in prior year and current year. Then calculate the change. 2) Calculate Total Invested Capital in prior year

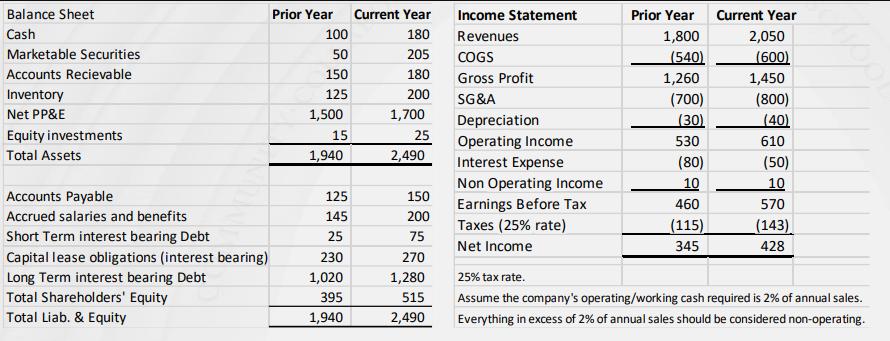

1) Calculate Operating Net Working Capital in prior year and current year. Then calculate the change. 2) Calculate Total Invested Capital in prior year and current year. 3) Calculate NOPAT in prior year and current year. 4) Calculate ROIC in prior year and current year. 5) Calculate Free Cash Flow in current year. Balance Sheet Cash Marketable Securities Accounts Recievable Inventory Net PP&E Equity investments Total Assets Accounts Payable Accrued salaries and benefits Short Term interest bearing Debt Capital lease obligations (interest bearing) Long Term interest bearing Debt Total Shareholders' Equity Total Liab. & Equity Prior Year Current Year 180 205 180 200 100 50 150 125 1,500 15 1,940 125 145 25 230 1,020 395 1,940 1,700 25 2,490 150 200 75 270 1,280 515 2,490 Income Statement Revenues COGS Gross Profit SG&A Depreciation Operating Income Interest Expense Non Operating Income Earnings Before Tax Taxes (25% rate) Net Income Prior Year 1,800 (540) 1,260 (700) (30) 530 (80) 10 460 (115) 345 Current Year 2,050 (600) 1,450 (800) (40) 610 (50) 10 570 (143) 428 25% tax rate. Assume the company's operating/working cash required is 2% of annual sales. Everything in excess of 2% of annual sales should be considered non-operating.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started