Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Calculate the amount of accumulated depreciation for each machine as at 31 December 2017. (show all workings) 2. If machine 2 had been purchased

1. Calculate the amount of accumulated depreciation for each machine as at 31 December 2017. (show all workings)

1. Calculate the amount of accumulated depreciation for each machine as at 31 December 2017. (show all workings)

2. If machine 2 had been purchased on 1 April 2015 instead of 1 January 2015, what would be the depreciation expense for this machine in 2015 and 2016?

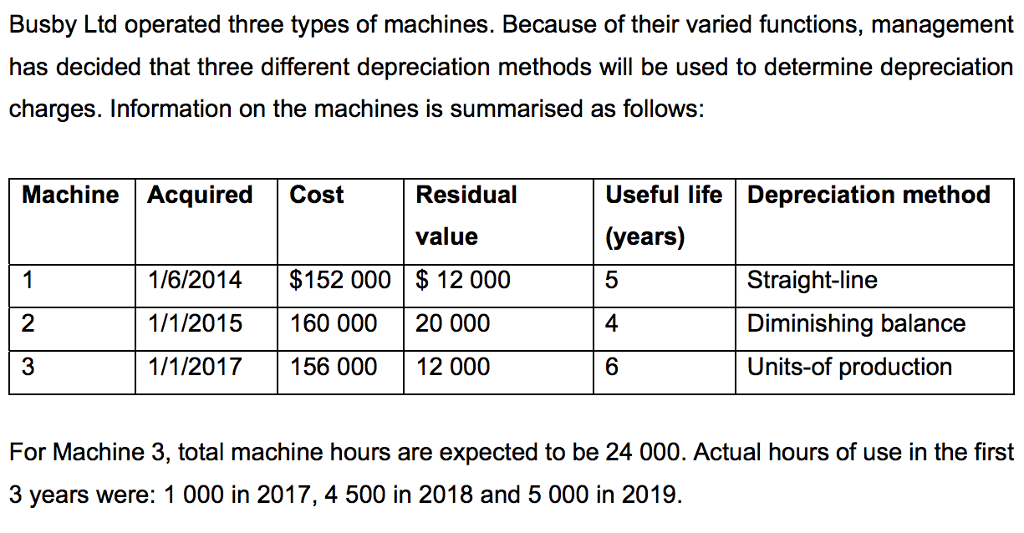

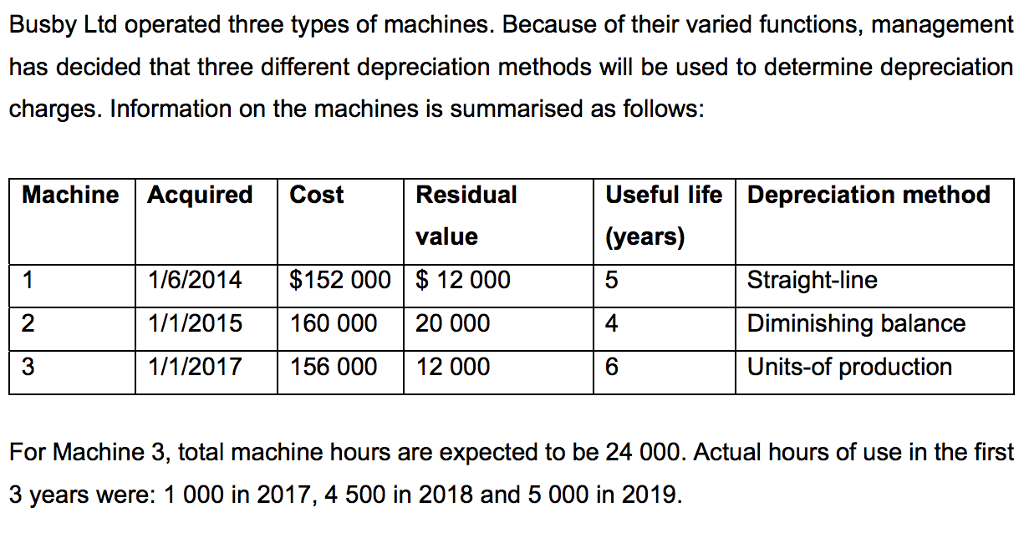

Busby Ltd operated three types of machines. Because of their varied functions, management has decided that three different depreciation methods will be used to determine depreciation charges. Information on the machines is summarised as follows: Machine Acquired Cost Residual Useful life Depreciation method (years) value 1/6/2014 $152 000 12 000 5 Straight-line 2 1/1/2015 160 000 20 000 4 Diminishing balance 3 1/1/2017 156 000 12000 6 Units of production For Machine 3, total machine hours are expected to be 24 000. Actual hours of use in the first 3 years were: 1 000 in 2017, 4 500 in 2018 and 5 000 in 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started