Question

1. Calculate the days in receivables ratio for the year ending 30 April 2020. Use the net receivables when calculating this ratio. Net sales revenue

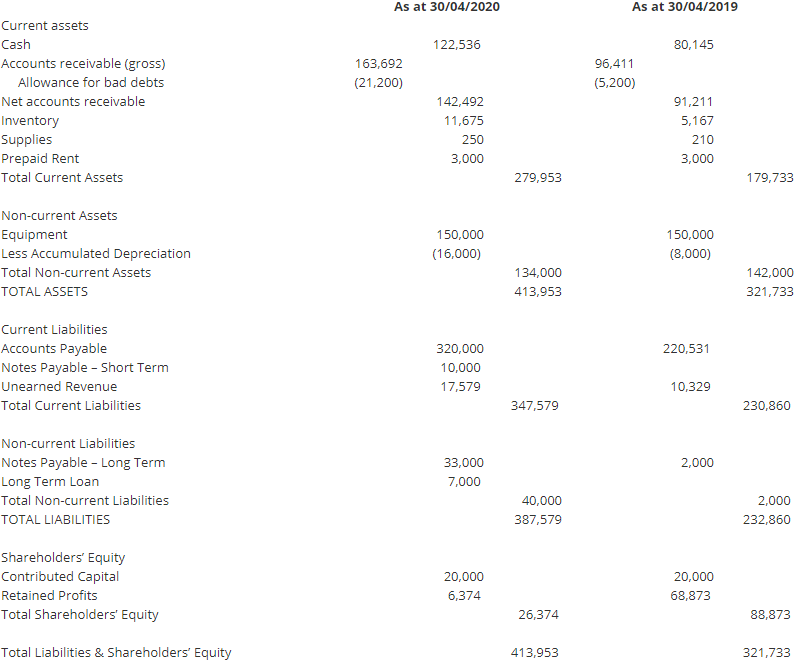

1. Calculate the days in receivables ratio for the year ending 30 April 2020. Use the net receivables when calculating this ratio. Net sales revenue on credit for the year ending 30 April 2020 is $450,000 and for the year ending 30 April 2019 is $400,000. Assume days in the year are 365. Round your answer to the nearest day. (1 mark).

2. Complete a horizontal analysis for the "allowance for bad debts" account. Round the percentage change in the allowance for bad debts to one decimal place (1 mark)

3. Superstores Global is looking to acquire Sameeras Corner Stores. Describe two concerns Superstores Global may have relating to the financial position of Sameeras Corner Stores Conglomerate. Use the financial information in the comparative balance sheet as evidence to support these concerns. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started