Question

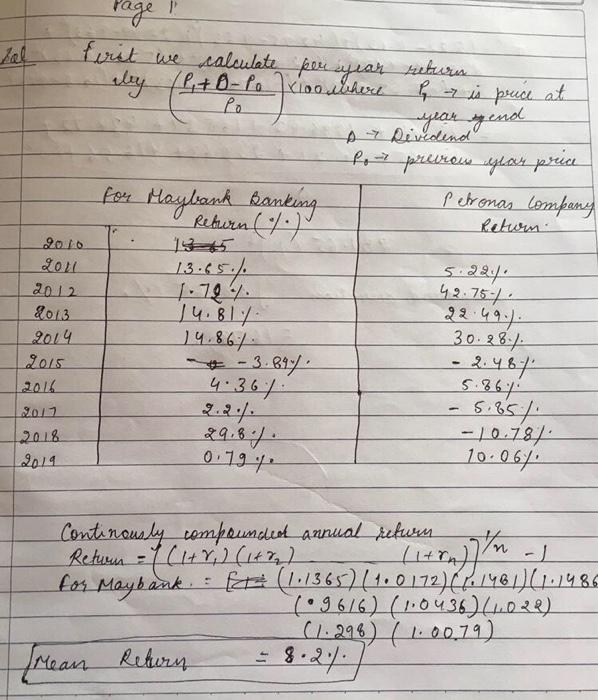

1. Calculate the discretely compounded annual returns and the respective risk for both firms. Analyse your answer. 2. Calculate the continuously compounded annual returns and

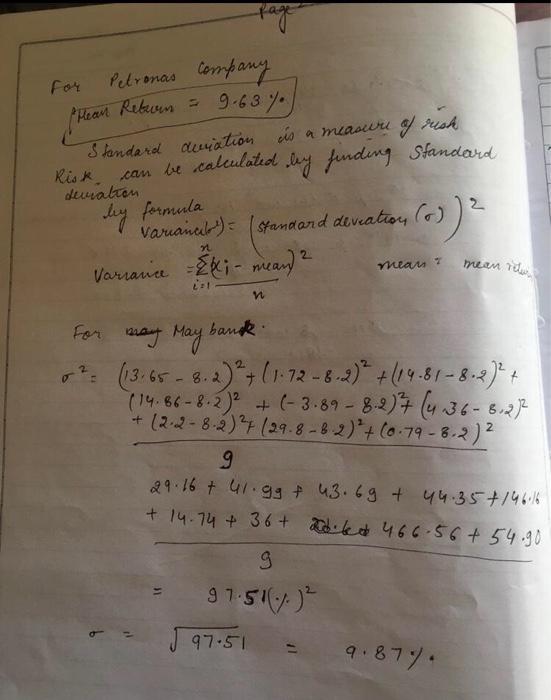

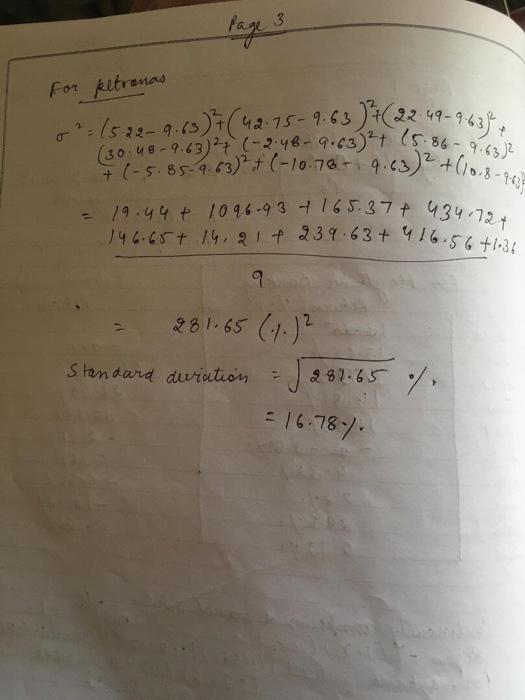

1. Calculate the discretely compounded annual returns and the respective risk for both firms. Analyse your answer.

2. Calculate the continuously compounded annual returns and the respective risk for both firms. Which is the better investment of the two? Analyse your answer.

3. Suppose that the annual returns on two shares are perfectly negatively correlated and that = 0.07, = 0.20,=0.12 , and =0.5. Assuming that there are no arbitrage opportunities, by using the Goal Seek function (excel) calculate the weight (proportion) of the two assets that produce the lowest portfolio variance? (Use the Goal Seek function)

4. You believe that there is a 20% chance that Astro companys share will drop by 11% and 80% chance that it will increase by 17%. In addition, there is a 25% chance that OCK Group Berhad companys share will drop by 15% and a 75% chance that it will increase by 24%. The covariance is 0.009. Calculate the expected return, the variance, the standard deviation, and the correlation for each share.

5. You are 30 years old today and decided to apply for a postgraduate in finance. Your current annual salary is RM36,000 and is expected to grow by 4% annually. Graduates in finance earns RM50,000 upon graduation, with salaries growing by 3.5% yearly. Cost of the 2 years of study is RM25,000 per year which should be paid at the end of each study year. If your retirement age is 67 and the discount rate is 7% annually, is it worthwhile to quit your current job and do your postgraduate? What is the IRR of your study?

Please can you do all calculations in excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started