Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Calculate the expected return and risk of Mrs Jones investment in Share A and share B and briefly discuss whether Mrs Jones decision to

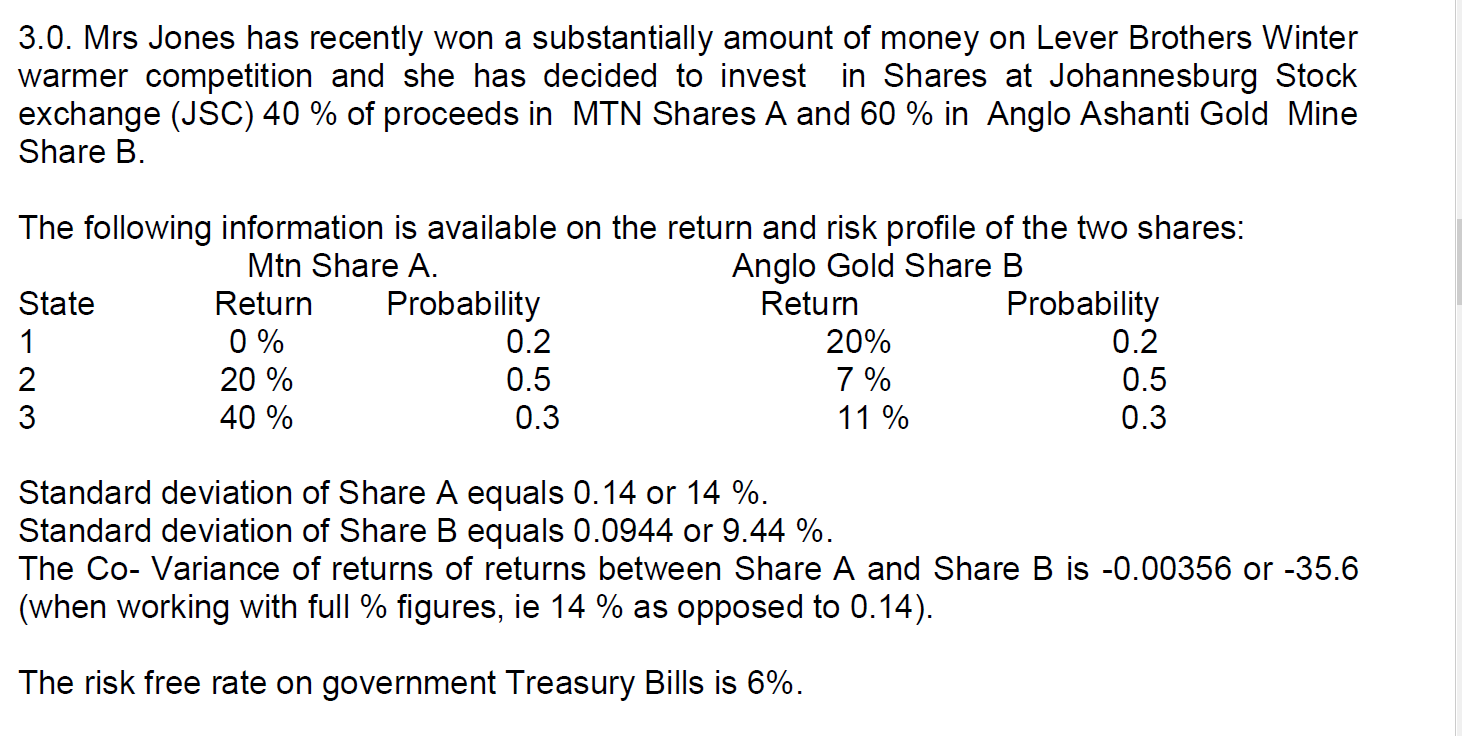

1 Calculate the expected return and risk of Mrs Jones investment in Share A and share B and briefly discuss whether Mrs Jones decision to invest in the two shares is wise.

2.Assuming that the combination of Shares A and B in the proportion of 40 % and 60 % B results in a return and risk profile that is the same as the market portfolio. Determine the required return for a portfolio that has a risk equal to a standard deviation of 18 %

3.0. Mrs Jones has recently won a substantially amount of money on Lever Brothers Winter warmer competition and she has decided to invest in Shares at Johannesburg Stock exchange (JSC) 40% of proceeds in MTN Shares A and 60% in Anglo Ashanti Gold Mine Share B. The following information is available on the return and risk profile of the two shares: Mtn Sharo ancin Gand Shars R Standard deviation of Share A equals 0.14 or 14%. Standard deviation of Share B equals 0.0944 or 9.44%. The Co- Variance of returns of returns between Share A and Share B is -0.00356 or -35.6 (when working with full \% figures, ie 14% as opposed to 0.14 ). The risk free rate on government Treasury Bills is 6%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started