Answered step by step

Verified Expert Solution

Question

1 Approved Answer

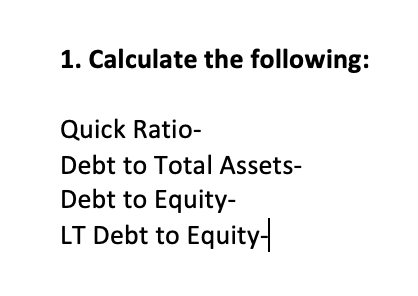

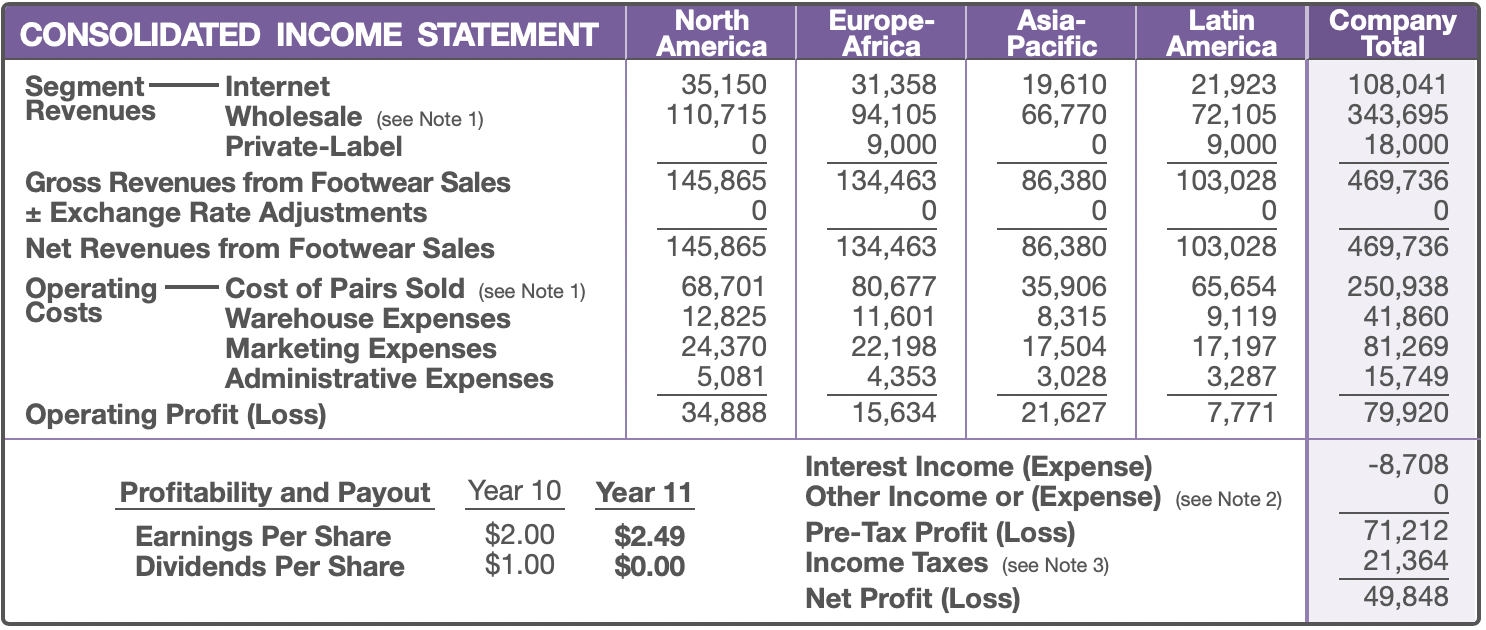

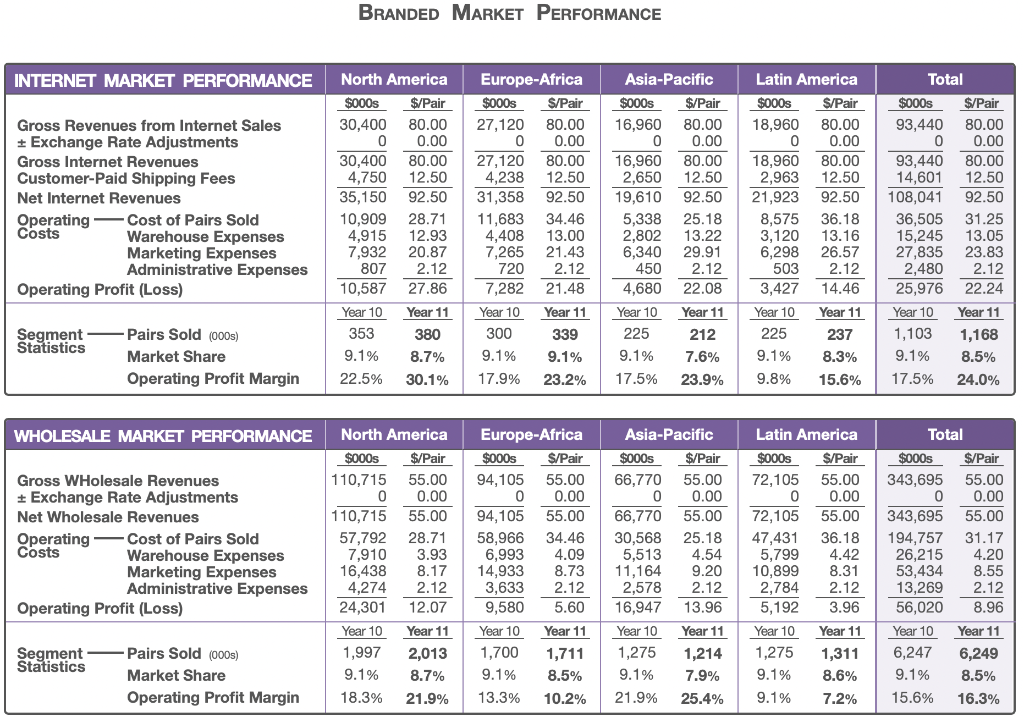

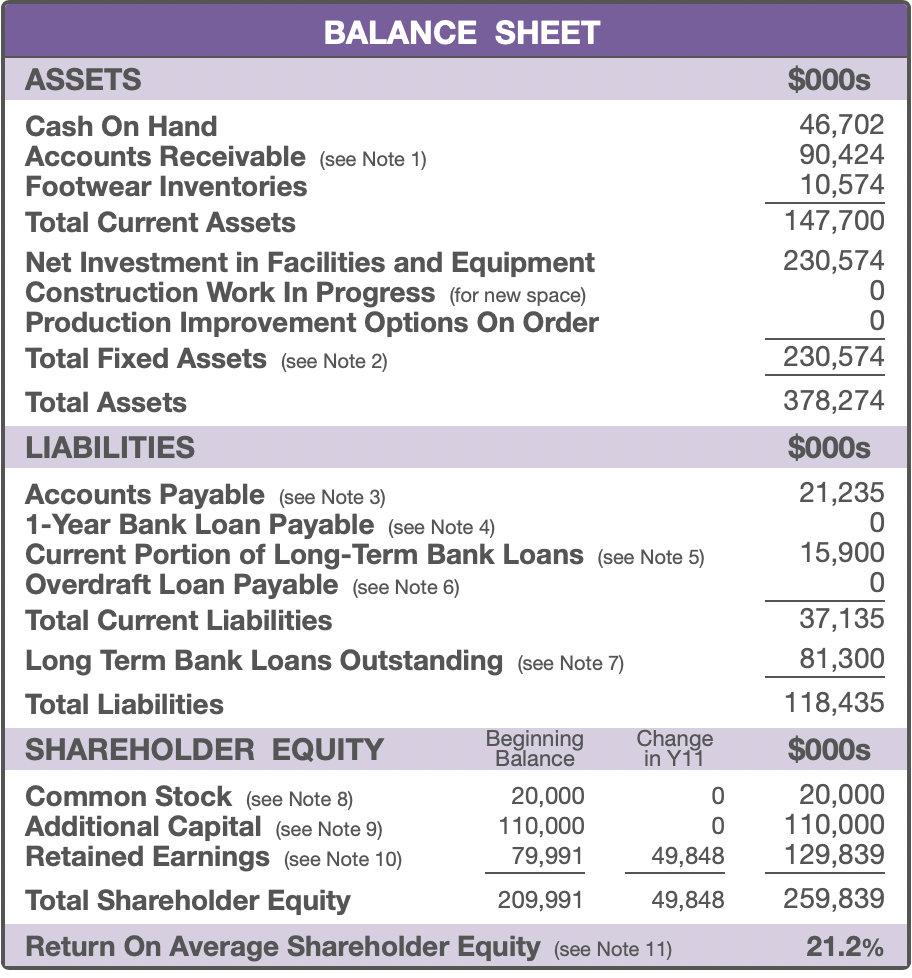

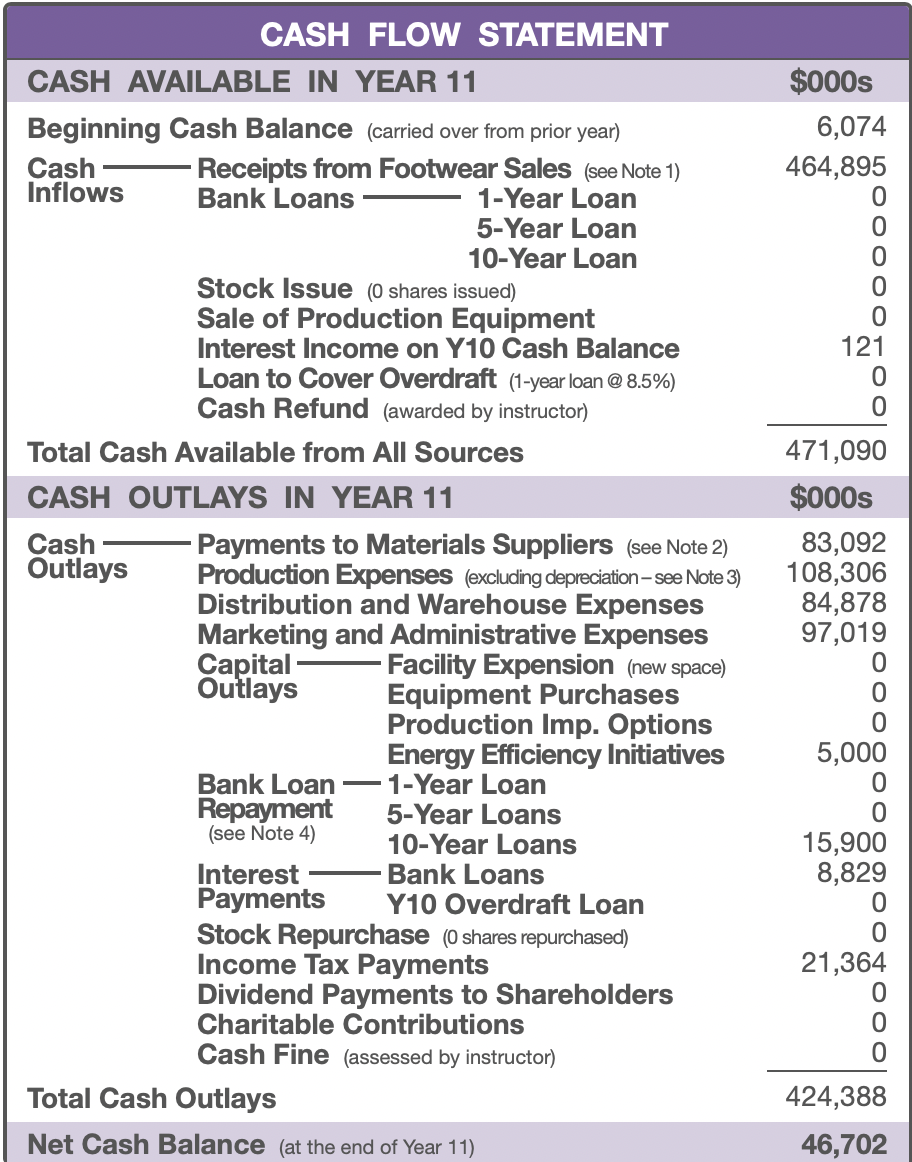

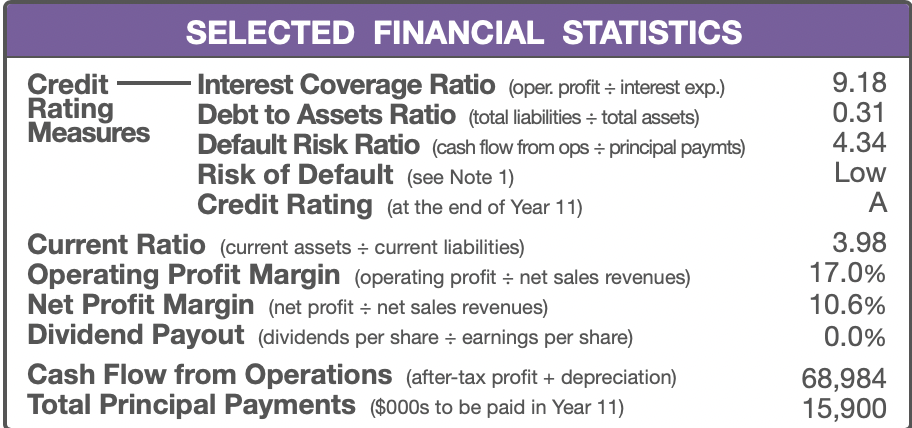

1. Calculate the following: Quick Ratio- Debt to Total Assets- Debt to Equity- LT Debt to Equity- BRANDED MaRKEt Performance Credit-InterestCoverageRatio(oper.profitinterestexp.)RatingMeasuresCurrentRatio(currentassetscurrentliabilities)OperatingProfitMargin(operatingprofitnetsalesrevenues)NetProfitMargin(netprofitnetsalesrevenues)DividendPayout(dividendspershareearningspershare)CashFlowfromOperations(after-taxprofit+depreciation)TotalPrincipalPayments($000stobepaidinYear11)9.18DebttoAssetsRatio(totalliabilitiestotalassets)DefaultRiskRatio(cashflowfromopsprincipalpaymts)RiskofDefault(seeNote1)CreditRating(attheendofYear11)3.9817.0%10.6%0.0%68,98415,9000.314.34LowA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started