Question

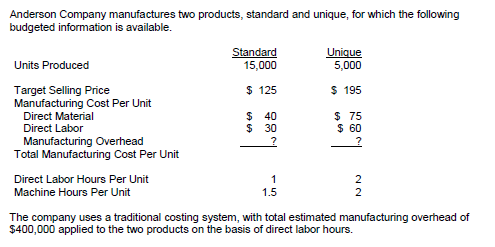

1. Calculate the gross margin per unit of the unique product under the current cost system. 2. For this question only assume that actual manufacturing

1. Calculate the gross margin per unit of the unique product under the current cost system.

2. For this question only assume that actual manufacturing overhead costs were $420,000 and actual direct labor hours were 27,500. How much is over/underapplied overhead?

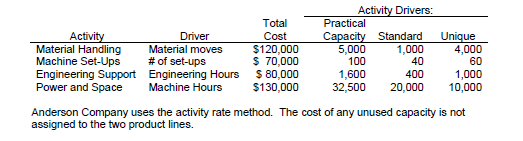

For the next 3 questions, assume that the $400,000 in manufacturing overhead was driven by the following activities.

Anderson Company uses the activity rate method. The cost of any unused capacity is not assigned to the two product lines.

3. Calculate the total manufacturing overhead cost assigned to the standard product under ABC.

4. Was the unique product over or under-costed in the traditional cost system compared to ABC?

5. How much of the $400,000 in manufacturing overhead cost is unutilized?

6. For this question only, assume that the ABC analysis showed that the total manufacturing cost of the unique model was $160 per unit. Anderson uses target costing to set its cost reduction goals. A recent market study revealed that customers would be willing to pay $180 for the unique product, and Anderson?s stockholders require a 20% gross margin. What is the cost reduction target (as a percentage of the ABC cost) for the unique product?

7. Provide two specific suggestions for how Anderson can use ABM to meet the cost reduction target calculated above:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started