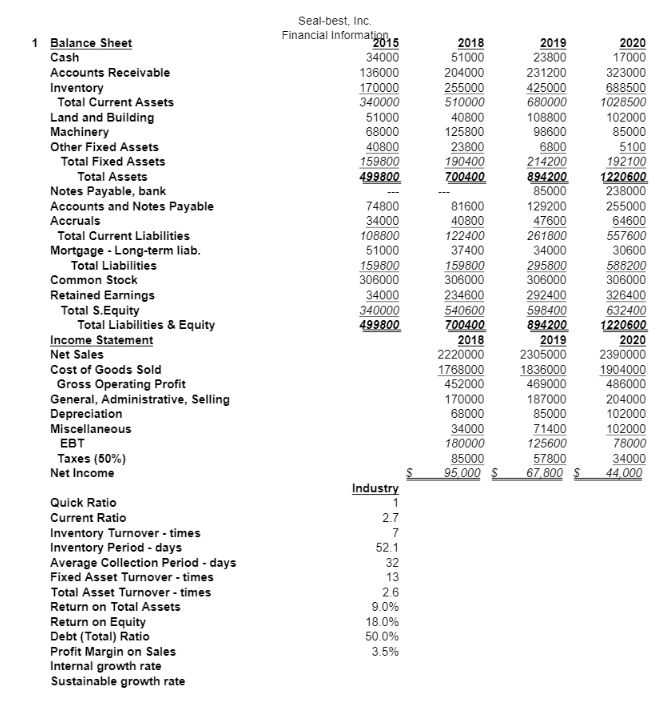

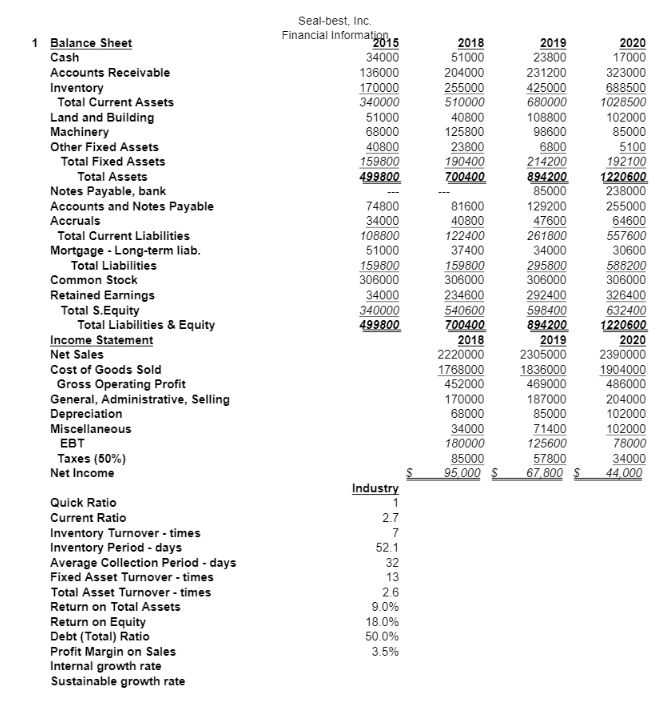

- 1) Calculate the key financial ratios for Seal-best, Inc., and plot trends in the firm's ratios against the industry averages.

- 2) What strengths and weaknesses are revealed by the ratio analysis?

Seal-best, Inc. Financial Information 2015 34000 136000 170000 340000 51000 68000 40800 159800 499800 2018 51000 204000 255000 510000 40800 125800 23800 190400 700400 1 Balance Sheet Cash Accounts Receivable Inventory Total Current Assets Land and Building Machinery Other Fixed Assets Total Fixed Assets Total Assets Notes Payable, bank Accounts and Notes Payable Accruals Total Current Liabilities Mortgage - Long-term liab. Total Liabilities Common Stock Retained Earnings Total S.Equity Total Liabilities & Equity Income Statement Net Sales Cost of Goods Sold Gross Operating Profit General Administrative, Selling Depreciation Miscellaneous EBT Taxes (50%) Net Income 74800 34000 108800 51000 159800 306000 34000 340000 499800 81600 40800 122400 37400 159800 306000 234600 540600 700400 2018 2220000 1768000 452000 170000 68000 34000 180000 85000 95.000 $ 2019 23800 231200 425000 680000 108800 98600 6800 214200 894200 85000 129200 47600 261800 34000 295800 306000 292400 598400 894200 2019 2305000 1836000 469000 187000 85000 71400 125600 57800 67.800 $ 2020 17000 323000 688500 1028500 102000 85000 5100 192100 1220600 238000 255000 64600 557600 30600 588200 306000 326400 632400 1220600 2020 2390000 1904000 486000 204000 102000 102000 78000 34000 44.000 Quick Ratio Current Ratio Inventory Turnover - times Inventory Period - days Average Collection Period - days Fixed Asset Turnover - times Total Asset Turnover - times Return on Total Assets Return on Equity Debt (Total) Ratio Profit Margin on Sales Internal growth rate Sustainable growth rate Industry 1 2.7 7 52.1 32 13 26 9.0% 18.0% 50.0% 3.5% Seal-best, Inc. Financial Information 2015 34000 136000 170000 340000 51000 68000 40800 159800 499800 2018 51000 204000 255000 510000 40800 125800 23800 190400 700400 1 Balance Sheet Cash Accounts Receivable Inventory Total Current Assets Land and Building Machinery Other Fixed Assets Total Fixed Assets Total Assets Notes Payable, bank Accounts and Notes Payable Accruals Total Current Liabilities Mortgage - Long-term liab. Total Liabilities Common Stock Retained Earnings Total S.Equity Total Liabilities & Equity Income Statement Net Sales Cost of Goods Sold Gross Operating Profit General Administrative, Selling Depreciation Miscellaneous EBT Taxes (50%) Net Income 74800 34000 108800 51000 159800 306000 34000 340000 499800 81600 40800 122400 37400 159800 306000 234600 540600 700400 2018 2220000 1768000 452000 170000 68000 34000 180000 85000 95.000 $ 2019 23800 231200 425000 680000 108800 98600 6800 214200 894200 85000 129200 47600 261800 34000 295800 306000 292400 598400 894200 2019 2305000 1836000 469000 187000 85000 71400 125600 57800 67.800 $ 2020 17000 323000 688500 1028500 102000 85000 5100 192100 1220600 238000 255000 64600 557600 30600 588200 306000 326400 632400 1220600 2020 2390000 1904000 486000 204000 102000 102000 78000 34000 44.000 Quick Ratio Current Ratio Inventory Turnover - times Inventory Period - days Average Collection Period - days Fixed Asset Turnover - times Total Asset Turnover - times Return on Total Assets Return on Equity Debt (Total) Ratio Profit Margin on Sales Internal growth rate Sustainable growth rate Industry 1 2.7 7 52.1 32 13 26 9.0% 18.0% 50.0% 3.5%