Question

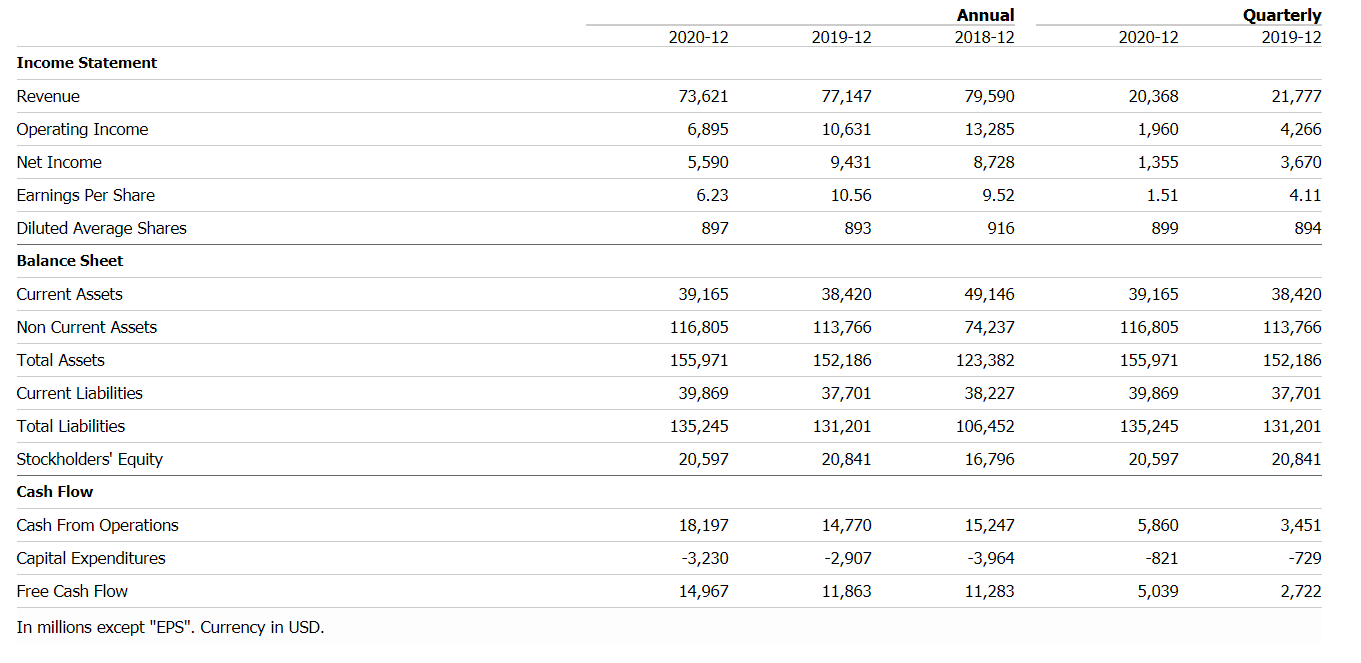

1) Calculate the liquidity, leverage, turnover, profitability, and market value ratios for the most recent two years (check the fiscal year and month.). In total,

1) Calculate the liquidity, leverage, turnover, profitability, and market value ratios for the most recent two years (check the fiscal year and month.). In total, you should calculate 20 (ratios) x 2 (years) = 40 ratios. Please use the basic shares.

1) Calculate the liquidity, leverage, turnover, profitability, and market value ratios for the most recent two years (check the fiscal year and month.). In total, you should calculate 20 (ratios) x 2 (years) = 40 ratios. Please use the basic shares.

2) After calculating all the ratios, please decompose the companys profitability over the two years using the Dupont analysis. Explain the composition of the profitability for your company. Has each component of Dupont increased or decreased from the previous year? How has that affected the companys overall profitability? Is there room for improvements?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started