Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Calculate the net present value for automated mixer project 2) What is the internal rate of return for mixer? 3) Determine the NPV of

1) Calculate the net present value for automated mixer project

2) What is the internal rate of return for mixer?

3) Determine the NPV of continuous oven

4) Determine NPV of semiautomated packaging unit

5) Which capital projects should Mike undertake this year?

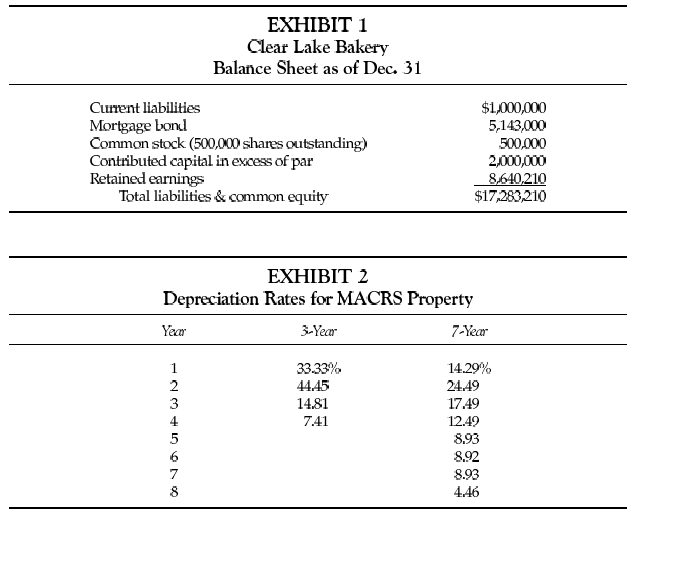

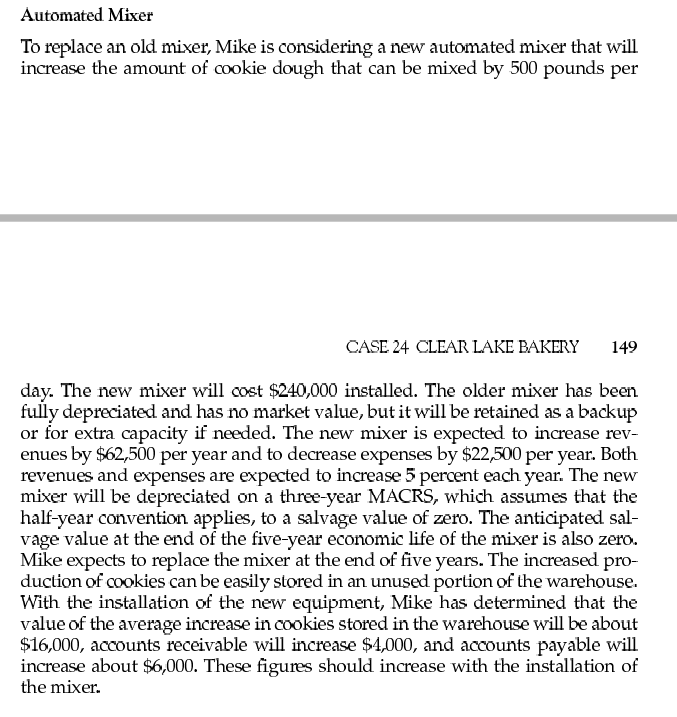

EXHIBIT 1 Clear Lake Bakery Balance Sheet as of Dec. 31 Current liabilities Mortgage bond Common stock (500,000 shares outstanding) Contributed capital in excess of par Retained earnings Total liabilities & common equity $1,000,000 5,143,000 500,000 2,000,000 8.640,210 $17,283,210 EXHIBIT 2 Depreciation Rates for MACRS Property Year 3-Year 7-Year 33.33% 44.45 14.81 7.41 OVOULUN 2 3 4 5 6 7 8 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 Automated Mixer To replace an old mixer, Mike is considering a new automated mixer that will increase the amount of cookie dough that can be mixed by 500 pounds per CASE 24 CLEAR LAKE BAKERY 149 day. The new mixer will cost $240,000 installed. The older mixer has been fully depreciated and has no market value, but it will be retained as a backup or for extra capacity if needed. The new mixer is expected to increase rev- enues by $62,500 per year and to decrease expenses by $22,500 per year. Both revenues and expenses are expected to increase 5 percent each year. The new mixer will be depreciated on a three-year MACRS, which assumes that the half-year convention applies, to a salvage value of zero. The anticipated sal- vage value at the end of the five-year economic life of the mixer is also zero. Mike expects to replace the mixer at the end of five years. The increased pro- duction of cookies can be easily stored in an unused portion of the warehouse. With the installation of the new equipment, Mike has determined that the value of the average increase in cookies stored in the warehouse will be about $16,000, accounts receivable will increase $4,000, and accounts payable will increase about $6,000. These figures should increase with the installation of the mixer. EXHIBIT 1 Clear Lake Bakery Balance Sheet as of Dec. 31 Current liabilities Mortgage bond Common stock (500,000 shares outstanding) Contributed capital in excess of par Retained earnings Total liabilities & common equity $1,000,000 5,143,000 500,000 2,000,000 8.640,210 $17,283,210 EXHIBIT 2 Depreciation Rates for MACRS Property Year 3-Year 7-Year 33.33% 44.45 14.81 7.41 OVOULUN 2 3 4 5 6 7 8 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 Automated Mixer To replace an old mixer, Mike is considering a new automated mixer that will increase the amount of cookie dough that can be mixed by 500 pounds per CASE 24 CLEAR LAKE BAKERY 149 day. The new mixer will cost $240,000 installed. The older mixer has been fully depreciated and has no market value, but it will be retained as a backup or for extra capacity if needed. The new mixer is expected to increase rev- enues by $62,500 per year and to decrease expenses by $22,500 per year. Both revenues and expenses are expected to increase 5 percent each year. The new mixer will be depreciated on a three-year MACRS, which assumes that the half-year convention applies, to a salvage value of zero. The anticipated sal- vage value at the end of the five-year economic life of the mixer is also zero. Mike expects to replace the mixer at the end of five years. The increased pro- duction of cookies can be easily stored in an unused portion of the warehouse. With the installation of the new equipment, Mike has determined that the value of the average increase in cookies stored in the warehouse will be about $16,000, accounts receivable will increase $4,000, and accounts payable will increase about $6,000. These figures should increase with the installation of the mixerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started