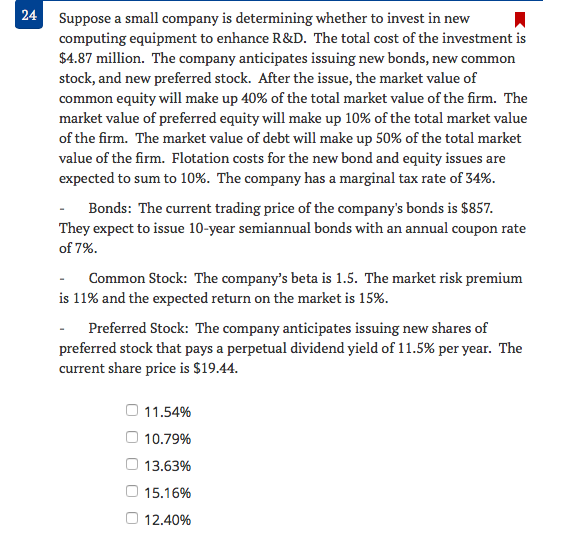

24 Suppose a small company is determining whether to invest in new computing equipment to enhance R&D. The total cost of the investment is $4.87 million. The company anticipates issuing new bonds, new common stock, and new preferred stock. After the issue, the market value of common equity will make up 40% of the total market value of the firm. The market value of preferred equity will make up 10% of the total market value of the firm. The market value of debt will make up 50% of the total market value of the firm. Flotation costs for the new bond and equity issues are expected to sum to 10%. The company has a marginal tax rate of 34%. Bonds: The current trading price of the company's bonds is $857. They expect to issue 10-year semiannual bonds with an annual coupon rate of 7%. Common Stock: The company's beta is 1.5. The market risk premium is 11% and the expected return on the market is 15%. Preferred Stock: The company anticipates issuing new shares of preferred stock that pays a perpetual dividend yield of 11.5% per year. The current share price is $19.44. 11.54% 10.79% 13.63% 15.16% 12.40% 24 Suppose a small company is determining whether to invest in new computing equipment to enhance R&D. The total cost of the investment is $4.87 million. The company anticipates issuing new bonds, new common stock, and new preferred stock. After the issue, the market value of common equity will make up 40% of the total market value of the firm. The market value of preferred equity will make up 10% of the total market value of the firm. The market value of debt will make up 50% of the total market value of the firm. Flotation costs for the new bond and equity issues are expected to sum to 10%. The company has a marginal tax rate of 34%. Bonds: The current trading price of the company's bonds is $857. They expect to issue 10-year semiannual bonds with an annual coupon rate of 7%. Common Stock: The company's beta is 1.5. The market risk premium is 11% and the expected return on the market is 15%. Preferred Stock: The company anticipates issuing new shares of preferred stock that pays a perpetual dividend yield of 11.5% per year. The current share price is $19.44. 11.54% 10.79% 13.63% 15.16% 12.40%