Question

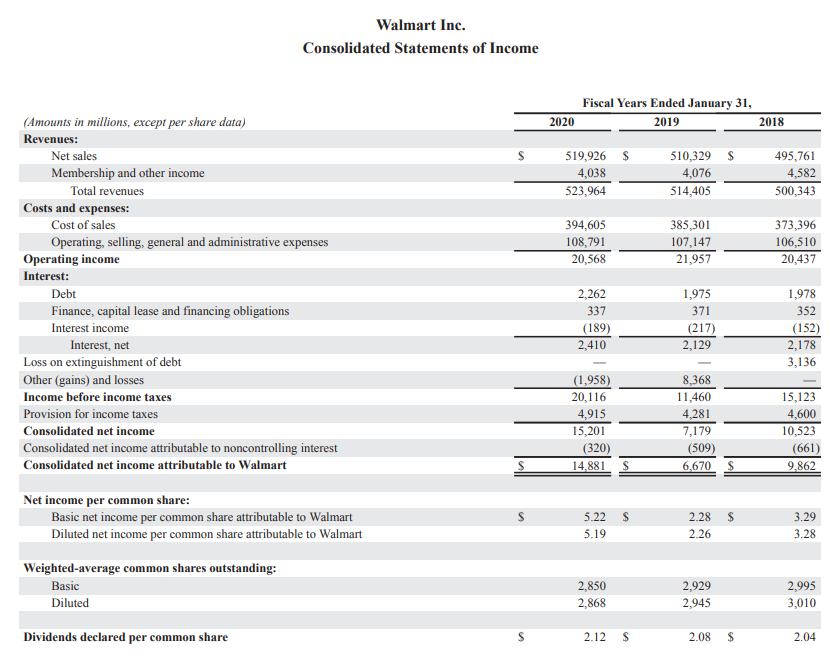

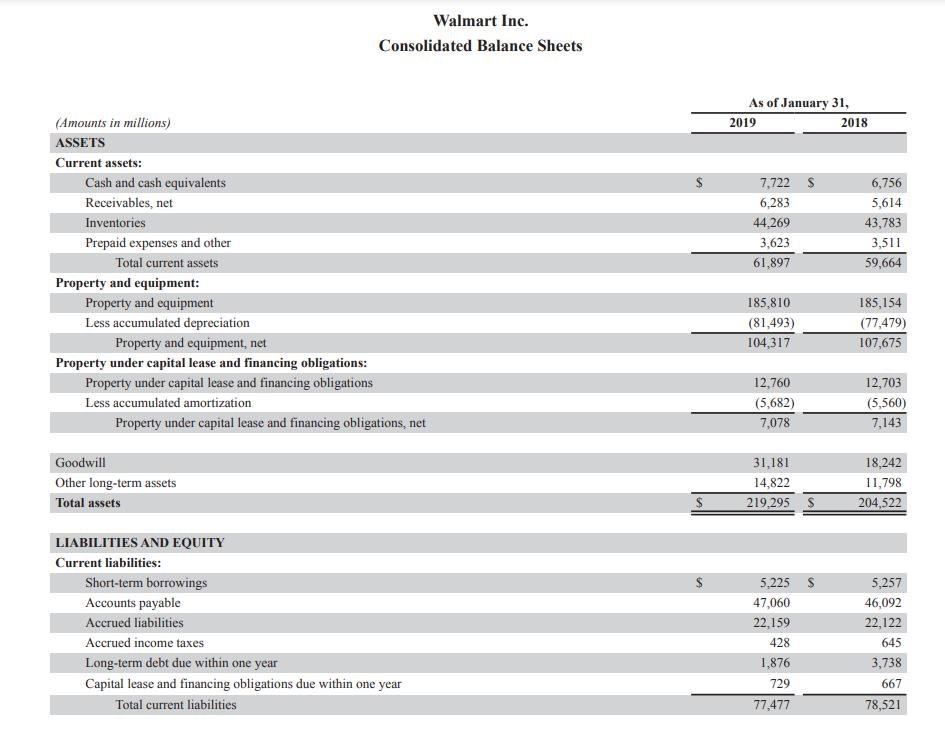

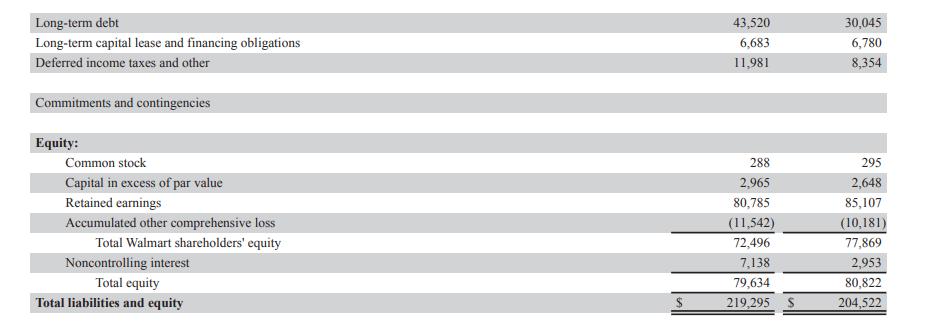

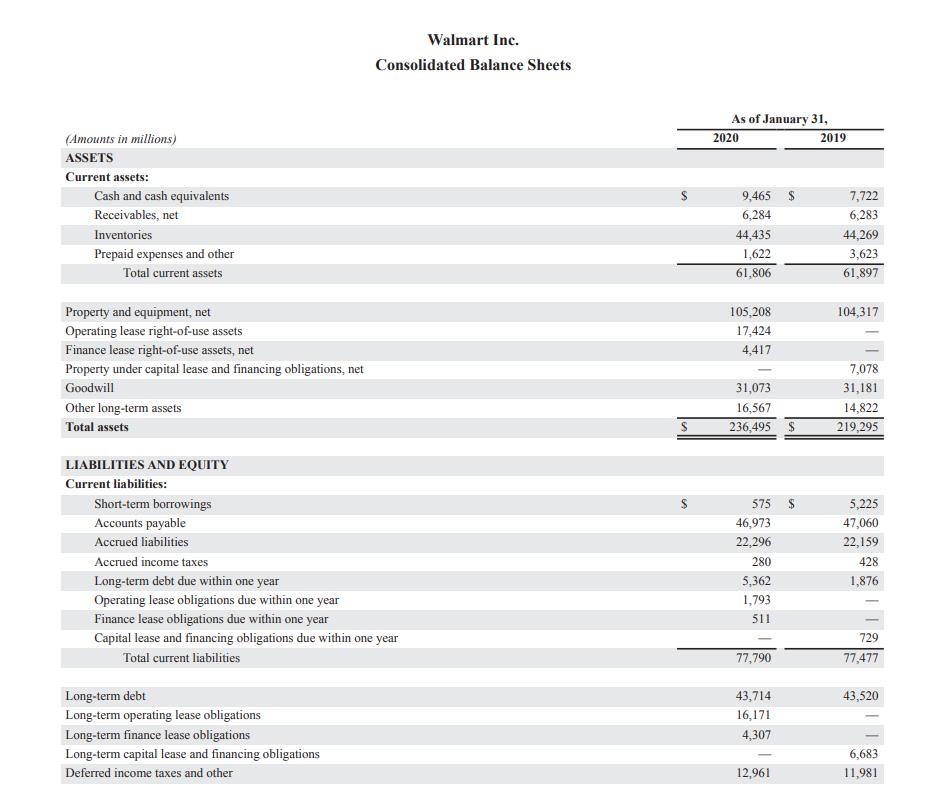

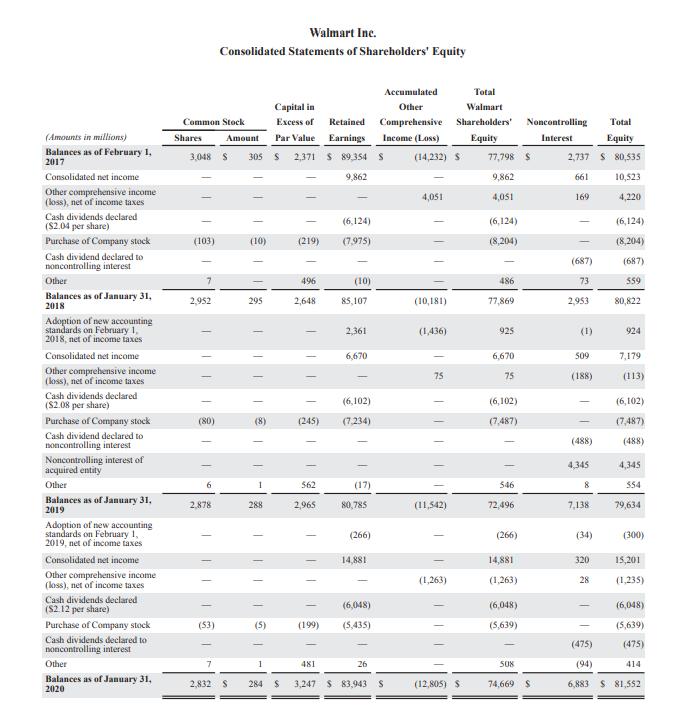

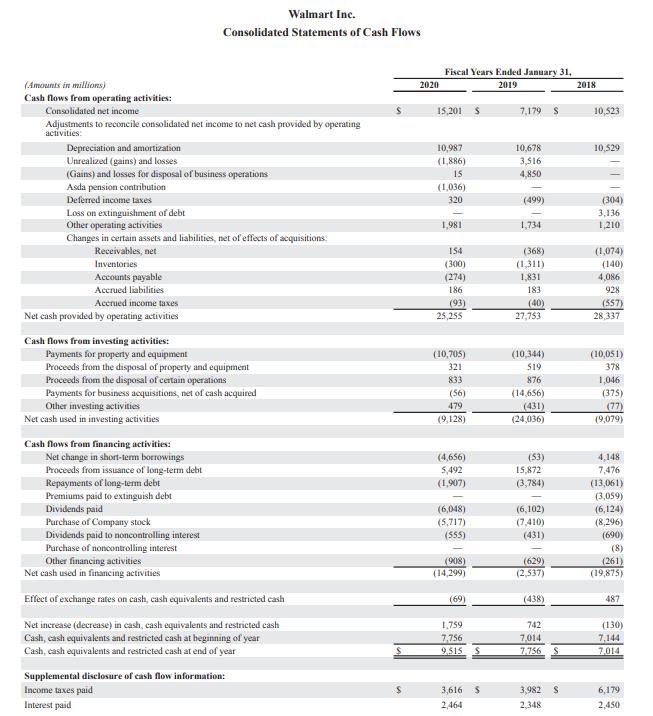

1. Calculate the ratios discussed in class for both the years 2019 and 2020. The ratios should be calculated using formulas and not direct inputs.

1. Calculate the ratios discussed in class for both the years 2019 and 2020. The ratios should be calculated using formulas and not direct inputs. To calculate the ratios, you need to use both the Balance Sheet and Income Statement included in the Annual Report.

Stock Prices to use in Ratio Calculations:

Walmart: 2019: $84.98 2020: $66.36

Shares Outstanding to use in Ratio Calculations:

Use “Weighted Average Common Shares Outstanding, BASIC” Information.

Once the ratio for both years has been calculated, you need to calculate the change in the ratio from one year to the other and provide a brief comment on your observations. Refer below for the ratios that you need to calculate.

• Profitability Ratios

• Return on Equity

• Return of Assets

• Gross Profit Margin

• Operating Profit Margin

• Net Profit Margin

• Liquidity Ratios

• Current Ratio

• Quick Ratio

• Activity Ratios

• Inventory turnover

• Accounts Receivable Turnover

• Total Assets Turnover

• Average Collection Period

• Financing Ratios

• Debt Ratio

• Debt Equity Ratio

• Times Interest Earned Ratio

• Market Ratios

• Earnings Per Share

• Price Earnings

• Market to Book

Please provide the correct EXCEL functions for the question above. I know this is a lot of information and any help would be appreciated! Will give thumbs up!

Walmart Inc. Consolidated Statements of Income Fiscal Years Ended January 31, 2019 (Amounts in millions, except per share data) 2020 2018 Revenues: Net sales 519,926 $ 510,329 S 495,761 Membership and other income 4,038 523,964 4,076 4,582 Total revenues 514,405 500,343 Costs and expenses: Cost of sales 394,605 385,301 373,396 Operating, selling, general and administrative expenses Operating income 108,791 107,147 21,957 106,510 20,568 20,437 Interest: Debt 2,262 1,975 1,978 337 (189) 2,410 Finance, capital lease and financing obligations 371 352 Interest income (217) (152) Interest, net Loss on extinguishment of debt Other (gains) and losses 2,129 2,178 3,136 (1,958) 20,116 8,368 Income before income taxes 11,460 15,123 Provision for income taxes 4,915 15,201 4,281 4,600 Consolidated net income 7,179 10,523 Consolidated net income attributable to noncontrolling interest (320) (509) (661) Consolidated net income attributable to Walmart 14,881 6,670 S 9,862 Net income per common share: Basic net income per common share attributable to Walmart Diluted net income per common share attributable to Walmart 5.22 2.28 3.29 5.19 2.26 3.28 Weighted-average common shares outstanding: Basic 2,850 2,929 2,945 2,995 Diluted 2,868 3,010 Dividends declared per common share 2.12 2.08 2.04

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started