1. Calculate the total amount of cash you will need to have before the launching day of your business, in order to buy all necessary equipment and machines, to purchase all materials and supplies needed for the first three months operations, and to pay your employees first three months salaries. Assume that your parents have agreed to loan you this amount, interest free. The following is information regarding the cash payment needs for your variable costs and fixed costs:

a. Variable Costs and Expenses: For every variable cost item, you decide to buy sufficient quantity for making the first 2,000 T-shirts. You also want to prepare sufficient amount of cash to pay for the labor costs needed for making, folding, and wrapping the first 2,000 T-shirts. Assume that you can pay your workers for a fraction of an hour. However, you cannot purchase a fraction of an ink-jet cartridge or a partial case or ream of paper.

b. Fixed Costs and Expenses: In addition to covering variable costs for the first 2,000 T-shirts, your initial amount of cash should be sufficient to pay for the first quarters cash needs for your fixed costs.

2. Prepare a cash budget for your companys first year of operations. (NOT the first three months or the first 2,000 T-shirts!). Continue to assume that the selling price is $15 and that 7,800 tshirts will be made and sold in the first year. Assume all sales are cash sales and that all costs and expenses are paid in cash. Prepare cash budget for the entire year; do not separate the budget into four quarters. Your initial cash balance is the amount you reported in Item 1 above. You decide to keep a cash balance of $20,000 at December 31, 2019 and use the extra cash, if there is any, to pay back part of the loan you borrowed from your parents.

Information and solutions from previous questions to this project are provided below:

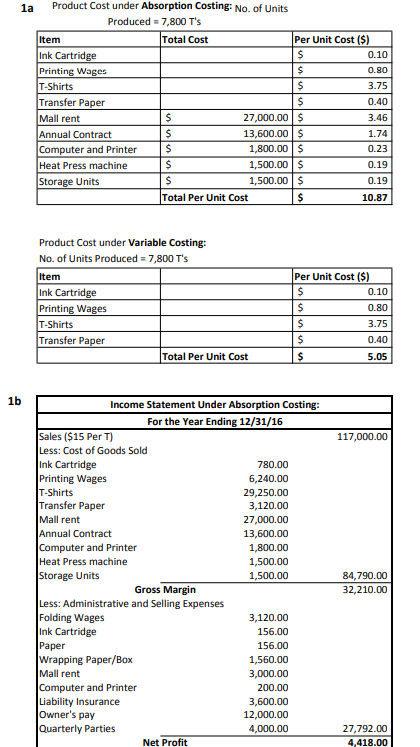

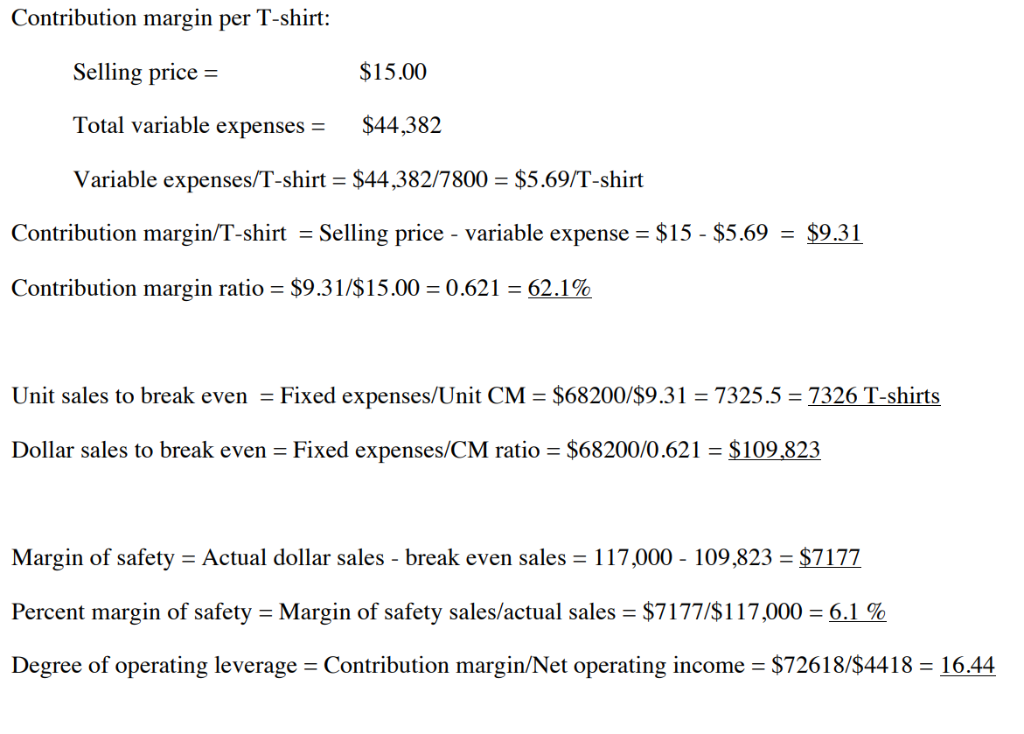

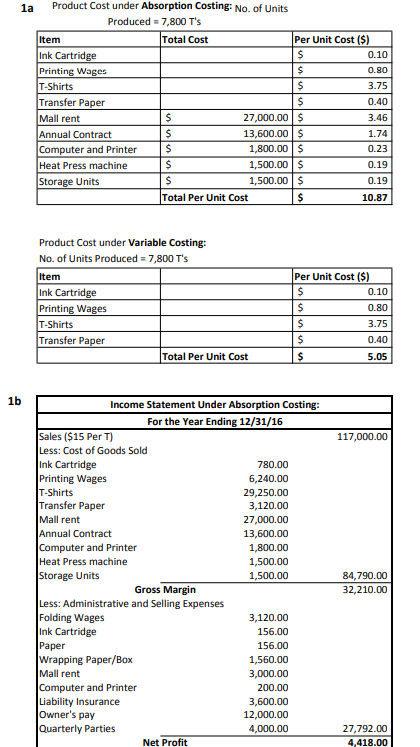

Product Cost under Absorption Costing: No. of Units 1a Produced = 7,800 T's Per Unit Cost (S) Item Ink Cartridge Printing Wages T-Shirts Transfer Paper Mall rent Annual Contract Computer and Printer Heat Press machine Storage Units Total Cost 0.10 0.80 3.75 0.40 3.46 1.74 0.23 0.19 0.19 10.87 27,000.00 $ 13,600.00 $ 1,800.00S 1,500.00 $ 1,500.00 $ Total Per Unit Cost Product Cost under Variable Costing: No. of Units Produced 7,800 T's Item Ink Cartridge Printing Wages T-Shirts Transfer Paper Per Unit Cost (S) 0.10 0.80 3.75 0.40 5.05 Total Per Unit Cost 1b Income Statement Under Absorption Costing For the Year Ending 12/31/16 Sales ($15 Per T) Less: Cost of Goods Sold Ink Cartridge Printing Wages T-Shirts Transfer Paper Mall rent Annual Contract Computer and Printer Heat Press machine Storage Units 117,000.00 780.00 6,240.00 29,250.00 3,120.00 27,000.00 13,600.00 1,800.00 1,500.00 1,500.00 84,790.00 32,210.00 Gross Margin Less: Administrative and Selling Expenses Folding Wages Ink Cartridge Paper Wrapping Paper/Box Mall rent Computer and Printer Liability Insurance Owner's pay Quarterly Parties 3,120.00 156.00 156.00 1,560.00 3,000.00 200.00 3,600.00 12,000.00 4,000.00 27,792.00 4,418.00 Net Profit Contribution margin per T-shirt: $15.00 Selling price Total variable expenses$44,382 Variable expenses/T-shirt $44,382/7800 $5.69/T-shirt Contribution margin/T-shirt Selling price variable expense $15-$5.69 $9.31 Contribution margin ratio-$9.31/$15.00-0.621-62.1% Unit sales to break even Fixed expenses/Unit CM $68200/s9.31 7325.5 7326 T-shirts Dollar sales to break even Fixed expenses/CM ratio $68200/0.621 S109,823 Margin of safety Actual dollar sales break even sales 117,000 - 109,823 $7177 Percent margin of safety-Margin of safety sales/actual sales-$7177/$17,000-6.1 % Degree of operating leverage Contribution margin/Net operating income $72618/S4418 1644 Product Cost under Absorption Costing: No. of Units 1a Produced = 7,800 T's Per Unit Cost (S) Item Ink Cartridge Printing Wages T-Shirts Transfer Paper Mall rent Annual Contract Computer and Printer Heat Press machine Storage Units Total Cost 0.10 0.80 3.75 0.40 3.46 1.74 0.23 0.19 0.19 10.87 27,000.00 $ 13,600.00 $ 1,800.00S 1,500.00 $ 1,500.00 $ Total Per Unit Cost Product Cost under Variable Costing: No. of Units Produced 7,800 T's Item Ink Cartridge Printing Wages T-Shirts Transfer Paper Per Unit Cost (S) 0.10 0.80 3.75 0.40 5.05 Total Per Unit Cost 1b Income Statement Under Absorption Costing For the Year Ending 12/31/16 Sales ($15 Per T) Less: Cost of Goods Sold Ink Cartridge Printing Wages T-Shirts Transfer Paper Mall rent Annual Contract Computer and Printer Heat Press machine Storage Units 117,000.00 780.00 6,240.00 29,250.00 3,120.00 27,000.00 13,600.00 1,800.00 1,500.00 1,500.00 84,790.00 32,210.00 Gross Margin Less: Administrative and Selling Expenses Folding Wages Ink Cartridge Paper Wrapping Paper/Box Mall rent Computer and Printer Liability Insurance Owner's pay Quarterly Parties 3,120.00 156.00 156.00 1,560.00 3,000.00 200.00 3,600.00 12,000.00 4,000.00 27,792.00 4,418.00 Net Profit Contribution margin per T-shirt: $15.00 Selling price Total variable expenses$44,382 Variable expenses/T-shirt $44,382/7800 $5.69/T-shirt Contribution margin/T-shirt Selling price variable expense $15-$5.69 $9.31 Contribution margin ratio-$9.31/$15.00-0.621-62.1% Unit sales to break even Fixed expenses/Unit CM $68200/s9.31 7325.5 7326 T-shirts Dollar sales to break even Fixed expenses/CM ratio $68200/0.621 S109,823 Margin of safety Actual dollar sales break even sales 117,000 - 109,823 $7177 Percent margin of safety-Margin of safety sales/actual sales-$7177/$17,000-6.1 % Degree of operating leverage Contribution margin/Net operating income $72618/S4418 1644