Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 . Calculate the Unit and Package Contribution Margin. Prepare in Excel with proper headings, titles and formulas. Sabrina: All this sounds reasonable, but why

Calculate the Unit and Package Contribution Margin. Prepare in Excel with proper headings, titles and formulas. Sabrina: "All this sounds reasonable, but why is reimbursement such an important

factor?

Peter: "Well, if you admit Medicaid patients, the state will reimburse at most $ per

year. Private insurance policies will pay roughly $ per year. We can charge up

to about $ for private patients, but this type of care is so expensive that many

of these patients exhaust their funds and go on Medicaid. The nice aspect of

Medicaid is that we can be virtually assured that we will operate at capacity."

Sabrina: "Can we cross that bridge when we come to it

Peter: No not really. Once the patient is a resident of our facility, it is hard to evict him

or her. Also, while it is legal to force patients out before they go on Medicaid and to

refuse to accept Medicaid patients, once we do accept Medicaid patients, we are

prevented by law from evicting themno matter how high our costs go

Sabrina: OK it looks as if we have some hard work ahead of us to decide whether or

not to get into this line of business."

What is the markup percent of cost of services charged on the assistedliving expenses? What would the price per month for a Basic Care patient be if the same markup were used? For a Lifestyle Care patient? Assume in both cases that occupancy is at percent of capacity.

What is the payback period for the new addition?

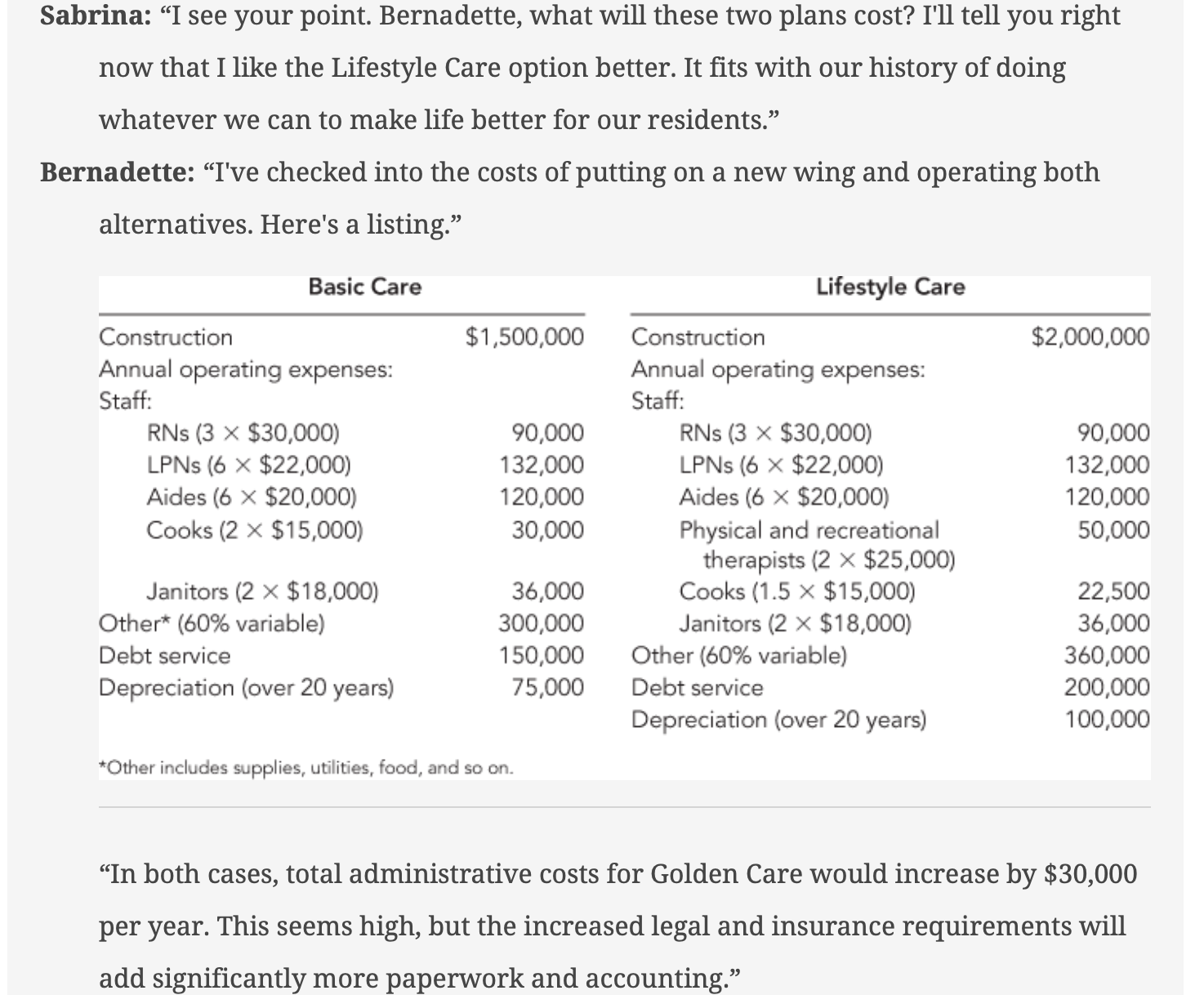

Sabrina: "I see your point. Bernadette, what will these two plans cost? I'll tell you right now that I like the Lifestyle Care option better. It fits with our history of doing whatever we can to make life better for our residents."

Bernadette: "I've checked into the costs of putting on a new wing and operating both alternatives. Here's a listing."

tableBasic Care,Lifestyle CareConstruction$Construction,$Annual operating expenses:,,Annual operating expenses:,Staff:Staff:,RNs times $RNs times $LPNs times $LPNs times $Aides times $Aides times $Cooks times $tablePhysical and recreationaltherapists times $Janitors times $Cooks times $Other variableJanitors times $Debt service,Other variableDepreciation over yearsDebt service,Depreciation over years

Other includes supplies, utilities, food, and so on

In both cases, total administrative costs for Golden Care would increase by $ per year. This seems high, but the increased legal and insurance requirements will add signif

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started