Answered step by step

Verified Expert Solution

Question

1 Approved Answer

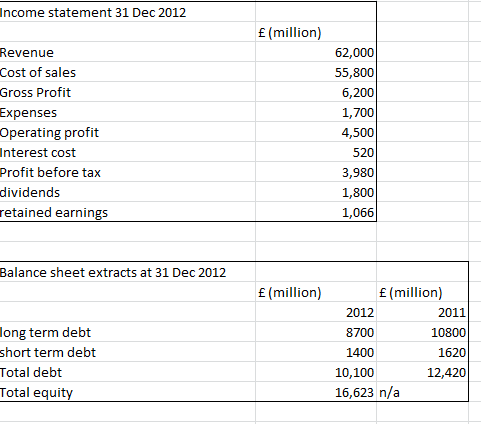

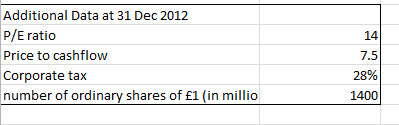

1. calculate the value of each share as at 31 Dec 2012 2. calculate dividend yield as at 31 Dec 2012 3. calculate the price

1. calculate the value of each share as at 31 Dec 2012

2. calculate dividend yield as at 31 Dec 2012

3. calculate the price to book ratio as at 31 Dec 2012

4. explain the four market multiple ratios which were identified in this question and comment on the value of this company

5. critically discuss whether book value is a good estimate of economic value of assets? briefly outline how we can arrive at economic value by giving two examples of balance sheet items

Income statement 31 Dec 2012 Revenue Cost of sales Gross Profit Expenses operating profit Interest cost Profit before tax dividends retained earnings Balance sheet extracts at 31 Dec 2012 long term debt short term debt Total debt Total equity (million) 62,000 55,800 6,200 1,700 4,500 520 3,980 1,800 1,066 (million) (million) 2012 2011 8700 10800 1400 1620 10,100 12,420 16,623 n/aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started