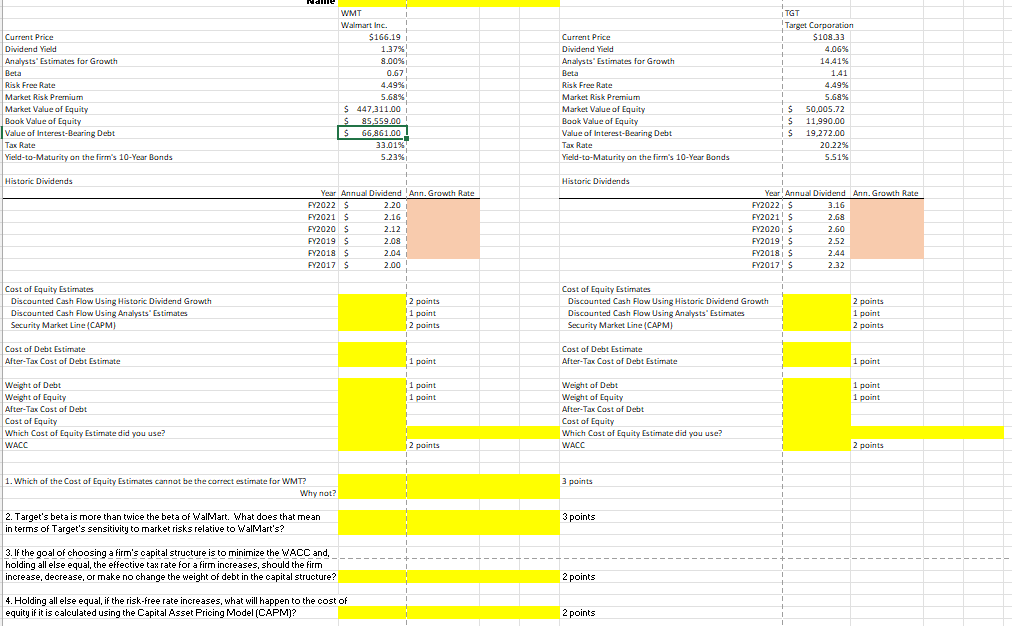

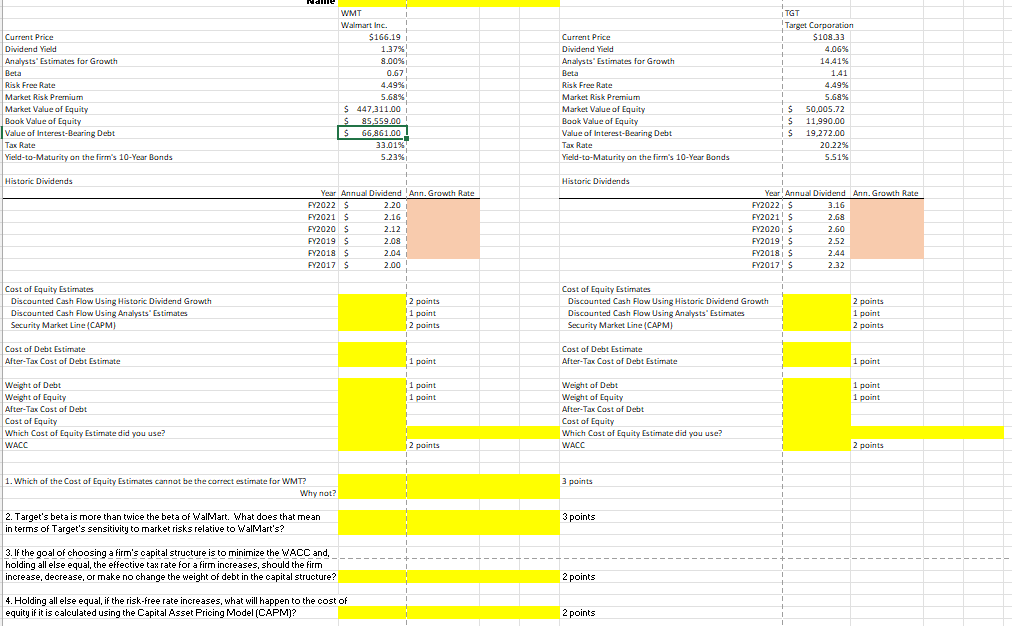

1. Calculate the WACCs for Walmart and Target using the information on the Assignment 3 spreadsheet. (20 points) 2. Answer the four questions on the spreadsheet. (10 points)

\begin{tabular}{|c|c|c|c|c|c|} \hline \\ \hline & WMT & i & & |TGT & \\ \hline & Walmart Inc. & & & Target Corporation & \\ \hline Current Price & $166.19 & & Current Price & $108.33 & \\ \hline Dividend Yield & 1.37%! & & Dividend Yeld & 4.06% & \\ \hline Analysts" Estimates for Growth & 8.00% & & Analysts" Estimates for Growth & 14.41% & \\ \hline Beta & 0.67! & & Beta & 1.41 & \\ \hline Risk Free Rate & 4.49% & & Risk Free Rate & 4.49% & \\ \hline Market Risk Premium & 5.68% & & Market Risk Premium & 5.68% & \\ \hline Market Value of Equity & $447,311.00 & & Market Value of Equity & is 50,005.72 & \\ \hline Book Value of Equity & $85.559.00 & & Book Value of Equity & Is 11,990.00 & \\ \hline Value of Interest-Bearing Debt & 566,861.00 & & Value of Interest-Bearing Debt & is 19,272.00 & \\ \hline Tax Rate & 33.01% & & Tax Rate & 20.22% & \\ \hline Yield-to-Maturity on the firm's 10-Year Bonds & 5.23% & & Yeld-to-Maturity on the firm's 10-Year Bonds & 5.51% & \\ \hline & \begin{tabular}{l} 1 \\ 1 \end{tabular} & \begin{tabular}{l} i \\ \end{tabular} & & & \\ \hline Historic Dividends & 1 & & Historic Dividends & i & \\ \hline Year & Annual Dividend! & Arn. Growth Rate & Year ! & Annual Dividend & Ann. Growth Rate \\ \hline FY2022 & 2.20 & & FY2022 & 3.16 & \\ \hline FY2021 & 2.16 & & FY2021 & 2.68 & \\ \hline FY2020 & 2.12 & & FY2020 & 2.60 & \\ \hline FY2019 & 2.08 & & FY2019 & 2.52 & \\ \hline FY2018 & 2.04 & & FY2018 & 2.44 & \\ \hline FY2017 & 2.00 & & FY2017 & 2.32 & \\ \hline & & i & & i & \\ \hline Cost of Equity Estimates & & ! & Cost of Equity Estimates & 1 & \\ \hline Discounted Cash Flow Using Historic Dividend Growth & & 2 points & Discounted Cash Flaw Using Historic Dividend Growth & 1 & 2 points \\ \hline Discounted Cash Flow Using Analysts" Estimates & & 1 point & Discounted Cash Flow Using Analysts' Estimates & & 1 point \\ \hline Security Market Line (CAPM) & & 12 points & Security Market Line (CAPM) & i & 2 points \\ \hline & i & & & i & \\ \hline Cost of Debt Estimate & i & & Cost of Debt Estimate & & \\ \hline After-Tax Cost of Debt Estimate & & 1 point & After-Tax Cost of Debt Estimate & 1 & 1 point \\ \hline & & i & & i & \\ \hline Weight of Debt & & 1 point & Weight of Debt & & 1 point \\ \hline Weight of Equity & & 1 point & Weight of Equity & i & 1 point \\ \hline After-Tax Cost of Debt & & & After-Tax Cost of Debt & 1 & \\ \hline Cost of Equity & & & Cost of Equity & 1 & \\ \hline Which Cost of Equity Estimate did you use? & i & i & Which Cost of Equity Estimate did you use? & 1 & \\ \hline WACC & & 2 points & WACC & 1 & 2 points \\ \hline & & & & 1 & \\ \hline & i & i & & i & \\ \hline 1. Which of the Cost of Equity Estimates cannot be the correct estimate for WMT? & & i & 3 points & i & \\ \hline Why not? & & is & & i & \\ \hline & & i & & i & \\ \hline 2. Target's beta is more than twice the beta of WalMart. 'What does that mean & i & & 3 points & 1 & \\ \hline in terms of Target's sensitivity to market risks relative to WalMart's? & i & i & & 1 & \\ \hline & & & & & \\ \hline 3. If the goal of choosing a firm's capital structure is to minimize the W'ACC and, & & & & & \\ \hline holding all else equal, the effective tan rate for a firm increases, should the firm & & & & & \\ \hline increase, decrease, or make no change the weight of debt in the capital structure? & i & i & 2 points & & \\ \hline & 1 & & & 1 & \\ \hline 4. Holding all else equal, if the risk-free rate increases, what will happen to the cost & & & & & \\ \hline equity if it is calculated using the Capital Asset Pricing Model (CA.PM)? & i & i & 2 points & & \\ \hline \end{tabular}