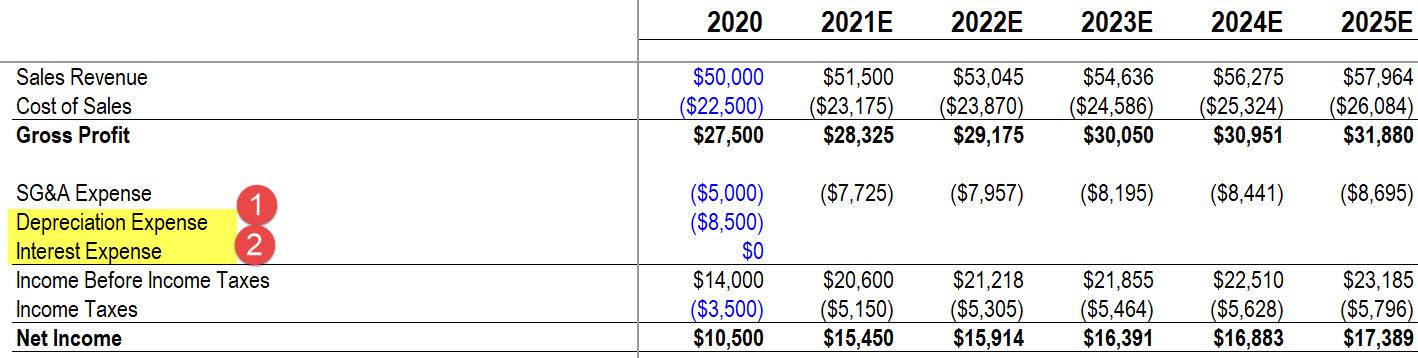

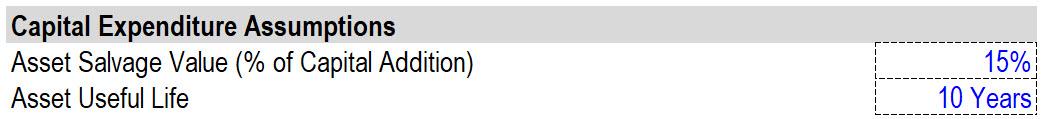

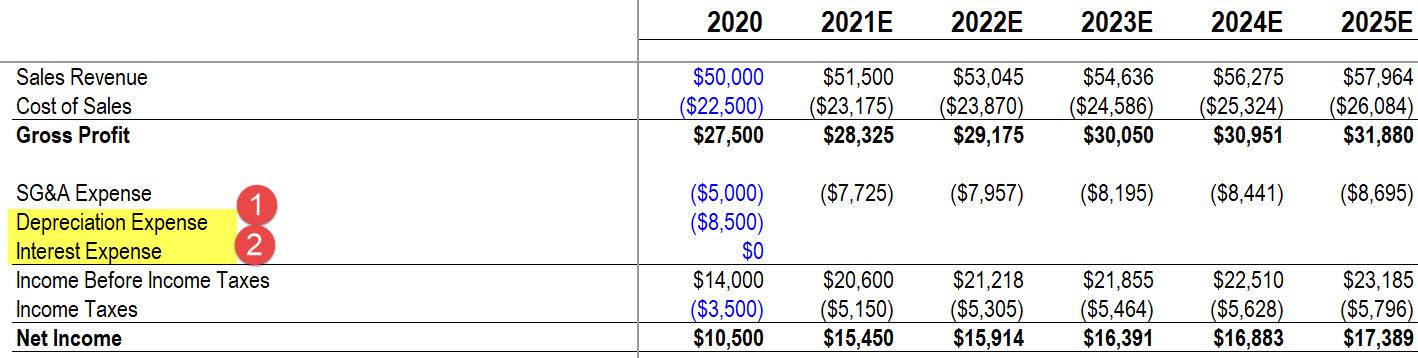

1- calculate total depreciation expense for the year 2025E, select the correct answer below:

$9,775 $17,500 $14,875 $11,500

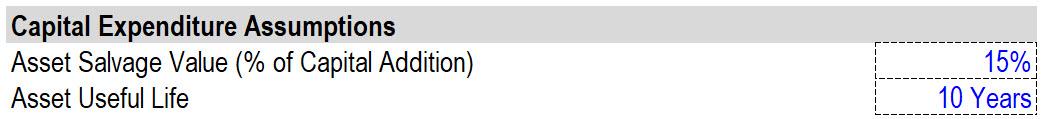

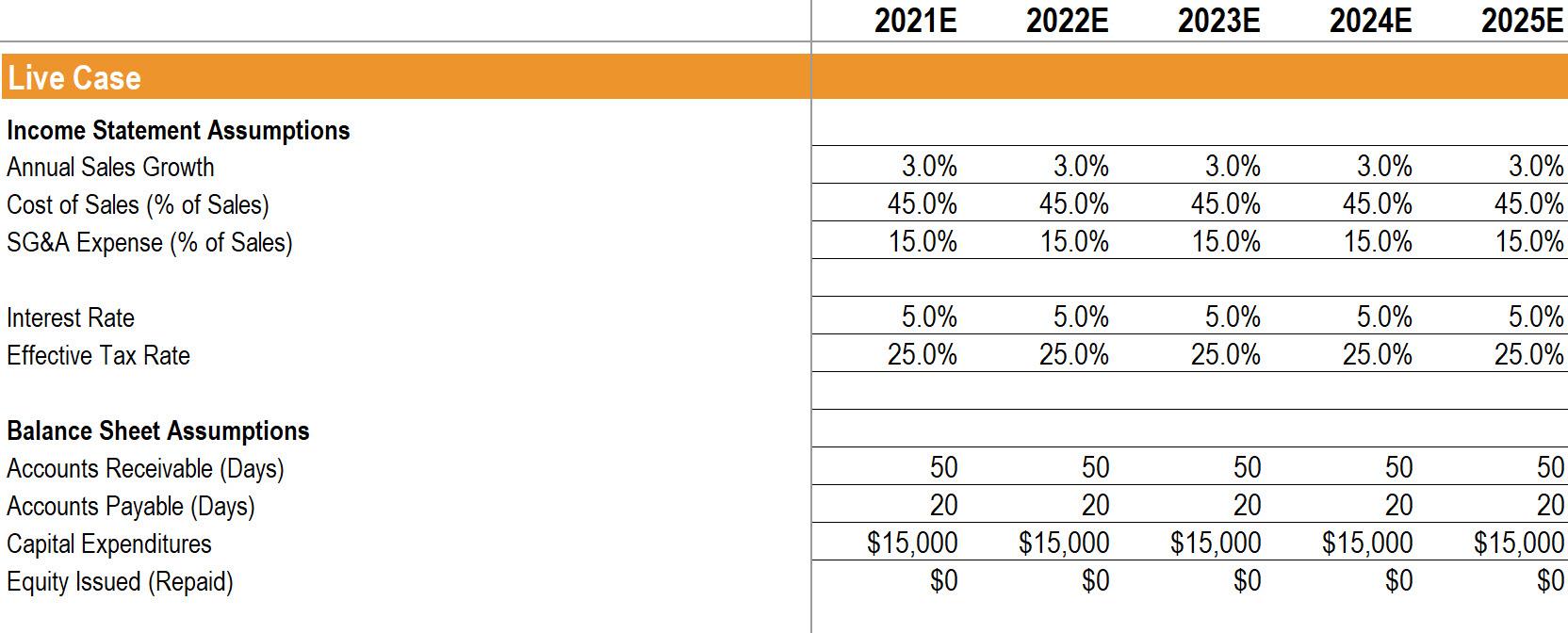

2- calculate the Interest Expense for all the forecasted years: .............

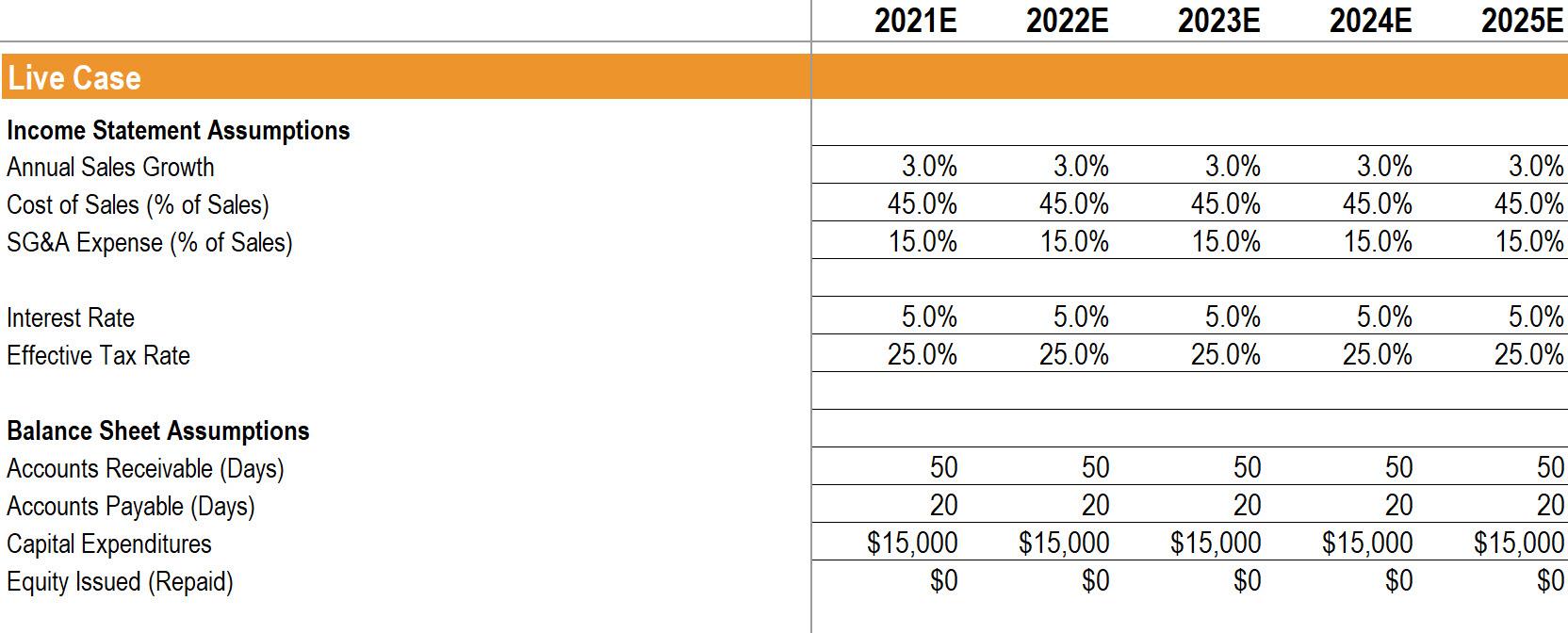

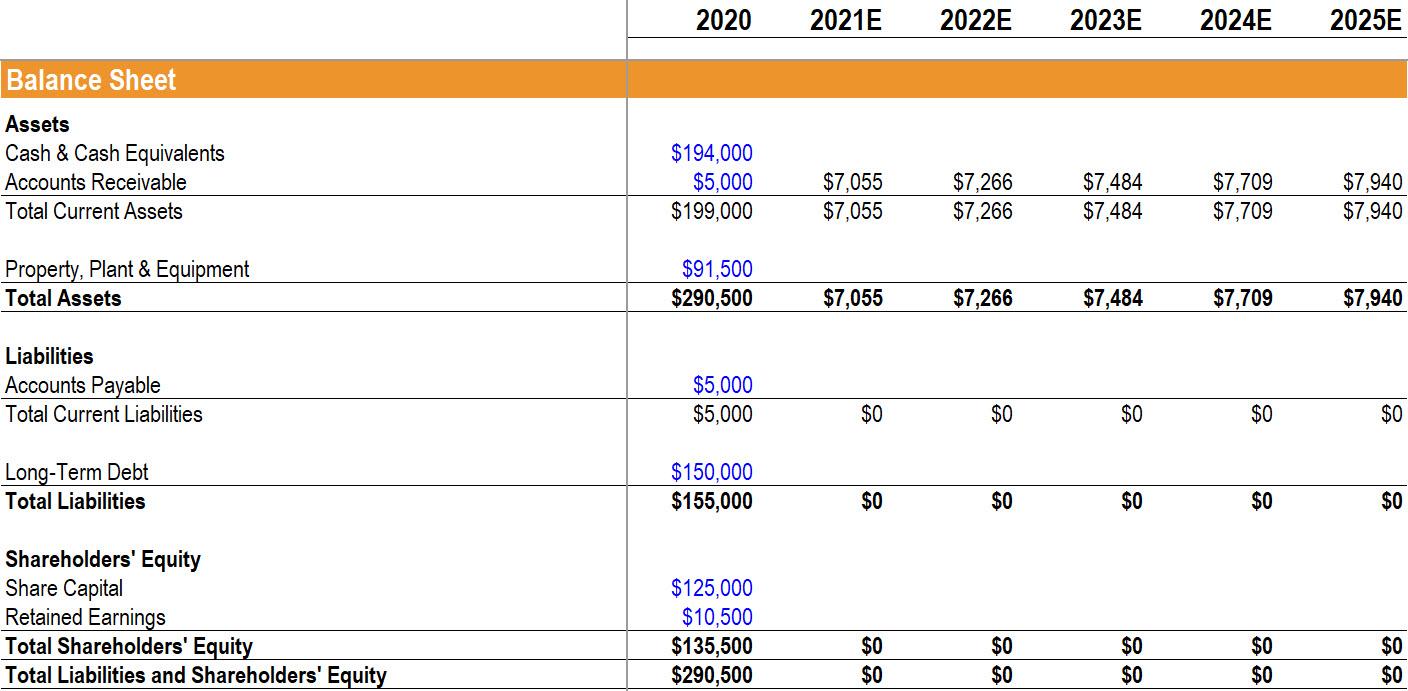

3-calculate the account payable for all the forecasted years: .............

4-calculate the PP&E for all the forecasted years: .............

5-calculate the long term debt for all the forecasted years: .............

6-calculate the share Capital for all the forecasted years: .............

7-calculate the retained earning for all the forecasted years: .............

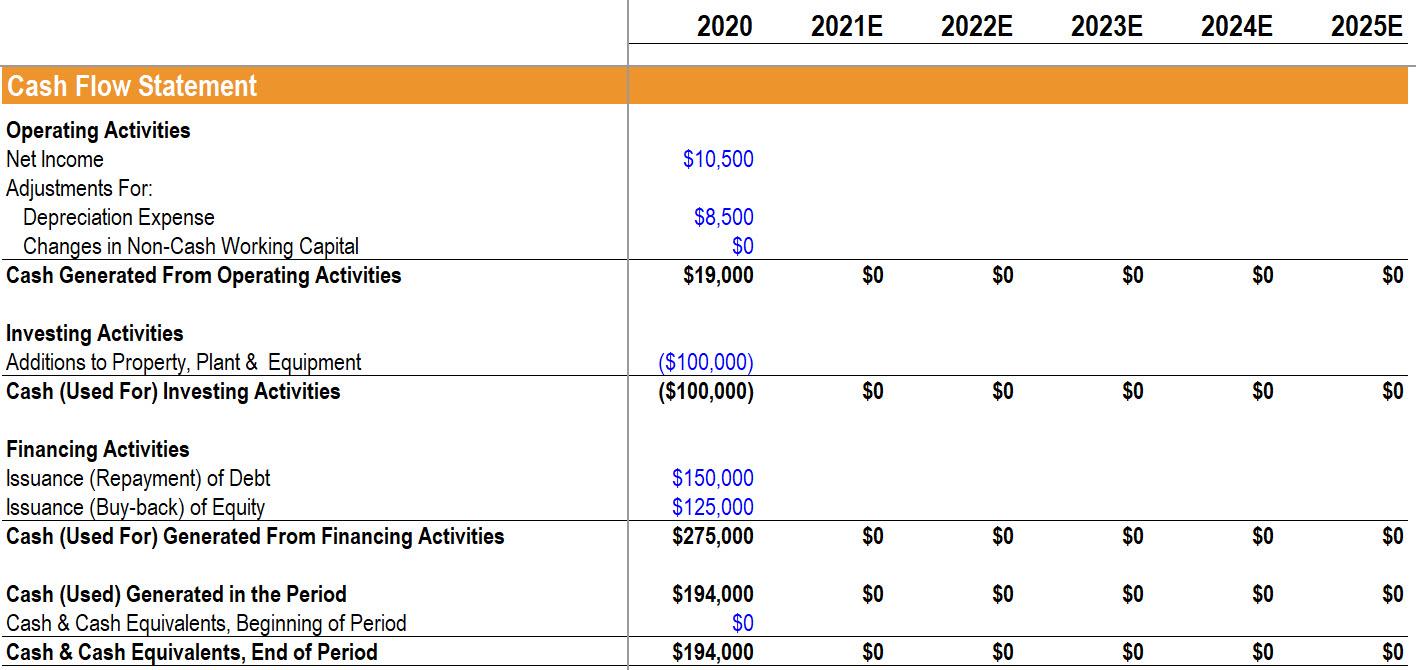

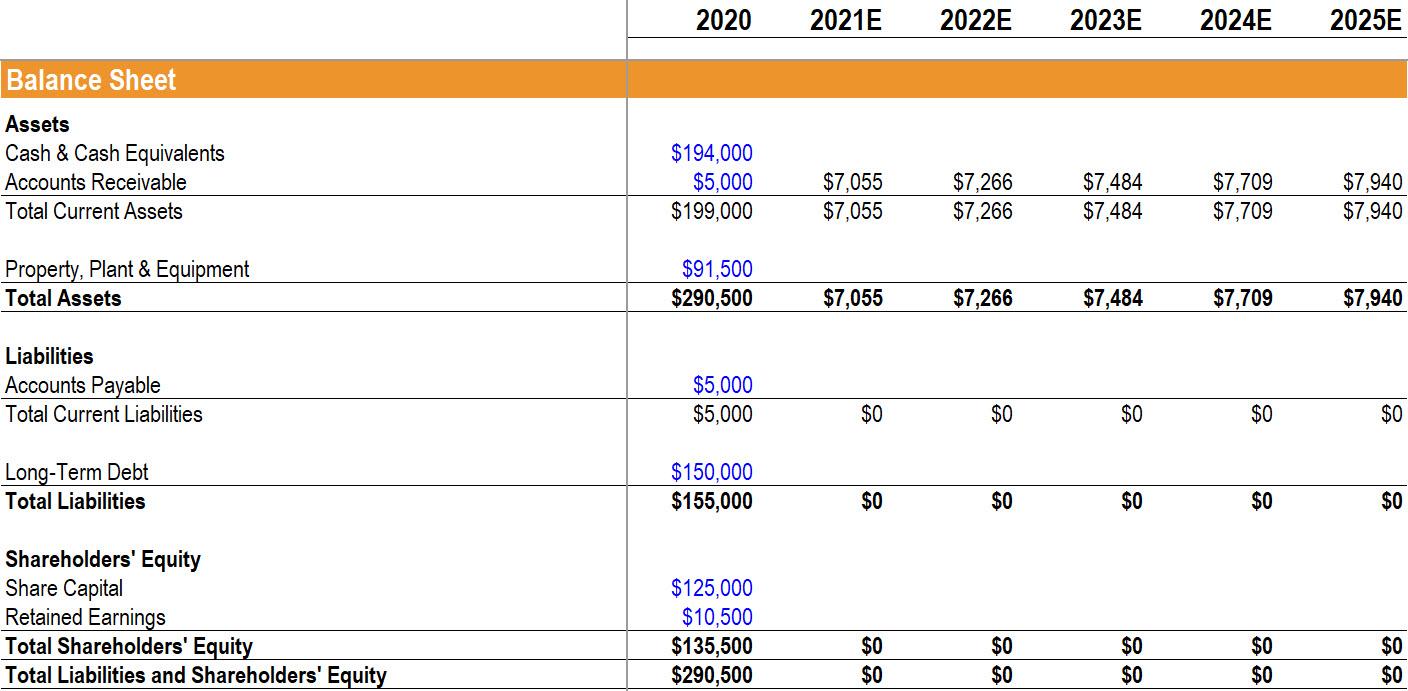

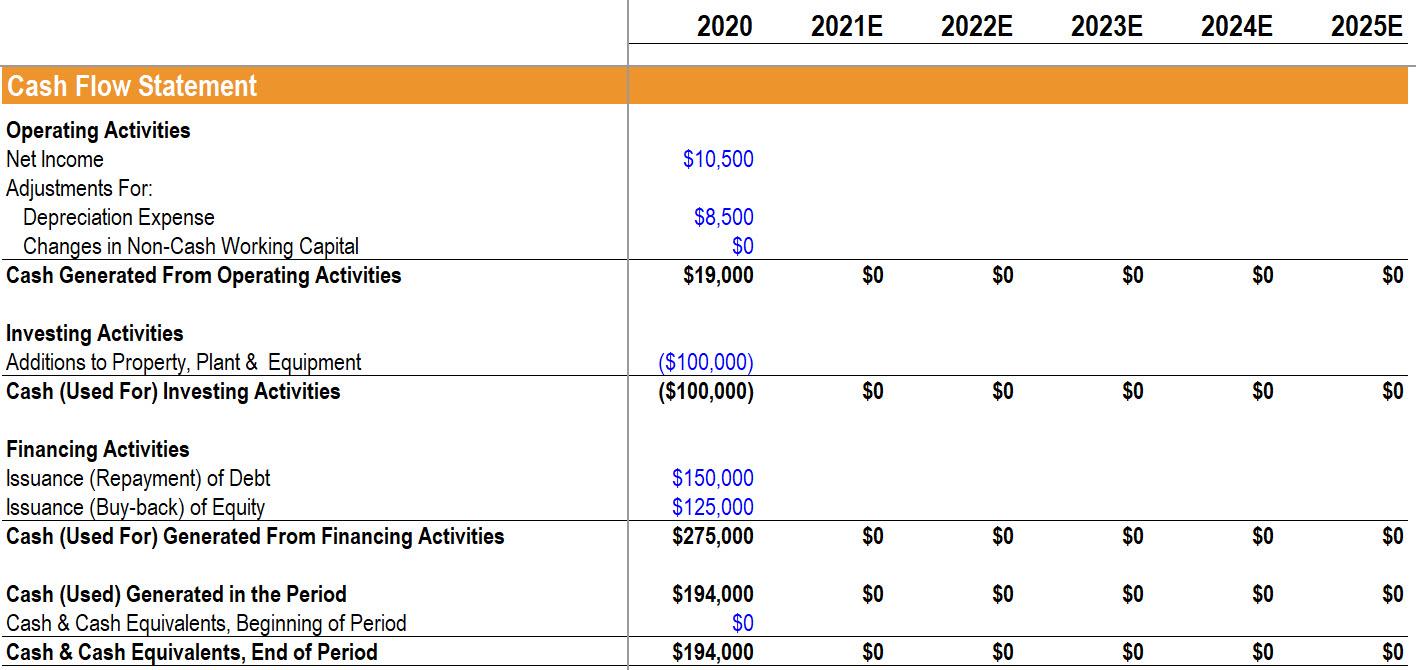

2020 2021E 2022E 2023E 2024E 2025E Sales Revenue Cost of Sales Gross Profit $50,000 ($22,500) $27,500 $51,500 ($23,175) $28,325 $53,045 ($23,870) $29,175 $54,636 ($24,586) $30,050 $56,275 ($25,324) $30,951 $57,964 ($26,084) $31,880 ($7,725) ($7,957) ($8,195) ($8,441) ($8,695) SG&A Expense 1 Depreciation Expense Interest Expense 2 Income Before Income Taxes Income Taxes Net Income ($5,000) ($8,500) $0 $14,000 ($3,500) $10,500 $20,600 ($5,150) $15,450 $21,218 ($5,305) $15,914 $21,855 ($5,464) $16,391 $22,510 ($5,628) $16,883 $23,185 ($5,796) $17,389 Capital Expenditure Assumptions Asset Salvage Value (% of Capital Addition) Asset Useful Life 15% 10 Years 2021E 2022E 2023E 2024E 2025E Live Case Income Statement Assumptions Annual Sales Growth Cost of Sales (% of Sales) SG&A Expense (% of Sales) 3.0% 45.0% 15.0% 3.0% 45.0% 15.0% 3.0% 45.0% 15.0% 3.0% 45.0% 15.0% 3.0% 45.0% 15.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) 50 20 $15,000 $0 50 20 $15,000 $0 50 20 $15,000 $0 50 20 $15,000 $0 50 20 $15,000 $0 2020 2021E 2022E 2023E 2024E 2025E Balance Sheet Assets Cash & Cash Equivalents Accounts Receivable Total Current Assets $194,000 $5,000 $199,000 $7,055 $7,055 $7,266 $7,266 $7,484 $7,484 $7,709 $7,709 $7,940 $7,940 Property, Plant & Equipment Total Assets $91,500 $290,500 $7,055 $7,266 $7,484 $7,709 $7,940 Liabilities Accounts Payable Total Current Liabilities $5,000 $5,000 $0 $0 $0 $0 $0 Long-Term Debt Total Liabilities $150,000 $155,000 $0 $0 $0 $0 $0 Shareholders' Equity Share Capital Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $125,000 $10,500 $135,500 $290,500 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 2020 2021E 2022E 2023E 2024E 2025E $10,500 Cash Flow Statement Operating Activities Net Income Adjustments For: Depreciation Expense Changes in Non-Cash Working Capital Cash Generated From Operating Activities $8,500 $0 $19,000 $0 $0 $0 $0 $0 Investing Activities Additions to Property, Plant & Equipment Cash (Used For) Investing Activities ($100,000) ($100,000) $0 $0 $0 $0 $0 Financing Activities Issuance (Repayment) of Debt Issuance (Buy-back) of Equity Cash (Used For) Generated From Financing Activities $150,000 $125,000 $275,000 $0 $0 $0 50 $0 $0 $0 $0 $0 $0 Cash (Used) Generated in the Period Cash & Cash Equivalents, Beginning of Period Cash & Cash Equivalents, End of Period $194,000 $0 $194,000 $0 $0 $0 $0 $0