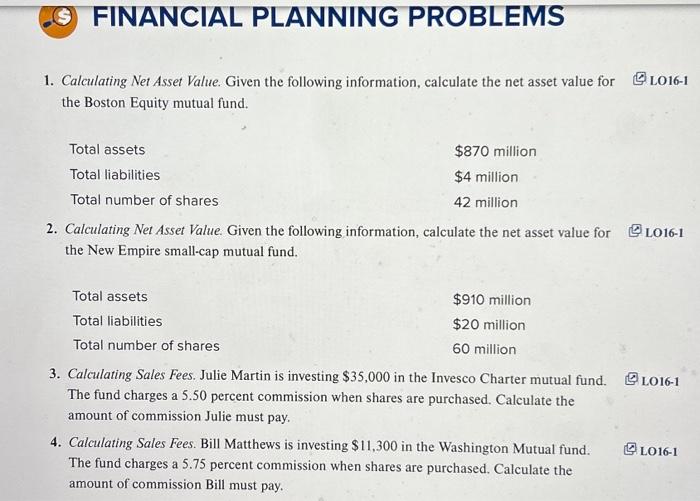

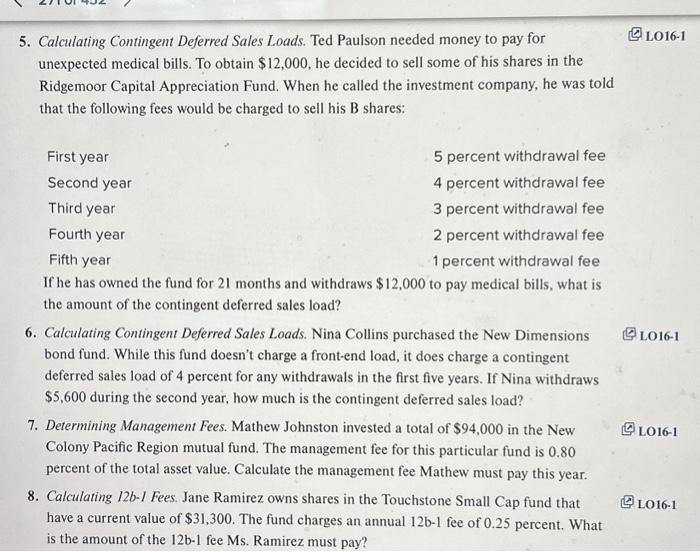

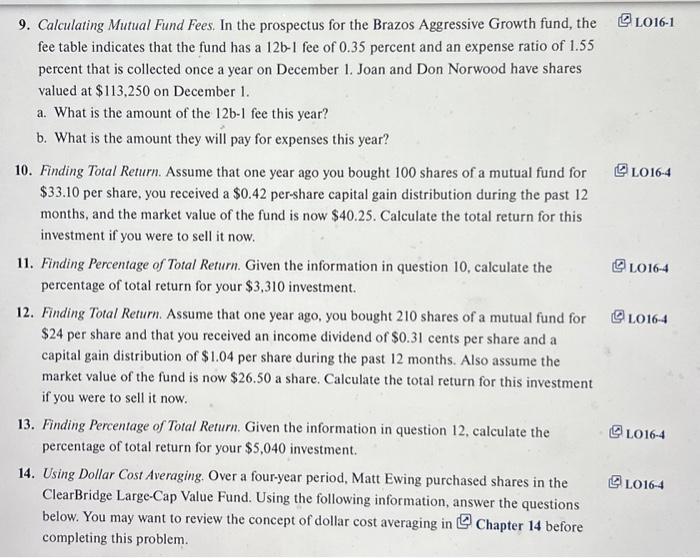

1. Calculating Net Asset Value. Given the following information, calculate the net asset value for (4) LO16-1 the Boston Equity mutual fund. 2. Calculating Net Asset Value. Given the following information, calculate the net asset value for (4) LO16-1 the New Empire small-cap mutual fund. 3. Calculating Sales Fees. Julie Martin is investing $35,000 in the Invesco Charter mutual fund. () LO16-1 The fund charges a 5.50 percent commission when shares are purchased. Calculate the amount of commission Julie must pay. 4. Calculating Sales Fees. Bill Matthews is investing $11,300 in the Washington Mutual fund. 16-1 The fund charges a 5.75 percent commission when shares are purchased. Calculate the amount of commission Bill must pay. Calculating Contingent Deferred Sales Loads. Ted Paulson needed money to pay for unexpected medical bills. To obtain $12,000, he decided to sell some of his shares in the Ridgemoor Capital Appreciation Fund. When he called the investment company, he was told that the following fees would be charged to sell his B shares: 6. Calculating Contingent Deferred Sales Loads. Nina Collins purchased the New Dimensions bond fund. While this fund doesn't charge a front-end load, it does charge a contingent deferred sales load of 4 percent for any withdrawals in the first five years. If Nina withdraws $5,600 during the second year, how much is the contingent deferred sales load? 7. Determining Management Fees. Mathew Johnston invested a total of $94,000 in the New Colony Pacific Region mutual fund. The management fee for this particular fund is 0.80 percent of the total asset value. Calculate the management fee Mathew must pay this year. 8. Calculating 12b-I Fees. Jane Ramirez owns shares in the Touchstone Small Cap fund that have a current value of $31,300. The fund charges an annual 12b1 fee of 0.25 percent. What is the amount of the 12b1 fee Ms. Ramirez must pay? 9. Calculating Mutual Fund Fees. In the prospectus for the Brazos Aggressive Growth fund, the () LO16-1 fee table indicates that the fund has a 12b1 fee of 0.35 percent and an expense ratio of 1.55 percent that is collected once a year on December 1 . Joan and Don Norwood have shares valued at $113,250 on December 1 . a. What is the amount of the 12b1 fee this year? b. What is the amount they will pay for expenses this year? 10. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for () LO16-4 $33.10 per share, you received a $0.42 per-share capital gain distribution during the past 12 months, and the market value of the fund is now $40.25. Calculate the total return for this investment if you were to sell it now. 11. Finding Percentage of Total Return. Given the information in question 10 , calculate the () LO16-4 percentage of total return for your $3,310 investment. 12. Finding Total Return. Assume that one year ago, you bought 210 shares of a mutual fund for () L016-4 $24 per share and that you received an income dividend of $0.31 cents per share and a capital gain distribution of $1.04 per share during the past 12 months. Also assume the market value of the fund is now $26.50 a share. Calculate the total return for this investment if you were to sell it now. 13. Finding Percentage of Total Return. Given the information in question 12, calculate the () LO16-4 percentage of total return for your $5,040 investment. 14. Using Dollar Cost Averaging, Over a four-year period, Matt Ewing purchased shares in the ( LO16-4 ClearBridge Large-Cap Value Fund. Using the following information, answer the questions below. You may want to review the concept of dollar cost averaging in [ Chapter 14 before completing this problem. 1. Calculating Net Asset Value. Given the following information, calculate the net asset value for (4) LO16-1 the Boston Equity mutual fund. 2. Calculating Net Asset Value. Given the following information, calculate the net asset value for (4) LO16-1 the New Empire small-cap mutual fund. 3. Calculating Sales Fees. Julie Martin is investing $35,000 in the Invesco Charter mutual fund. () LO16-1 The fund charges a 5.50 percent commission when shares are purchased. Calculate the amount of commission Julie must pay. 4. Calculating Sales Fees. Bill Matthews is investing $11,300 in the Washington Mutual fund. 16-1 The fund charges a 5.75 percent commission when shares are purchased. Calculate the amount of commission Bill must pay. Calculating Contingent Deferred Sales Loads. Ted Paulson needed money to pay for unexpected medical bills. To obtain $12,000, he decided to sell some of his shares in the Ridgemoor Capital Appreciation Fund. When he called the investment company, he was told that the following fees would be charged to sell his B shares: 6. Calculating Contingent Deferred Sales Loads. Nina Collins purchased the New Dimensions bond fund. While this fund doesn't charge a front-end load, it does charge a contingent deferred sales load of 4 percent for any withdrawals in the first five years. If Nina withdraws $5,600 during the second year, how much is the contingent deferred sales load? 7. Determining Management Fees. Mathew Johnston invested a total of $94,000 in the New Colony Pacific Region mutual fund. The management fee for this particular fund is 0.80 percent of the total asset value. Calculate the management fee Mathew must pay this year. 8. Calculating 12b-I Fees. Jane Ramirez owns shares in the Touchstone Small Cap fund that have a current value of $31,300. The fund charges an annual 12b1 fee of 0.25 percent. What is the amount of the 12b1 fee Ms. Ramirez must pay? 9. Calculating Mutual Fund Fees. In the prospectus for the Brazos Aggressive Growth fund, the () LO16-1 fee table indicates that the fund has a 12b1 fee of 0.35 percent and an expense ratio of 1.55 percent that is collected once a year on December 1 . Joan and Don Norwood have shares valued at $113,250 on December 1 . a. What is the amount of the 12b1 fee this year? b. What is the amount they will pay for expenses this year? 10. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for () LO16-4 $33.10 per share, you received a $0.42 per-share capital gain distribution during the past 12 months, and the market value of the fund is now $40.25. Calculate the total return for this investment if you were to sell it now. 11. Finding Percentage of Total Return. Given the information in question 10 , calculate the () LO16-4 percentage of total return for your $3,310 investment. 12. Finding Total Return. Assume that one year ago, you bought 210 shares of a mutual fund for () L016-4 $24 per share and that you received an income dividend of $0.31 cents per share and a capital gain distribution of $1.04 per share during the past 12 months. Also assume the market value of the fund is now $26.50 a share. Calculate the total return for this investment if you were to sell it now. 13. Finding Percentage of Total Return. Given the information in question 12, calculate the () LO16-4 percentage of total return for your $5,040 investment. 14. Using Dollar Cost Averaging, Over a four-year period, Matt Ewing purchased shares in the ( LO16-4 ClearBridge Large-Cap Value Fund. Using the following information, answer the questions below. You may want to review the concept of dollar cost averaging in [ Chapter 14 before completing this