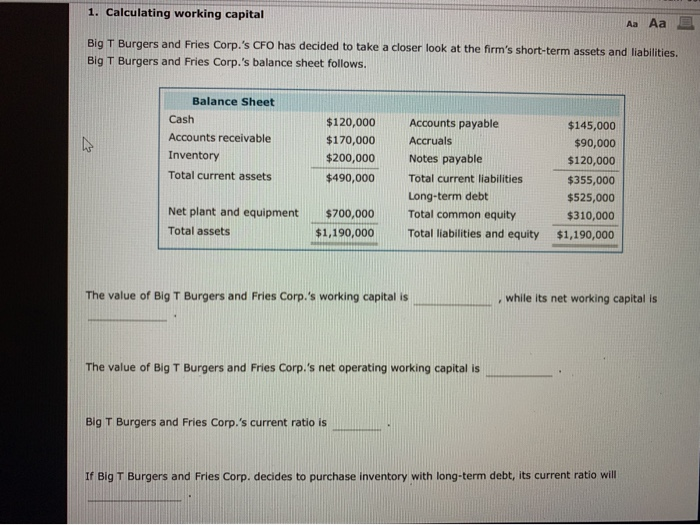

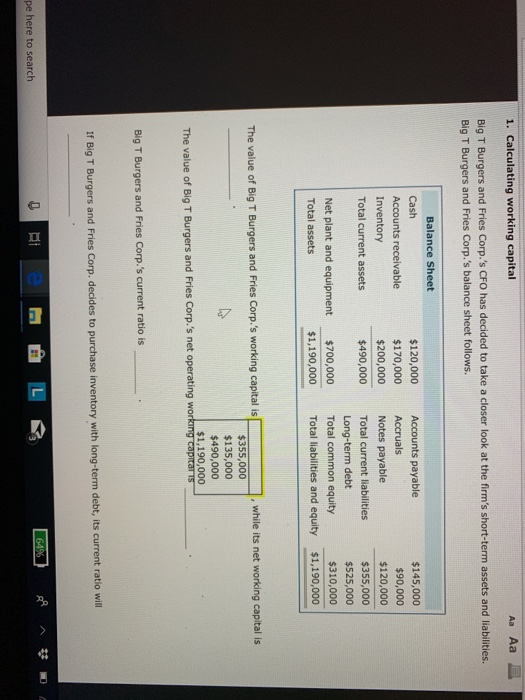

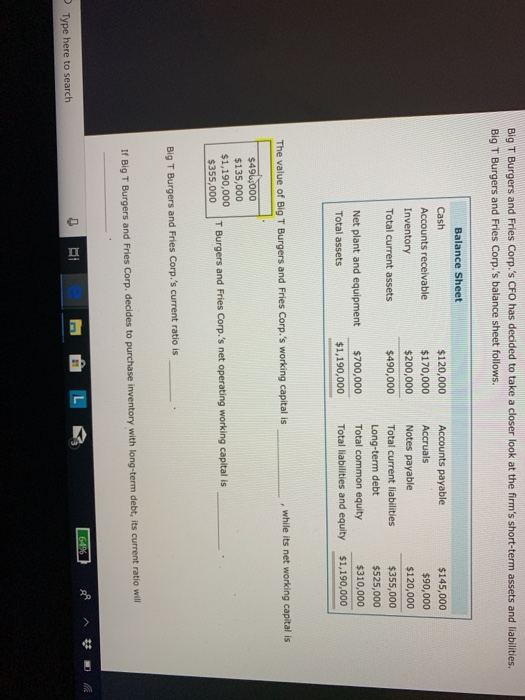

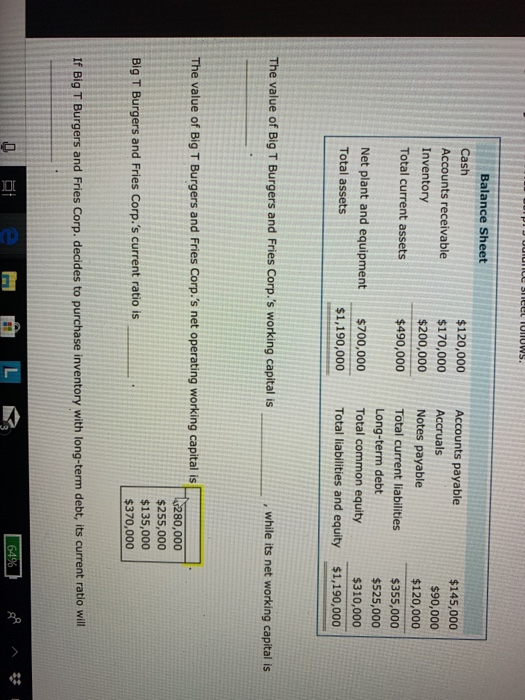

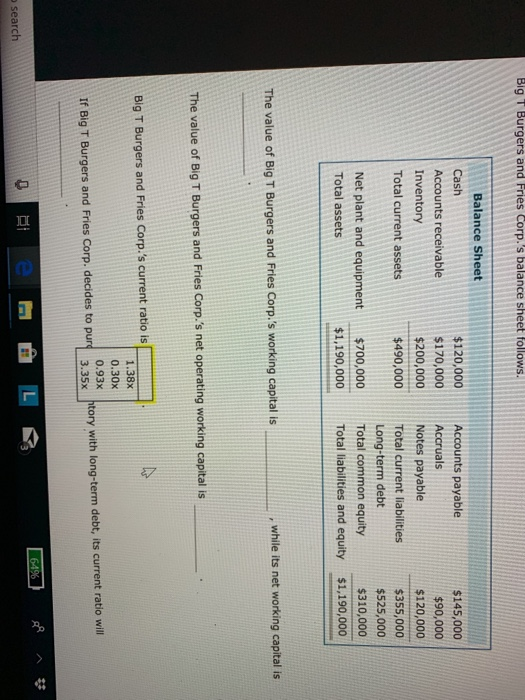

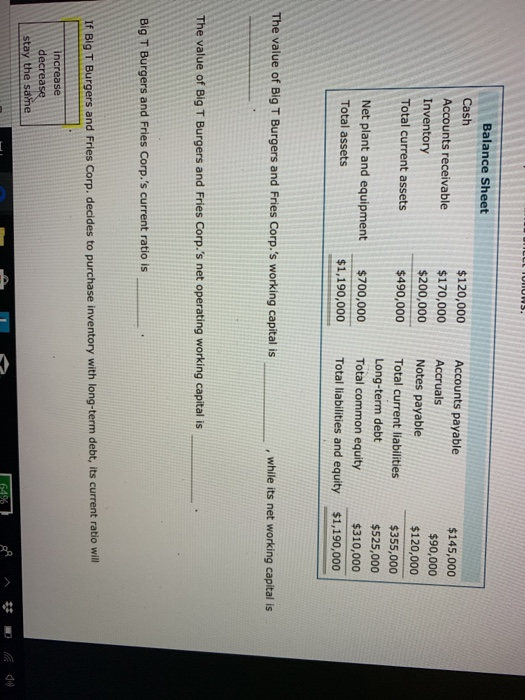

1. Calculating working capital Aa Aa Big T Burgers and Fries Corp.'s CFO has decided to take a closer look at the firm's short-term assets and liabilities. Big T Burgers and Fries Corp.'s balance sheet follows. Balance Sheet Cash $120,000 Accounts payable $145,000 Accounts receivable $170,000 Accruals $90,000 Inventory $200,000 Notes payable $120,000 Total current assets $490,000 Total current liabilities $355,000 Long-term debt $525,000 Net plant and equipment $700,000 Total common equity $310,000 Total ass $1,190,000 Total liabilities and equity $1,190,000 The value of Big T Burgers and Fries Corp.'s working capital is while its net working capital is The value of Big T Burgers and Fries Corp.'s net operating working capital is Big T Burgers and Fries Corp.'s current ratio is If Big T Burgers and Fries Corp. decides to purchase inventory with long-term debt, its current ratio will 1. Calculating working capital Aa Aa Big T Burgers and Fries Corp.'s CFO has decided to take a closer look at the firm's short-term assets and liabilities. Big T Burgers and Fries Corp.'s balance sheet follows. Balance Sheet Cash $120,000 Accounts payable $145,000 Accounts receivable $170,000 Accruals $90,000 Inventory $200,000 Notes payable $120,000 Total current assets $490,000 Total current liabilities $355,000 Long-term debt $525,000 Net plant and equipment $700,000 Total common equity $310,000 Total assets $1,190,000 Total liabilities and equity $1,190,000 The value of Big T Burgers and Fries Corp.'s working capital is while its net working capital is $355,000 $135,000 $490,000 $1,190,000 The value of Big T Burgers and Fries Corp.'s net operating working capitar is Big T Burgers and Fries Corp.'s current ratio is If Big T Burgers and Fries Corp. decides to purchase inventory with long-term debt, its current ratio will L 64% pe here to search Big T Burgers and Fries Corp.'s CFO has decided to take a closer look at the firm's short-term assets and liabilities. Big T Burgers and Fries Corp.'s balance sheet follows. Balance Sheet Cash $120,000 Accounts payable $145,000 Accounts receivable $170,000 Accruals $90,000 Inventory $200,000 Notes payable $120,000 Total current assets $490,000 Total current liabilities $355,000 Long-term debt Total common equity $525,000 Net plant and equipment $700,000 $310,000 Total assets $1,190,000 Total liabilities and equity $1,190,000 The value of Big T Burgers and Fries Corp.'s working capital is while its net working capital is $49000 $135,000 $1,190,000 $355,000 T Burgers and Fries Corp.'s net operating working capital is Big T Burgers and Fries Corp.'s current ratio is If Big T Burgers and Fries Corp. decides to purchase inventory with long-term debt, its current ratio will 64% Type here to search unce 31IEEL 1UNOWS. Balance Sheet Cash $120,000 Accounts payable $145,000 Accounts receivable $170,000 Accruals $90,000 Inventory $200,000 Notes payable $120,000 Total current assets $490,000 Total current liabilities $355,000 Long-term debt $525,000 Net plant and equipment $700,000 Total common equity $310,000 Total assets $1,190,000 Total liabilities and equity $1,190,000 The value of Big T Burgers and Fries Corp.'s working capital is while its net working capital is The value of Big T Burgers and Fries Corp.'s net operating working capital is 280,000 $255,000 $135,000 Big T Burgers and Fries Corp.'s current ratio is $370,000 If Big T Burgers and Fries Corp. decides to purchase inventory with long-term debt, its current ratio will L 64% # OnONS Balance Sheet Cash $120,000 Accounts payable $145,000 Accounts receivable $170,000 Accruals $90,000 Inventory $200,000 Notes payable $120,000 Total current assets $490,000 Total current liabilities $355,000 Long-term debt $525,000 Net plant and equipment $700,000 Total common equity $310,000 Total assets $1,190,000 Total liabilities and equity $1,190,000 The value of Big T Burgers and Fries Corp.'s working capital is while its net working capital is The value of Big T Burgers and Fries Corp.'s net operating working capital is Big T Burgers and Fries Corp.'s current ratio is If Big T Burgers and Fries Corp. decides to purchase inventory with long-term debt, its current ratio will increase decrease stay the same 649%