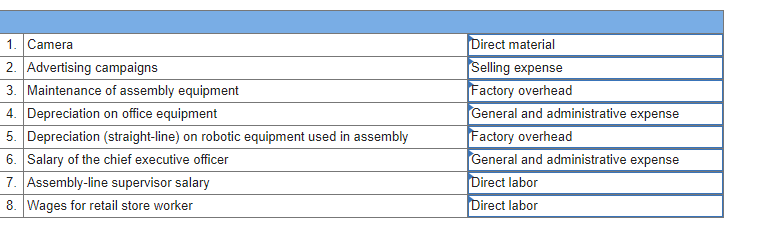

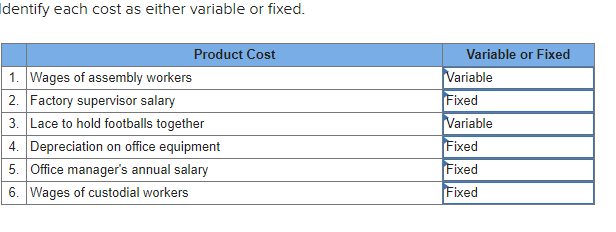

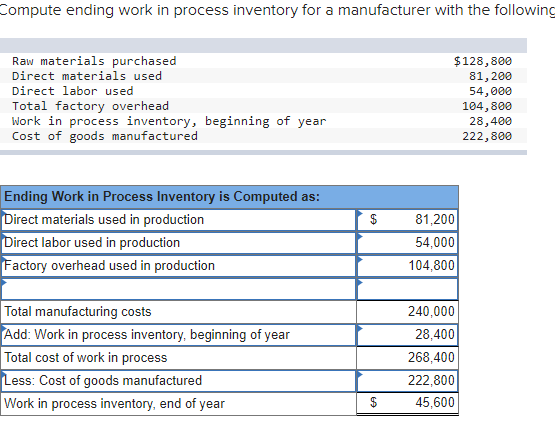

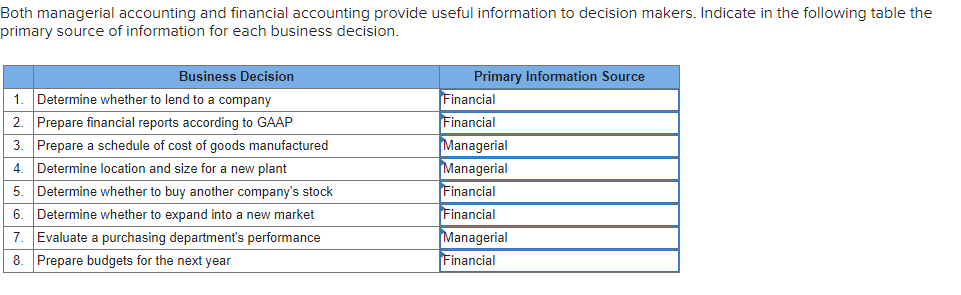

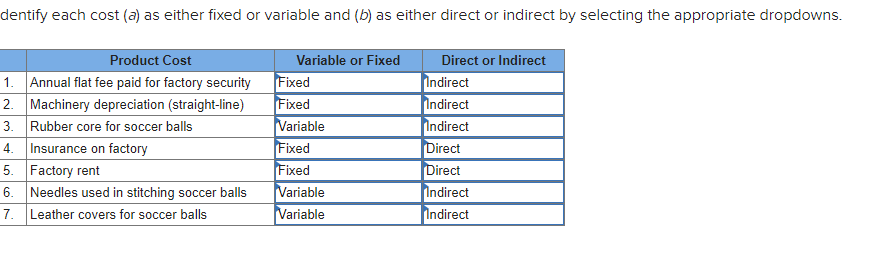

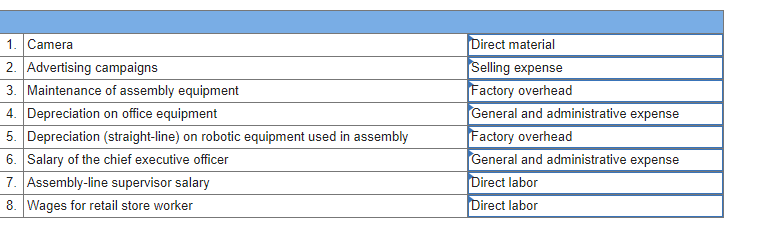

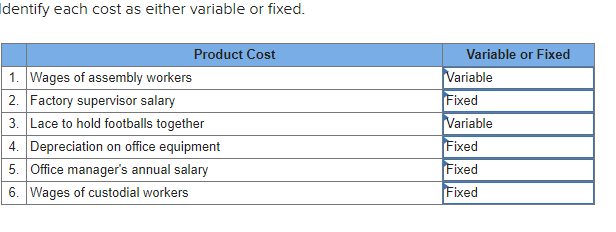

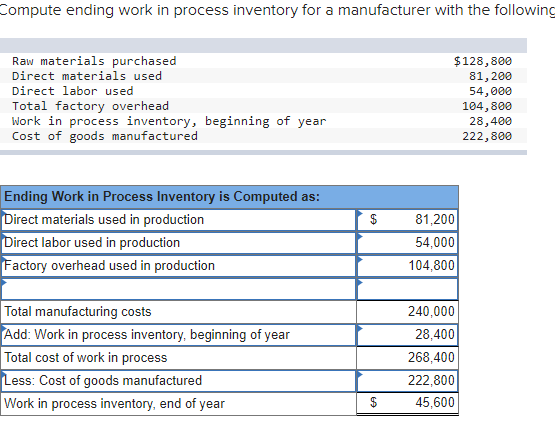

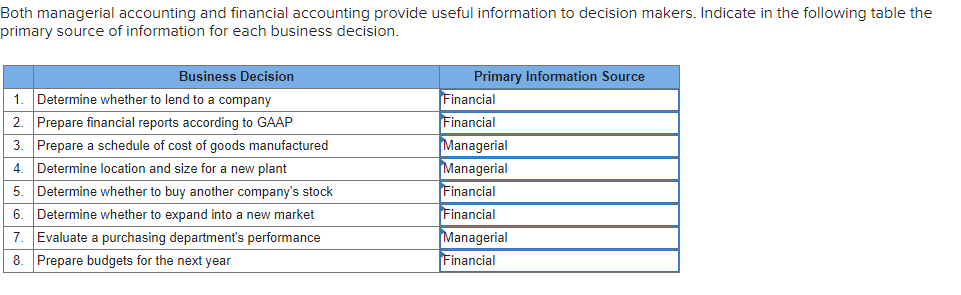

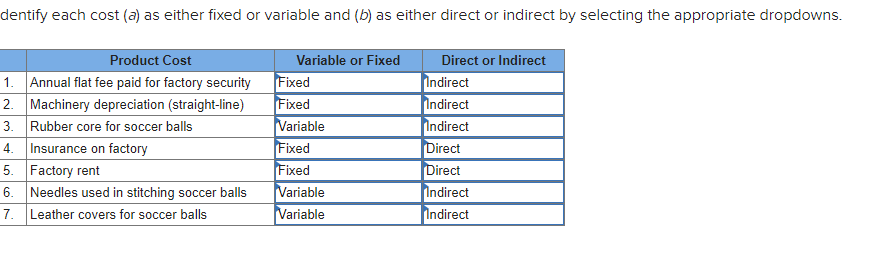

1. Camera 2. Advertising campaigns 3. Maintenance of assembly equipment 4. Depreciation on office equipment 5. Depreciation (straight-line) on robotic equipment used in assembly 6. Salary of the chief executive officer 7. Assembly-line supervisor salary 8. Wages for retail store worker Direct material Selling expense Factory overhead General and administrative expense Factory overhead General and administrative expense Direct labor Direct labor Identify each cost as either variable or fixed. Product Cost 1. Wages of assembly workers 2. Factory supervisor salary 3. Lace to hold footballs together 4. Depreciation on office equipment 5. Office manager's annual salary 6. Wages of custodial workers Variable or Fixed Variable Fixed Variable Fixed Fixed Fixed Compute ending work in process inventory for a manufacturer with the following Raw materials purchased Direct materials used Direct labor used Total factory overhead Work in process inventory, beginning of year Cost of goods manufactured $128,800 81,200 54,000 104,800 28,400 222,800 Ending Work in Process Inventory is Computed as: Direct materials used in production Direct labor used in production Factory overhead used in production 81,200 54,000 104,800 Total manufacturing costs Add: Work in process inventory, beginning of year Total cost of work in process Less: Cost of goods manufactured Work in process inventory, end of year 240,000 28,400 268,400 222,800 45,600 Both managerial accounting and financial accounting provide useful information to decision makers. Indicate in the following table the primary source of information for each business decision. Business Decision 1. Determine whether to lend to a company 2. Prepare financial reports according to GAAP 3. Prepare a schedule of cost of goods manufactured 4 Determine location and size for a new plant 5. Determine whether to buy another company's stock 6. Determine whether to expand into a new market 7. Evaluate a purchasing department's performance 8. Prepare budgets for the next year Primary Information Source Financial Financial Managerial Managerial Financial Financial Managerial Financial dentify each cost (a) as either fixed or variable and (b) as either direct or indirect by selecting the appropriate dropdowns. Product Cost 1. Annual flat fee paid for factory security 2. Machinery depreciation (straight-line) 3. Rubber core for soccer balls 4. Insurance on factory 5. Factory rent 6. Needles used in stitching soccer balls 7. Leather covers for soccer balls Variable or Fixed Fixed Fixed Variable Fixed Fixed Variable Variable Direct or Indirect Indirect Indirect Indirect Direct Direct Indirect Indirect 1. Camera 2. Advertising campaigns 3. Maintenance of assembly equipment 4. Depreciation on office equipment 5. Depreciation (straight-line) on robotic equipment used in assembly 6. Salary of the chief executive officer 7. Assembly-line supervisor salary 8. Wages for retail store worker Direct material Selling expense Factory overhead General and administrative expense Factory overhead General and administrative expense Direct labor Direct labor Identify each cost as either variable or fixed. Product Cost 1. Wages of assembly workers 2. Factory supervisor salary 3. Lace to hold footballs together 4. Depreciation on office equipment 5. Office manager's annual salary 6. Wages of custodial workers Variable or Fixed Variable Fixed Variable Fixed Fixed Fixed Compute ending work in process inventory for a manufacturer with the following Raw materials purchased Direct materials used Direct labor used Total factory overhead Work in process inventory, beginning of year Cost of goods manufactured $128,800 81,200 54,000 104,800 28,400 222,800 Ending Work in Process Inventory is Computed as: Direct materials used in production Direct labor used in production Factory overhead used in production 81,200 54,000 104,800 Total manufacturing costs Add: Work in process inventory, beginning of year Total cost of work in process Less: Cost of goods manufactured Work in process inventory, end of year 240,000 28,400 268,400 222,800 45,600 Both managerial accounting and financial accounting provide useful information to decision makers. Indicate in the following table the primary source of information for each business decision. Business Decision 1. Determine whether to lend to a company 2. Prepare financial reports according to GAAP 3. Prepare a schedule of cost of goods manufactured 4 Determine location and size for a new plant 5. Determine whether to buy another company's stock 6. Determine whether to expand into a new market 7. Evaluate a purchasing department's performance 8. Prepare budgets for the next year Primary Information Source Financial Financial Managerial Managerial Financial Financial Managerial Financial dentify each cost (a) as either fixed or variable and (b) as either direct or indirect by selecting the appropriate dropdowns. Product Cost 1. Annual flat fee paid for factory security 2. Machinery depreciation (straight-line) 3. Rubber core for soccer balls 4. Insurance on factory 5. Factory rent 6. Needles used in stitching soccer balls 7. Leather covers for soccer balls Variable or Fixed Fixed Fixed Variable Fixed Fixed Variable Variable Direct or Indirect Indirect Indirect Indirect Direct Direct Indirect Indirect