Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Can you please explain how is the term structure defined? Namely, how would it changes if today were february instead of january 1st? 2)

1) Can you please explain how is the term structure defined? Namely, how would it changes if today were february instead of january 1st?

2) Can you please explain why de fixed and floting parts are so different? Why the second term is 1050 in the fixed and 1000 on the floating option.

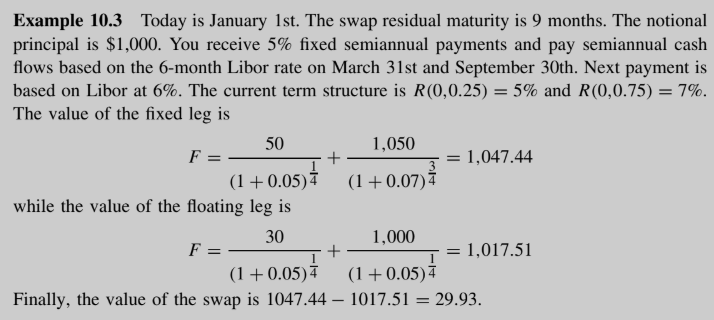

Example 10.3 Today is January 1st. The swap residual maturity is 9 months. The notional principal is $1,000. You receive 5% fixed semiannual payments and pay semiannual cash flows based on the 6-month Libor rate on March 31st and September 30th. Next payment is based on Libor at 6%. The current term structure is R(0,025)-5% and R(0,0.75)-7%. The value of the fixed leg is 50 1,050 1,047.44 + (1 +0.05)4 (0.07)4 while the value of the floating leg is 1.000 (1 + 0.05) 30 1,017.51 (1 + 0.05)T Finally, the value of the swap is 1047.44-1017.51 29.93Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started