1. Can you rank the projects simply by inspecting the cash flows?

2. What criteria might you use to rank the projects? Which quantitative ranking methods are better? Why?

3. What is the ranking you found by using quantitative methods? Does this ranking differ from the ranking obtained by simple inspection of the cash flows?

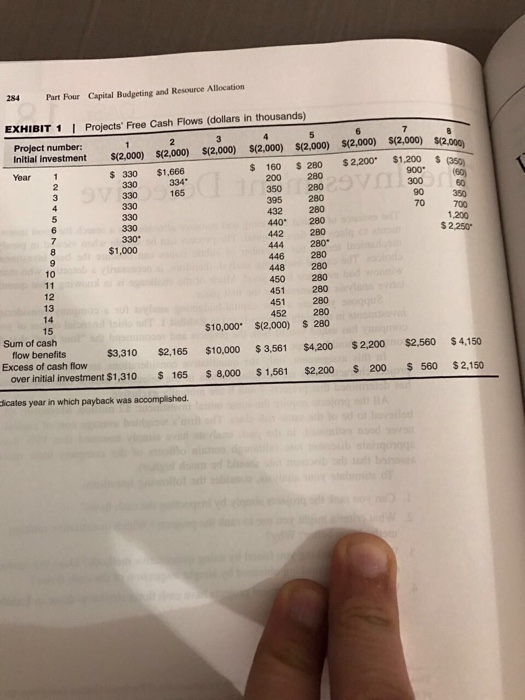

4. What kinds of real investment projects have cash flows similar to those in Exhibit 1?

18 The Investment Detective The essence of capital budgeting and resource allocation is a search for good ments to place the firm's capital. The process be simple when viewed in purely can mechanical terms, but a number of subtle issues can obscure the best investment choices. The capital-budgeting analyst, therefore, is necessarily a detective who must winnow bad evidence from good. Much of the challenge is in knowing what quanti- tative analysis to generate in the first place. Suppose you are a new capital-budgeting analyst for a company considering investments in the eight projects listed in Exhibit 1. The chief financial officer of your company has asked you to rank the projects and recommend the "four best" that the company should accept. In this assignment, only the quantitative considerations are relevant. No other project characteristics are deciding factors in the selection, except that management has determined that projects 7 and 8 are mutually exclusive. All the projects require the same initial investment: $2 million. Moreover, all are believed to be of the same risk class. The firm's weighted average cost of capital has never been estimated. In the past, analysts have simply assumed that 10% was an appropriate discount rate (although certain officers of the company have recently asserted that the discount rate should be much higher). To stimulate your analysis, consider the following questions: 1. Can you rank the projects simply by inspecting the cash flows? 2. What criteria might you use to rank the projects? Which quantitative ranking methods are better? Why? 3. What is the ranking you found by using quantitative methods? Does this ranking differ from the ranking obtained by simple inspection of the cash flows? 4. what kinds of real investment projects have cash flows similar to those in Exhibit 1? This case was prepared by Robert F Bruner, with the permission of Professor Gordon Donaldson, the author of an antecedent case. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright o 1988 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To onder copies send an e-mail No part ofthis publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means- electroric, mechanical 0612. photocopying, recording, or otherwise without the permission ofthe Dandenschool Roundation. Rev. 283