Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Capital Investment Decisions RED TOWN FC has an empty unit in its stadium that could be used as a retail unit to sell club

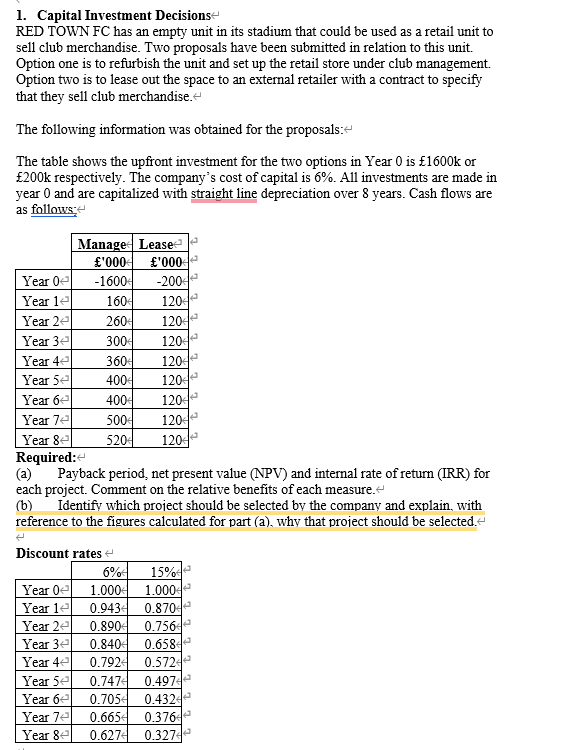

1. Capital Investment Decisions RED TOWN FC has an empty unit in its stadium that could be used as a retail unit to sell club merchandise. Two proposals have been submitted in relation to this unit. Option one is to refurbish the unit and set up the retail store under club management. Option two is to lease out the space to an external retailer with a contract to specify that they sell club merchandise. The following information was obtained for the proposals: The table shows the upfront investment for the two options in Year 0 is 1600k or 200k respectively. The company's cost of capital is 6%. All investments are made in year 0 and are capitalized with straight line depreciation over 8 years. Cash flows are as follows: Required: (a) Payback period, net present value (NPV) and internal rate of return (IRR) for each project. Comment on the relative benefits of each measure. (b) Identify which project should be selected by the company and explain. with reference to the figures calculated for part (a), why that project should be selected. Discount rates

1. Capital Investment Decisions RED TOWN FC has an empty unit in its stadium that could be used as a retail unit to sell club merchandise. Two proposals have been submitted in relation to this unit. Option one is to refurbish the unit and set up the retail store under club management. Option two is to lease out the space to an external retailer with a contract to specify that they sell club merchandise. The following information was obtained for the proposals: The table shows the upfront investment for the two options in Year 0 is 1600k or 200k respectively. The company's cost of capital is 6%. All investments are made in year 0 and are capitalized with straight line depreciation over 8 years. Cash flows are as follows: Required: (a) Payback period, net present value (NPV) and internal rate of return (IRR) for each project. Comment on the relative benefits of each measure. (b) Identify which project should be selected by the company and explain. with reference to the figures calculated for part (a), why that project should be selected. Discount rates Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started