Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Carefully explain the difference between hedging, speculation, and arbitrage. [3 Marks] 2. Define the following financial contracts. [6 Marks] 2.1 Forward contract 2.2 Futures

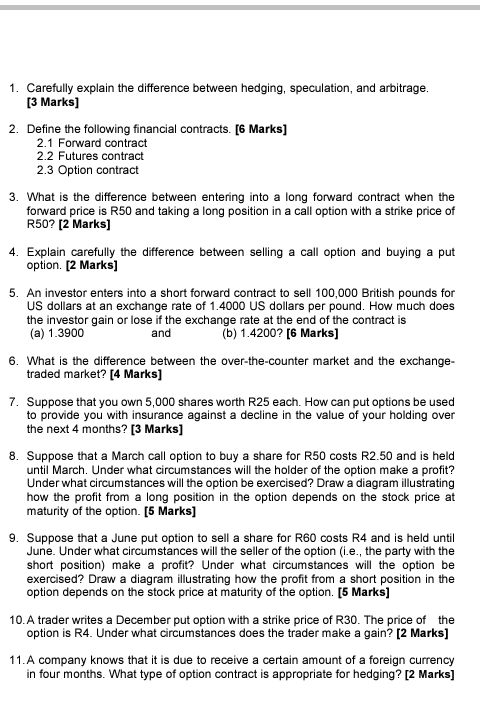

1. Carefully explain the difference between hedging, speculation, and arbitrage. [3 Marks] 2. Define the following financial contracts. [6 Marks] 2.1 Forward contract 2.2 Futures contract 2.3 Option contract 3. What is the difference between entering into a long forward contract when the forward price is R50 and taking a long position in a call option with a strike price of R50? [2 marks] 4. Explain carefully the difference between selling a call option and buying a put option. [2 marks] 5. An investor enters into a short forward contract to sell 100,000 British pounds for US dollars at an exchange rate of 1.4000 US dollars per pound. How much does the investor gain or lose if the exchange rate at the end of the contract is (a) 1.3900 and (b) 1.4200? [6 Marks] 6. What is the difference between the over-the-counter market and the exchange- traded market? [4 Marks] 7. Suppose that you own 5,000 shares worth R25 each. How can put options be used to provide you with insurance against a decline in the value of your holding over the next 4 months? [3 Marks] 8. Suppose that a March call option to buy a share for R50 costs R2.50 and is held until March. Under what circumstances will the holder of the option make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option. [5 Marks] 9. Suppose that a June put option to sell a share for R60 costs R4 and is held until June. Under what circumstances will the seller of the option (i.e., the party with the short position) make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a short position in the option depends on the stock price at maturity of the option. [5 Marks] 10. A trader writes a December put option with a strike price of R30. The price of the option is R4. Under what circumstances does the trader make a gain? [2 marks] 11. A company knows that it is due to receive a certain amount of a foreign currency in four months. What type of option contract is appropriate for hedging? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started