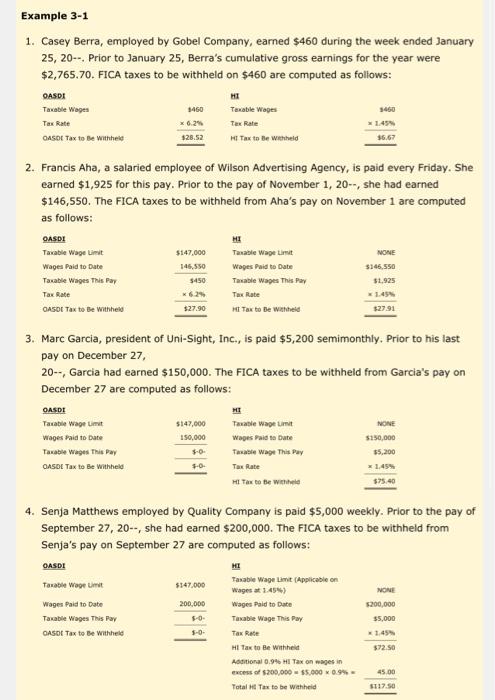

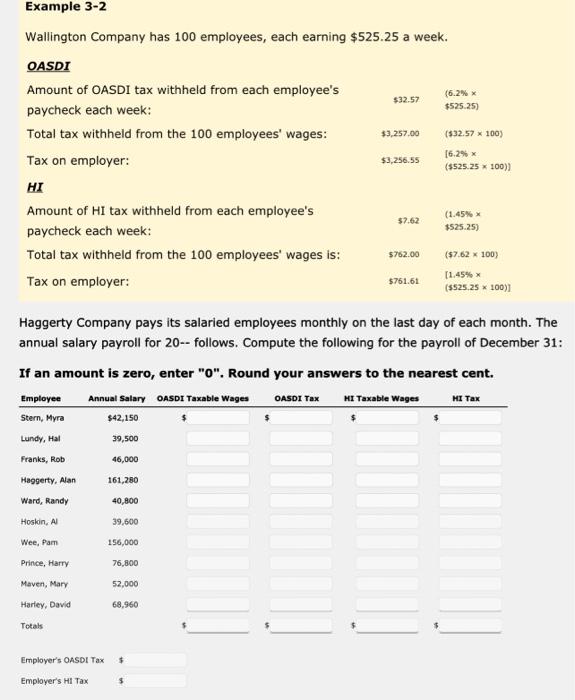

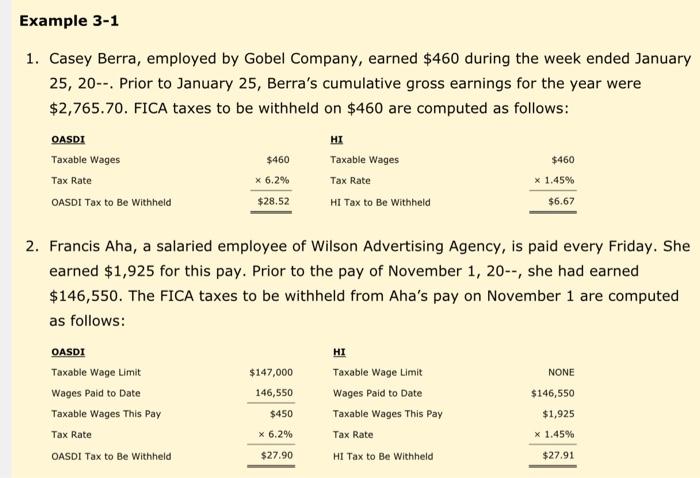

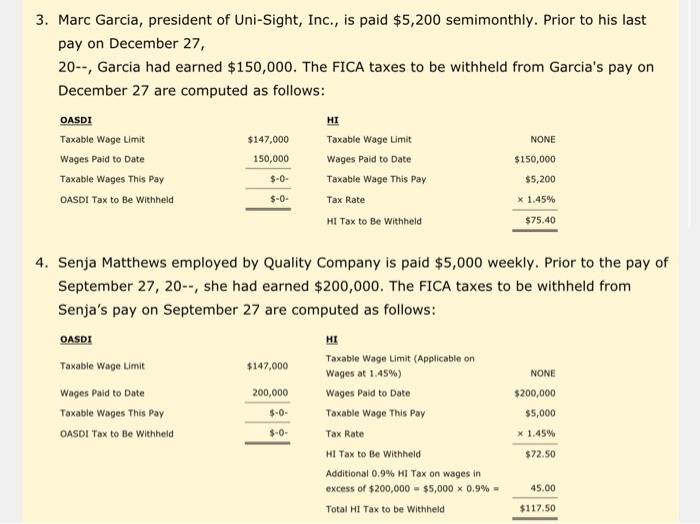

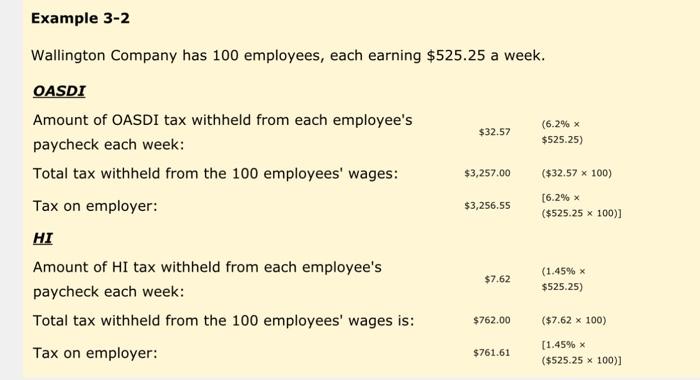

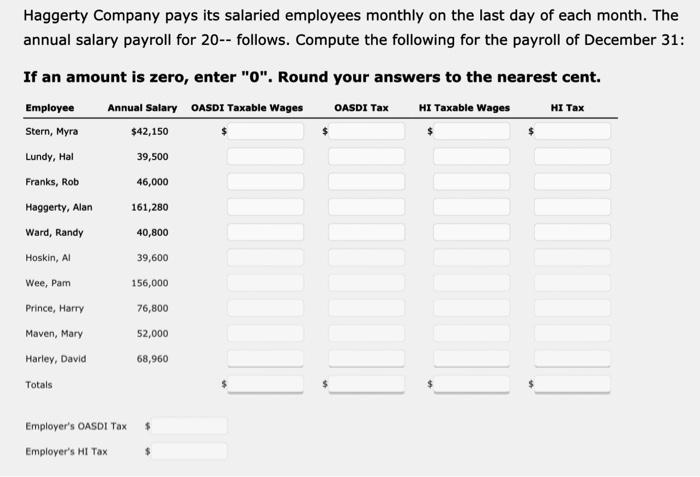

1. Casey Berra, employed by Gobel Company, earned $460 during the week ended January 25, 20-. Prior to January 25, Berra's cumulative gross earnings for the year were $2,765.70. FICA taxes to be withheld on $460 are computed as follows: 2. Francis Aha, a salaried employee of Wilson Advertising Agency, is paid every Friday. She earned $1,925 for this pay. Prior to the pay of November 1,20, she had earned $146,550. The FICA taxes to be withheld from Aha's pay on November 1 are computed as follows: 3. Marc Garcia, president of Uni-Sight, Inc, is paid $5,200 semimonthly. Prior to his last pay on December 27 , 20, Garcia had earned $150,000. The FICA taxes to be withheld from Garcia's pay on December 27 are computed as follows: 4. Senja Matthews employed by Quality Company is paid $5,000 weekly. Prior to the pay of September 27,20, she had earned $200,000. The FICA taxes to be withheld from Senja's pay on September 27 are computed as follows: Wallington Company has 100 employees, each earning $525.25 a week. Haggerty Company pays its salaried employees monthly on the last day of each month. The annual salary payroll for 20 -- follows. Compute the following for the payroll of December 31 : If an amount is zero, enter " 0 ". Round your answers to the nearest cent. 1. Casey Berra, employed by Gobel Company, earned $460 during the week ended January 25, 20--. Prior to January 25, Berra's cumulative gross earnings for the year were $2,765.70. FICA taxes to be withheld on $460 are computed as follows: 2. Francis Aha, a salaried employee of Wilson Advertising Agency, is paid every Friday. She earned $1,925 for this pay. Prior to the pay of November 1,20, she had earned $146,550. The FICA taxes to be withheld from Aha's pay on November 1 are computed as follows: 3. Marc Garcia, president of Uni-Sight, Inc., is paid $5,200 semimonthly. Prior to his last pay on December 27 , 20, Garcia had earned $150,000. The FICA taxes to be withheld from Garcia's pay on December 27 are computed as follows: 4. Senja Matthews employed by Quality Company is paid $5,000 weekly. Prior to the pay of September 27, 20--, she had earned $200,000. The FICA taxes to be withheld from Senja's pay on September 27 are computed as follows: Wallington Company has 100 employees, each earning $525.25 a week. Haggerty Company pays its salaried employees monthly on the last day of each month. The annual salary payroll for 20 follows. Compute the following for the payroll of December 31 : If an amount is zero, enter " 0 ". Round your answers to the nearest cent