Answered step by step

Verified Expert Solution

Question

1 Approved Answer

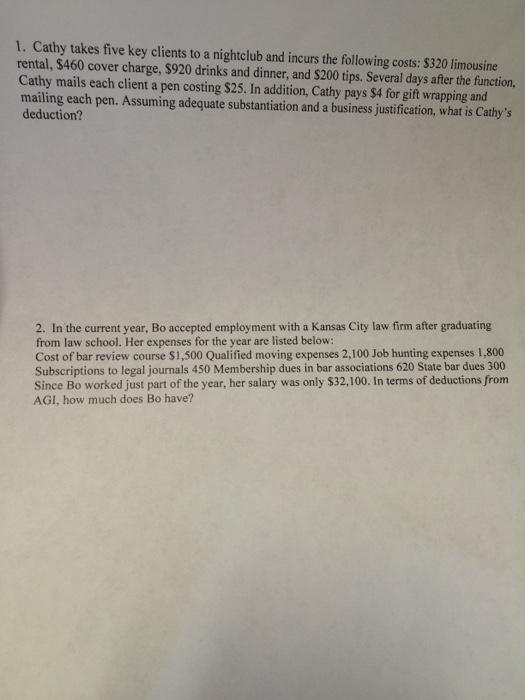

1. Cathy takes five key clients to a nightclub and incurs the following costs: $320 limousine rental, $460 cover charge, $920 drinks and dinner,

1. Cathy takes five key clients to a nightclub and incurs the following costs: $320 limousine rental, $460 cover charge, $920 drinks and dinner, and $200 tips. Several days after the function, Cathy mails each client a pen costing $25. In addition, Cathy pays $4 for gift wrapping and mailing each pen. Assuming adequate substantiation and a business justification, what is Cathy's deduction? 2. In the current year, Bo accepted employment with a Kansas City law firm after graduating from law school. Her expenses for the year are listed below: Cost of bar review course $1,500 Qualified moving expenses 2,100 Job hunting expenses 1,800 Subscriptions to legal journals 450 Membership dues in bar associations 620 State bar dues 300 Since Bo worked just part of the year, her salary was only $32,100. In terms of deductions from AGI, how much does Bo have?

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Solution Answer 1 1255 320 460 920 200 50 1110 Also all...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started