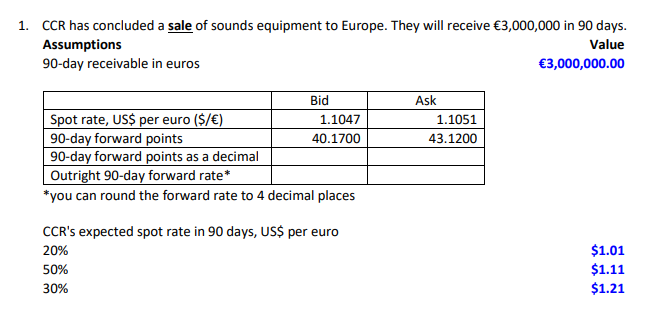

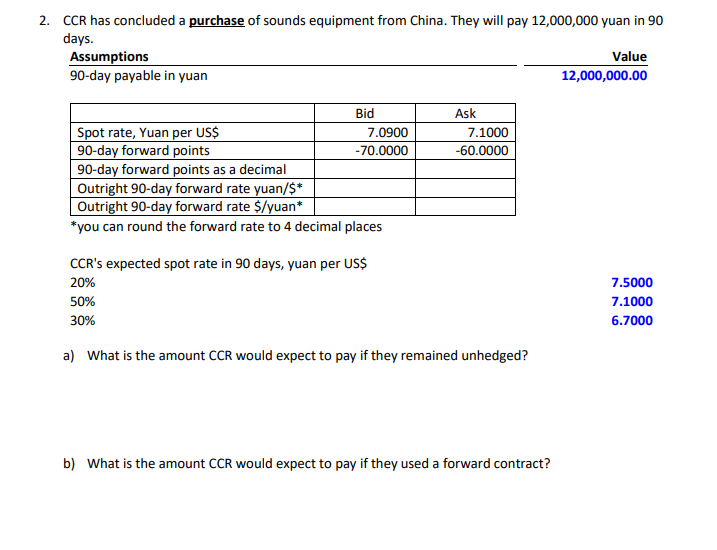

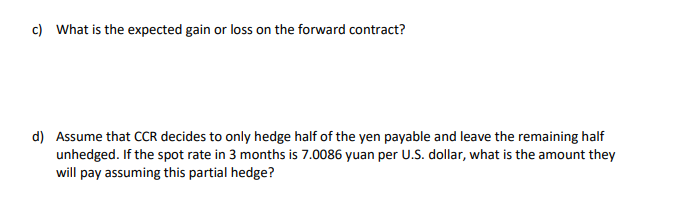

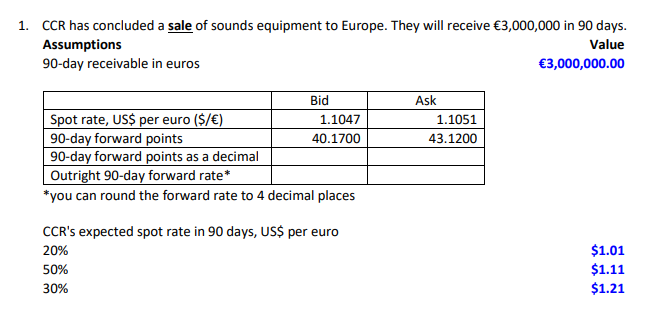

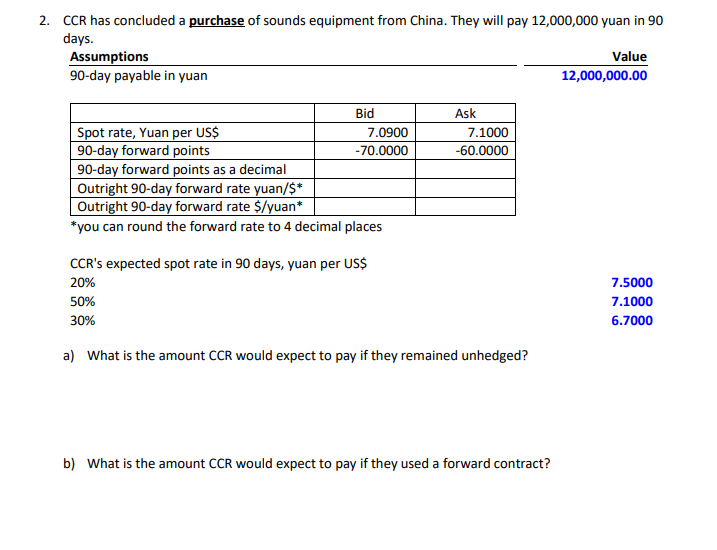

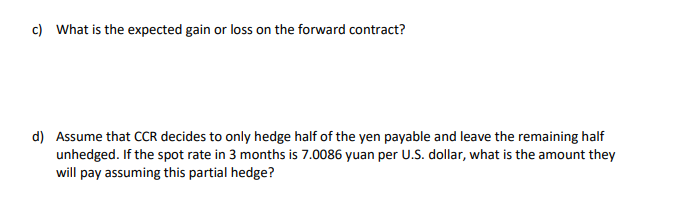

1. CCR has concluded a sale of sounds equipment to Europe. They will receive 3,000,000 in 90 days. Assumptions Value 90-day receivable in euros 3,000,000.00 Ask 1.1051 43.1200 Bid Spot rate, US$ per euro ($/) 1.1047 90-day forward points 40.1700 90-day forward points as a decimal Outright 90-day forward rate* *you can round the forward rate to 4 decimal places CCR's expected spot rate in 90 days, US$ per euro 20% 50% 30% $1.01 $1.11 $1.21 CCR has concluded a purchase of sounds equipment from China. They will pay 12,000,000 yuan in 90 days. Assumptions 90-day payable in yuan 12,000,000.00 Value Ask 7.1000 -60.0000 Bid Spot rate, Yuan per US$ 7.0900 90-day forward points -70.0000 90-day forward points as a decimal Outright 90-day forward rate yuan/$* Outright 90-day forward rate $/yuan* * you can round the forward rate to 4 decimal places CCR's expected spot rate in 90 days, yuan per US$ 20% 50% 30% 7.5000 7.1000 6.7000 a) What is the amount CCR would expect to pay if they remained unhedged? b) What is the amount CCR would expect to pay if they used a forward contract? c) What is the expected gain or loss on the forward contract? d) Assume that CCR decides to only hedge half of the yen payable and leave the remaining half unhedged. If the spot rate in 3 months is 7.0086 yuan per U.S. dollar, what is the amount they will pay assuming this partial hedge? 1. CCR has concluded a sale of sounds equipment to Europe. They will receive 3,000,000 in 90 days. Assumptions Value 90-day receivable in euros 3,000,000.00 Ask 1.1051 43.1200 Bid Spot rate, US$ per euro ($/) 1.1047 90-day forward points 40.1700 90-day forward points as a decimal Outright 90-day forward rate* *you can round the forward rate to 4 decimal places CCR's expected spot rate in 90 days, US$ per euro 20% 50% 30% $1.01 $1.11 $1.21 CCR has concluded a purchase of sounds equipment from China. They will pay 12,000,000 yuan in 90 days. Assumptions 90-day payable in yuan 12,000,000.00 Value Ask 7.1000 -60.0000 Bid Spot rate, Yuan per US$ 7.0900 90-day forward points -70.0000 90-day forward points as a decimal Outright 90-day forward rate yuan/$* Outright 90-day forward rate $/yuan* * you can round the forward rate to 4 decimal places CCR's expected spot rate in 90 days, yuan per US$ 20% 50% 30% 7.5000 7.1000 6.7000 a) What is the amount CCR would expect to pay if they remained unhedged? b) What is the amount CCR would expect to pay if they used a forward contract? c) What is the expected gain or loss on the forward contract? d) Assume that CCR decides to only hedge half of the yen payable and leave the remaining half unhedged. If the spot rate in 3 months is 7.0086 yuan per U.S. dollar, what is the amount they will pay assuming this partial hedge