Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. CDS Assume that the risk-free interest rate is 2% for all maturities and suppose that the CDS spreads for contracts that are starting

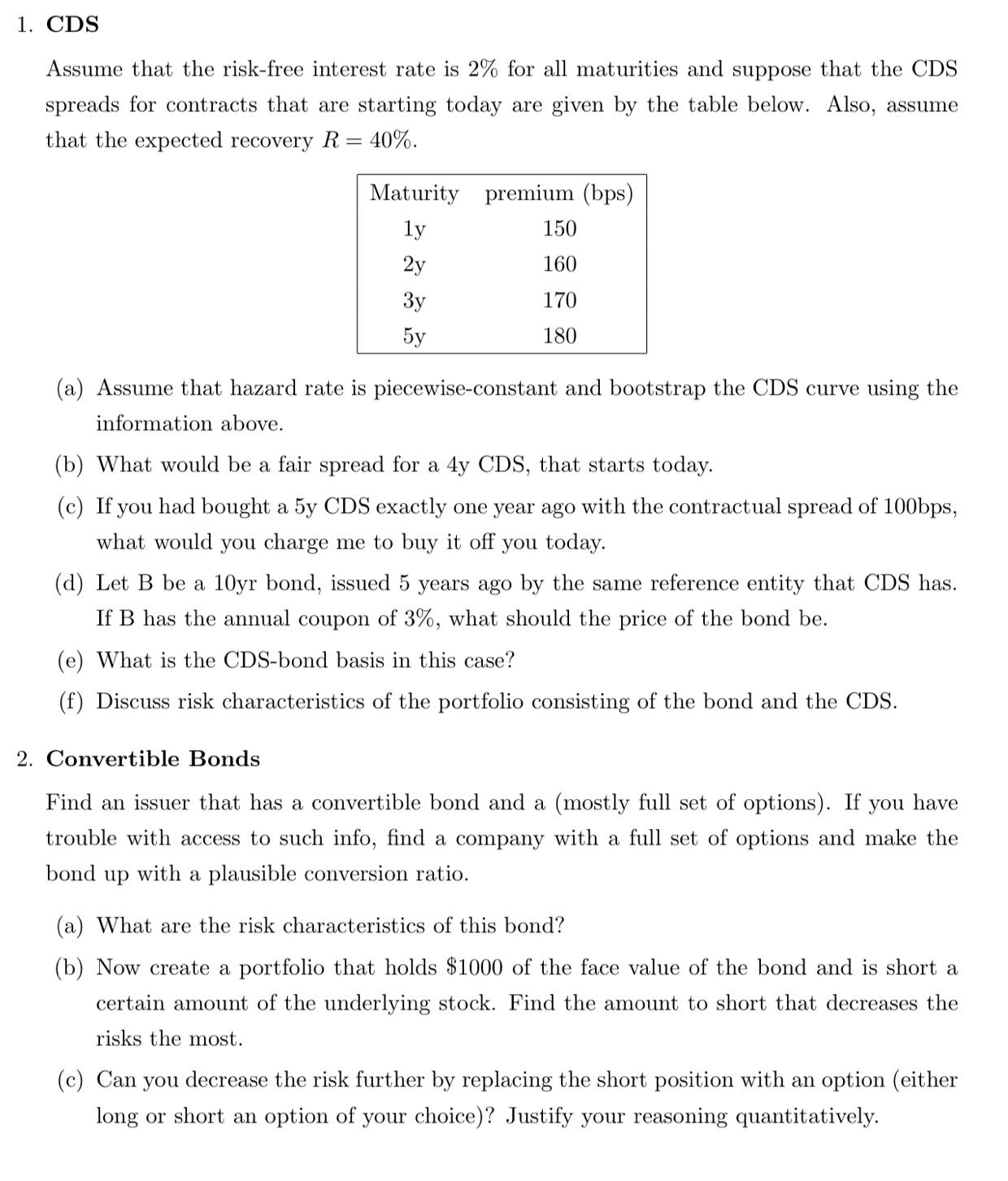

1. CDS Assume that the risk-free interest rate is 2% for all maturities and suppose that the CDS spreads for contracts that are starting today are given by the table below. Also, assume that the expected recovery R = 40%. Maturity premium (bps) ly 150 2y 160 3y 170 5y 180 (a) Assume that hazard rate is piecewise-constant and bootstrap the CDS curve using the information above. (b) What would be a fair spread for a 4y CDS, that starts today. (c) If you had bought a 5y CDS exactly one year ago with the contractual spread of 100bps, what would you charge me to buy it off you today. (d) Let B be a 10yr bond, issued 5 years ago by the same reference entity that CDS has. If B has the annual coupon of 3%, what should the price of the bond be. (e) What is the CDS-bond basis in this case? (f) Discuss risk characteristics of the portfolio consisting of the bond and the CDS. 2. Convertible Bonds Find an issuer that has a convertible bond and a (mostly full set of options). If you have trouble with access to such info, find a company with a full set of options and make the bond up with a plausible conversion ratio. (a) What are the risk characteristics of this bond? (b) Now create a portfolio that holds $1000 of the face value of the bond and is short a certain amount of the underlying stock. Find the amount to short that decreases the risks the most. (c) Can you decrease the risk further by replacing the short position with an option (either long or short an option of your choice)? Justify your reasoning quantitatively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started