Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Certain soft drink and citrus inventories are valued on the last-in first-out (LIFO) method. The excess of current costs over LIFO stated values

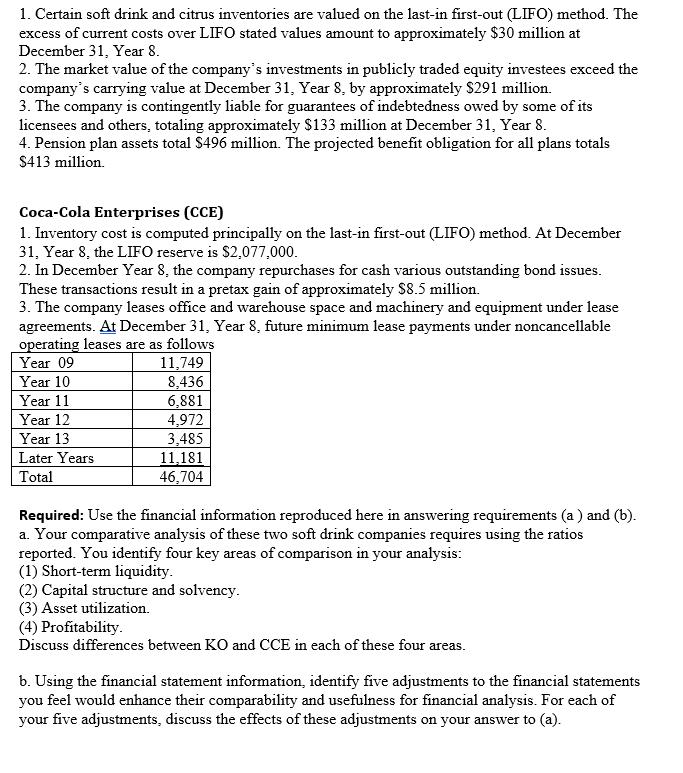

1. Certain soft drink and citrus inventories are valued on the last-in first-out (LIFO) method. The excess of current costs over LIFO stated values amount to approximately $30 million at December 31, Year 8. 2. The market value of the company's investments in publicly traded equity investees exceed the company's carrying value at December 31, Year 8, by approximately $291 million. 3. The company is contingently liable for guarantees of indebtedness owed by some of its licensees and others, totaling approximately $133 million at December 31, Year 8. 4. Pension plan assets total $496 million. The projected benefit obligation for all plans totals $413 million. Coca-Cola Enterprises (CCE) 1. Inventory cost is computed principally on the last-in first-out (LIFO) method. At December 31, Year 8, the LIFO reserve is $2,077,000. 2. In December Year 8, the company repurchases for cash various outstanding bond issues. These transactions result in a pretax gain of approximately $8.5 million. 3. The company leases office and warehouse space and machinery and equipment under lease agreements. At December 31, Year 8, future minimum lease payments under noncancellable operating leases are as follows Year 09 11,749 8,436 6,881 4,972 3,485 11,181 46,704 Year 10 Year 11 Year 12 Year 13 Later Years Total Required: Use the financial information reproduced here in answering requirements (a ) and (b). a. Your comparative analysis of these two soft drink companies requires using the ratios reported. You identify four key areas of comparison in your analysis: (1) Short-term liquidity. (2) Capital structure and solvency. (3) Asset utilization. (4) Profitability. Discuss differences between KO and CCE in each of these four areas. b. Using the financial statement information, identify five adjustments to the financial statements you feel would enhance their comparability and usefulness for financial analysis. For each of your five adjustments, discuss the effects of these adjustments on your answer to (a).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a 1 Shortterm liquidity Four of the ratios are indicators of shortterm liquidity KO has a greater current ratio and acidtest ratio CCE has a significantly higher inventory turnover ratio Turnover of a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started