Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Classify each of these transactions as an asset, a liability, or neither for each of the players in the money supply process-the federal reserve,

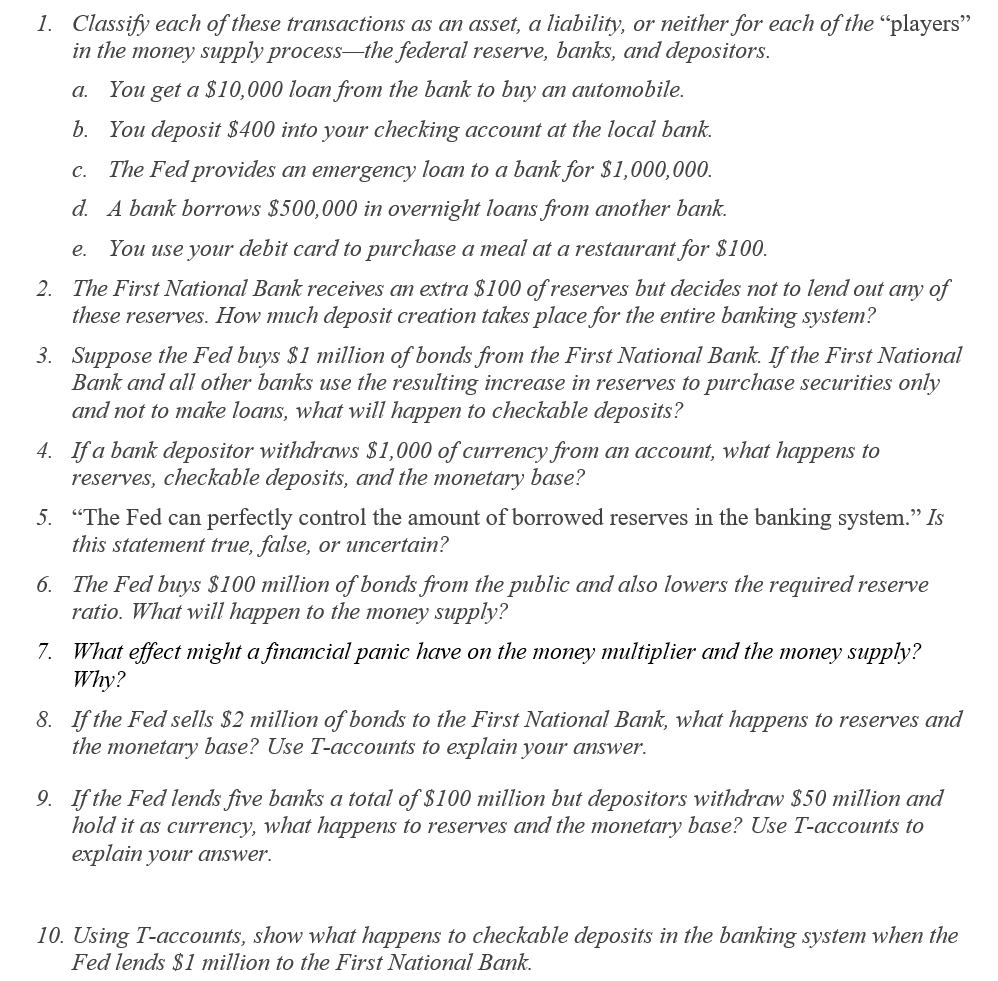

1. Classify each of these transactions as an asset, a liability, or neither for each of the "players" in the money supply process-the federal reserve, banks, and depositors. a. You get a \$10,000 loan from the bank to buy an automobile. b. You deposit $400 into your checking account at the local bank. c. The Fed provides an emergency loan to a bank for $1,000,000. d. A bank borrows $500,000 in overnight loans from another bank. e. You use your debit card to purchase a meal at a restaurant for $100. 2. The First National Bank receives an extra $100 of reserves but decides not to lend out any of these reserves. How much deposit creation takes place for the entire banking system? 3. Suppose the Fed buys $1 million of bonds from the First National Bank. If the First National Bank and all other banks use the resulting increase in reserves to purchase securities only and not to make loans, what will happen to checkable deposits? 4. If a bank depositor withdraws $1,000 of currency from an account, what happens to reserves, checkable deposits, and the monetary base? 5. "The Fed can perfectly control the amount of borrowed reserves in the banking system." Is this statement true, false, or uncertain? 6. The Fed buys $100 million of bonds from the public and also lowers the required reserve ratio. What will happen to the money supply? 7. What effect might a financial panic have on the money multiplier and the money supply? Why? 8. If the Fed sells $2 million of bonds to the First National Bank, what happens to reserves and the monetary base? Use T-accounts to explain your answer. 9. If the Fed lends five banks a total of $100 million but depositors withdraw $50 million and hold it as currency, what happens to reserves and the monetary base? Use T-accounts to explain your answer. 10. Using T-accounts, show what happens to checkable deposits in the banking system when the Fed lends $1 million to the First National Bank

1. Classify each of these transactions as an asset, a liability, or neither for each of the "players" in the money supply process-the federal reserve, banks, and depositors. a. You get a \$10,000 loan from the bank to buy an automobile. b. You deposit $400 into your checking account at the local bank. c. The Fed provides an emergency loan to a bank for $1,000,000. d. A bank borrows $500,000 in overnight loans from another bank. e. You use your debit card to purchase a meal at a restaurant for $100. 2. The First National Bank receives an extra $100 of reserves but decides not to lend out any of these reserves. How much deposit creation takes place for the entire banking system? 3. Suppose the Fed buys $1 million of bonds from the First National Bank. If the First National Bank and all other banks use the resulting increase in reserves to purchase securities only and not to make loans, what will happen to checkable deposits? 4. If a bank depositor withdraws $1,000 of currency from an account, what happens to reserves, checkable deposits, and the monetary base? 5. "The Fed can perfectly control the amount of borrowed reserves in the banking system." Is this statement true, false, or uncertain? 6. The Fed buys $100 million of bonds from the public and also lowers the required reserve ratio. What will happen to the money supply? 7. What effect might a financial panic have on the money multiplier and the money supply? Why? 8. If the Fed sells $2 million of bonds to the First National Bank, what happens to reserves and the monetary base? Use T-accounts to explain your answer. 9. If the Fed lends five banks a total of $100 million but depositors withdraw $50 million and hold it as currency, what happens to reserves and the monetary base? Use T-accounts to explain your answer. 10. Using T-accounts, show what happens to checkable deposits in the banking system when the Fed lends $1 million to the First National Bank Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started