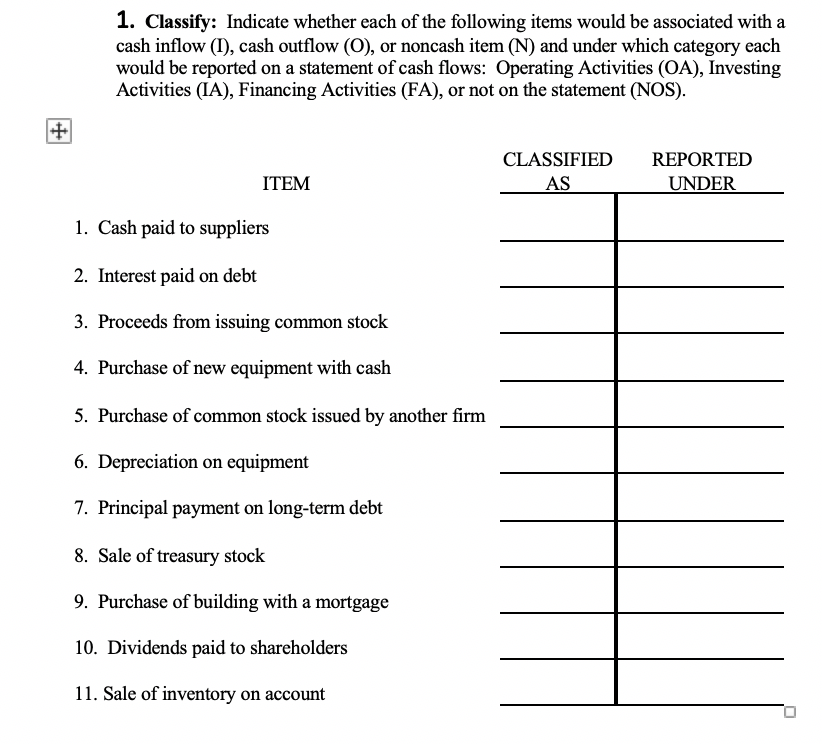

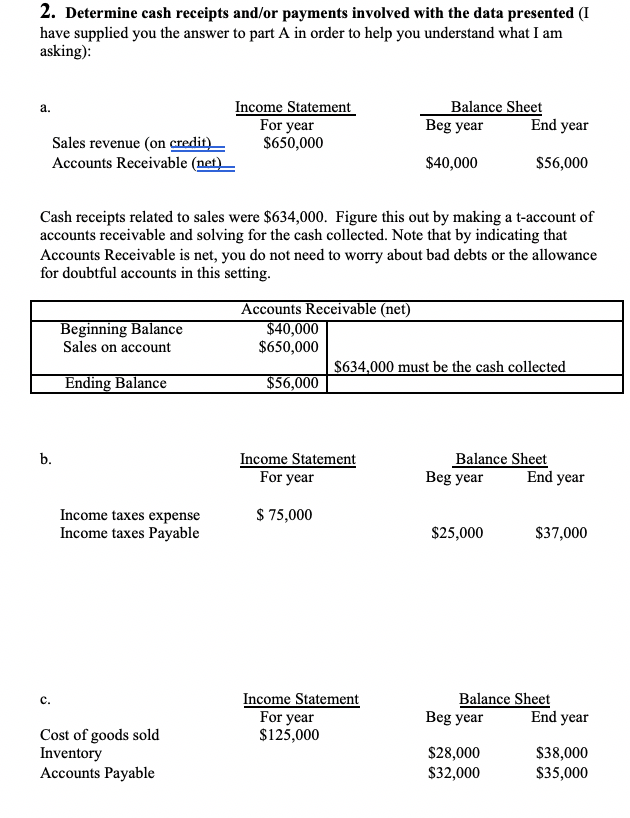

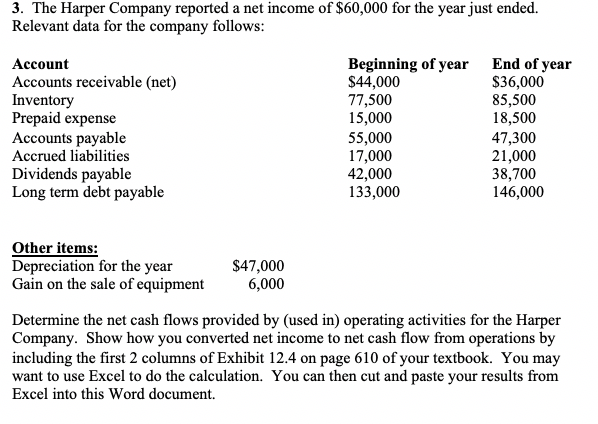

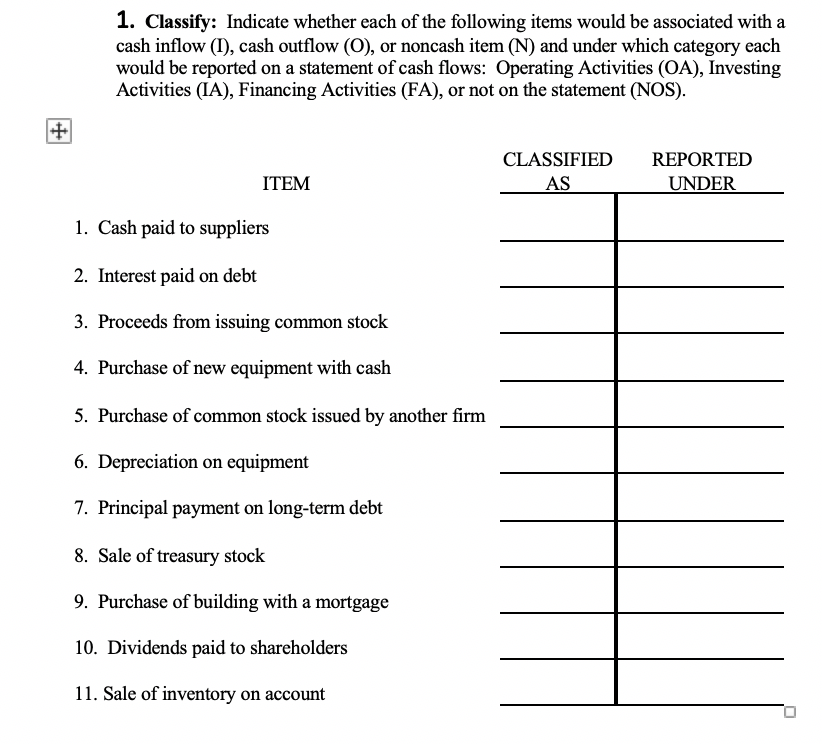

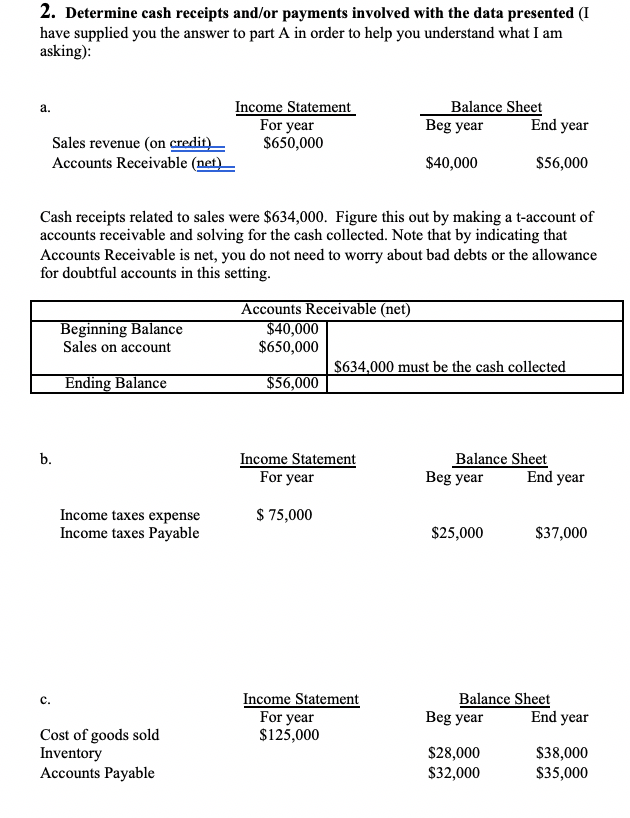

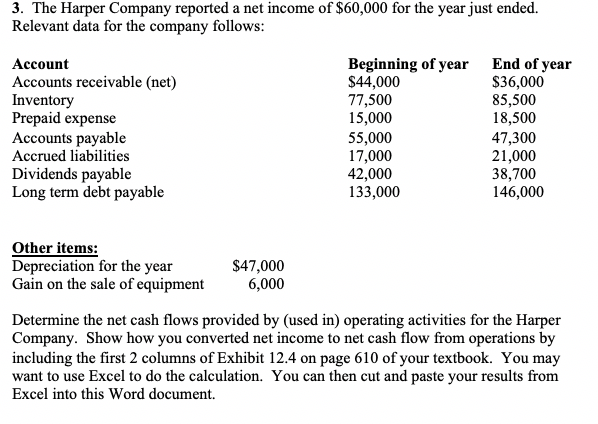

1. Classify: Indicate whether each of the following items would be associated with a cash inflow (I), cash outflow (O), or noncash item (N) and under which category each would be reported on a statement of cash flows: Operating Activities (OA), Investing Activities (IA), Financing Activities (FA), or not on the statement (NOS) CLASSIFIED REPORTED ITEM AS UNDER 1. Cash paid to suppliers 2. Interest paid on debt 3. Proceeds from issuing common stock 4. Purchase of new equipment with cash 5. Purchase of common stock issued by another firm 6. Depreciation on equipment 7. Principal payment on long-term debt 8. Sale of treasury stock 9. Purchase of building with a mortgage 10. Dividends paid to shareholders 11. Sale of inventory on account 2. Determine cash receipts and/or payments involved with the data presented (I have supplied you the answer to part A in order to help you understand what I am asking) Income Statement For year $650,000 Balance Sheet a. End year Beg year Sales revenue (on credit) Accounts Receivable (net) $40,000 $56,000 Cash receipts related to sales were $634,000. Figure this out by making a t-account of accounts receivable and solving for the cash collected. Note that by indicating that Accounts Receivable is net, you do not need to worry about bad debts or the allowance for doubtful accounts in this setting Accounts Receivable (net) $40,000 $650,000 Beginning Balance Sales on account $634,000 must be the cash collected $56,000 Ending Balance Balance Sheet Beg year b. Income Statement For year End year 75,000 Income taxes expense Income taxes Payable $25,000 $37,000 Income Statement For year $125,000 Balance Sheet C. End year Beg year Cost of goods sold Inventory Accounts Payable $38,000 $35,000 $28,000 $32,000 3. The Harper Company reported a net income of $60,000 for the year just ended. Relevant data for the company follows: End of year $36,000 85,500 18,500 47,300 21,000 38,700 146,000 Account Beginning of year $44,000 77,500 15,000 55,000 17,000 42,000 133,000 Accounts receivable (net) Inventory Prepaid expense Accounts payable Accrued liabilities Dividends payable Long term debt payable Other items: Depreciation for the year Gain on the sale of equipment $47,000 6,000 Determine the net cash flows provided by (used in) operating activities for the Harper Company. Show how you converted net income to net cash flow from operations by including the first 2 columns of Exhibit 12.4 on page 610 of your textbook. You may want to use Excel to do the calculation. You can then cut and paste your results from Excel into this Word document