Answered step by step

Verified Expert Solution

Question

1 Approved Answer

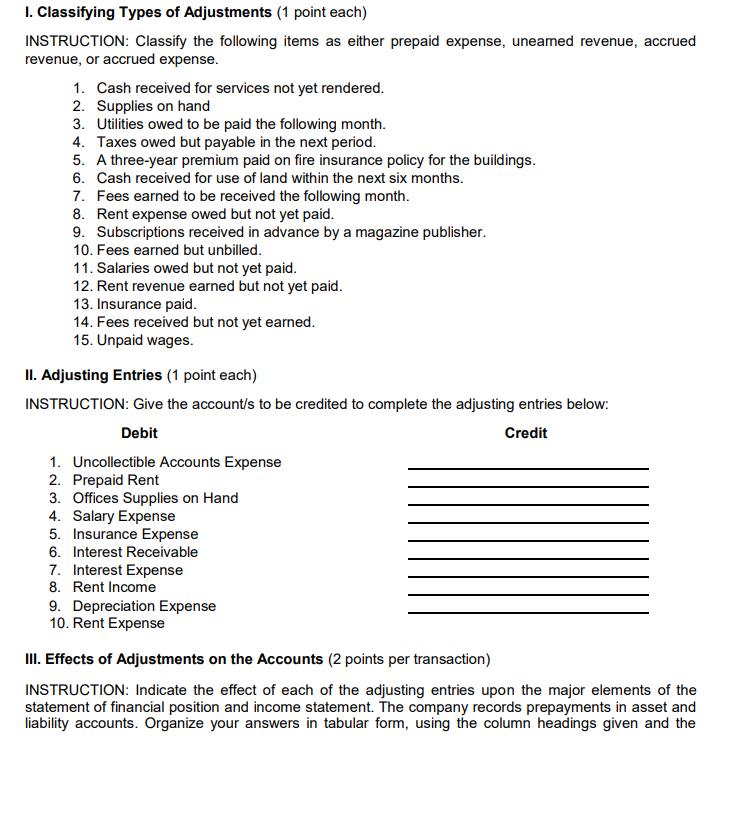

1. Classifying Types of Adjustments (1 point each) INSTRUCTION: Classify the following items as either prepaid expense, uneamed revenue, accrued revenue, or accrued expense.

1. Classifying Types of Adjustments (1 point each) INSTRUCTION: Classify the following items as either prepaid expense, uneamed revenue, accrued revenue, or accrued expense. 1. Cash received for services not yet rendered. 2. Supplies on hand 3. Utilities owed to be paid the following month. 4. Taxes owed but payable in the next period. 5. A three-year premium paid on fire insurance policy for the buildings. 6. Cash received for use of land within the next six months. 7. Fees earned to be received the following month. 8. Rent expense owed but not yet paid. 9. Subscriptions received in advance by a magazine publisher. 10. Fees earned but unbilled. 11. Salaries owed but not yet paid. 12. Rent revenue earned but not yet paid. 13. Insurance paid. 14. Fees received but not yet earned. 15. Unpaid wages. II. Adjusting Entries (1 point each) INSTRUCTION: Give the account/s to be credited to complete the adjusting entries below: Debit Credit 1. Uncollectible Accounts Expense 2. Prepaid Rent 3. Offices Supplies on Hand 4. Salary Expense 5. Insurance Expense 6. Interest Receivable 7. Interest Expense 8. Rent Income 9. Depreciation Expense 10. Rent Expense III. Effects of Adjustments on the Accounts (2 points per transaction) INSTRUCTION: Indicate the effect of each of the adjusting entries upon the major elements of the statement of financial position and income statement. The company records prepayments in asset and liability accounts. Organize your answers in tabular form, using the column headings given and the

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Prepaid Expense represent the amount paid in advance for the expenses to be incurred in future Unear...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started