Question

1 Company A lends cryptocurrency and USD to their clients. Because crypto markets can fluctuate indirectly with USD, the LTV ratio of the loan will

1

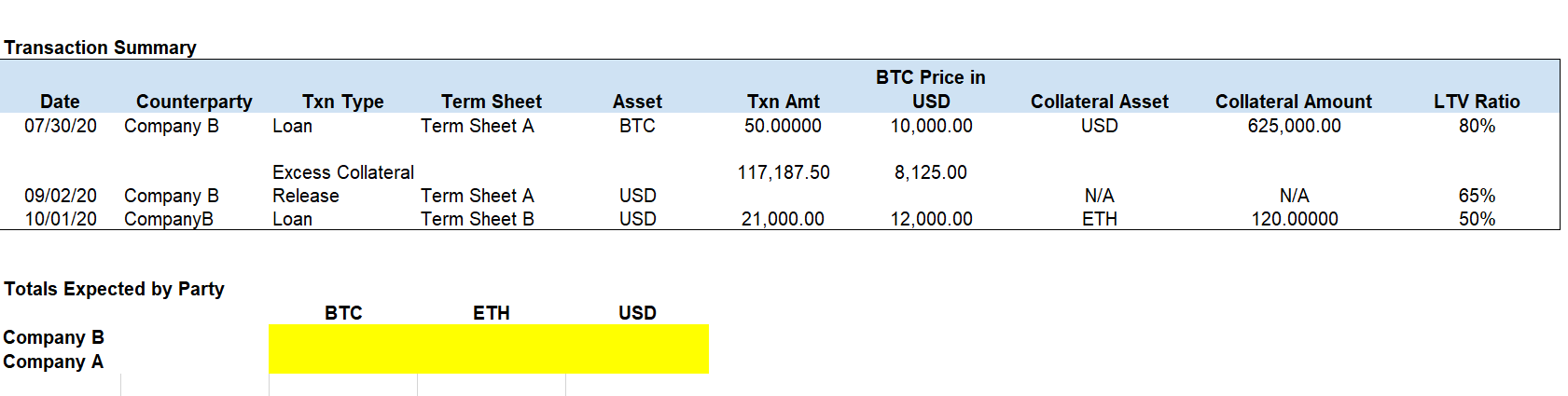

Company A lends cryptocurrency and USD to their clients. Because crypto markets can fluctuate indirectly with USD, the LTV ratio of the loan will fluctuate as well. This change in LTV ratio can prompt Company A to return a portion of the counterparty's collateral (excess collateral release), or request additional collateral (margin call). The transactions in the attached Excel sheet show Company As lending activity with the counterparty Company B. On 09/02, the BTC price fell, dropping Company Bs LTV to 65%, further overcollateralizing the BTC loan originated on 7/30. The price of BTC dropped to $8,125 and Company A returned $117,187.50 worth of excess collateral to Company B. On 10/30, Company B decides to close their loans with us. Please calculate what funds Company A and Company B owe one another to close the loans and show your work.

2

Below is an example of Company As trade process with our institutional counterparties. Please list other teams that should be included and any checks that need to be performed to ensure the trade is executed accurately and on time. Include any potential breaks in this workflow. Where can things go wrong? Step Action 1 Client requests trade through their Company As Sales contact 2 Trading manually inputs the trade request 3 Operations manually executes trade Please write show formulas step by step

Please write show formulas step by step

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started