Answered step by step

Verified Expert Solution

Question

1 Approved Answer

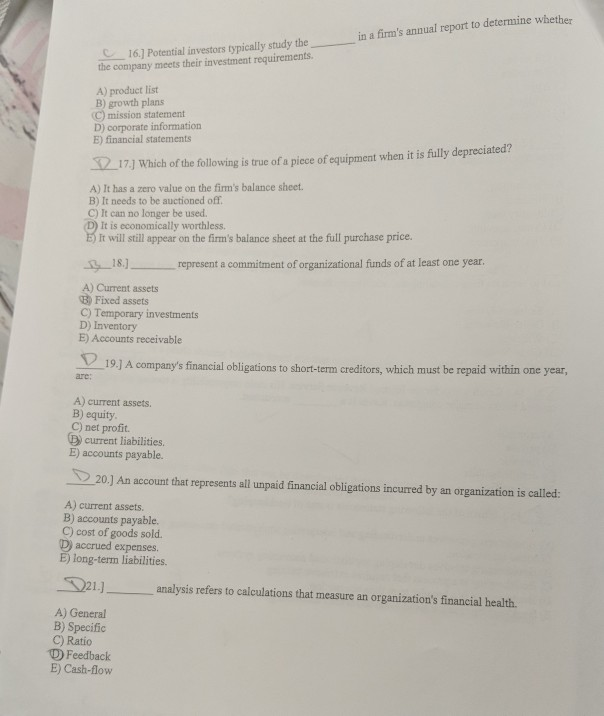

in a firm's annual report to determine whether _.-16] Potential investors typically study the the company meets their investment requirements A) product list B) growth

in a firm's annual report to determine whether _.-16] Potential investors typically study the the company meets their investment requirements A) product list B) growth plans C) mission statement D) corporate information E) financial statements 217J Which of the following is true of a picce of equipment when it is fully depreciated? A) It has a zero value on the firm's balance sheet B) It needs to be auctioned off C) It can no longer be used It is economically worthless. It will still appear on the firm's balance sheet at the full purchase price. )_18.]- -represent a commitment oforganizational funds of at least one year A) Current assets B) Fixed assets C) Temporary investments D) Inventory E) Accounts receivable 19.] A company's financial obligations to short-tern creditors, which must be repaid within one year, are: A) current assets. B) equity C) net profi. B current liabilities. E) accounts payable. 20] An account that represents all unpaid financial obligations incurred by an organization is called A) current assets. B) accounts payable. C) cost of goods sold. D accrued expenses E) long-term liabilities. 921)analysis refers to calculations that measure an organization's financial health. A) General B) Specific C) Ratio D Feedback E) Cash-flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started