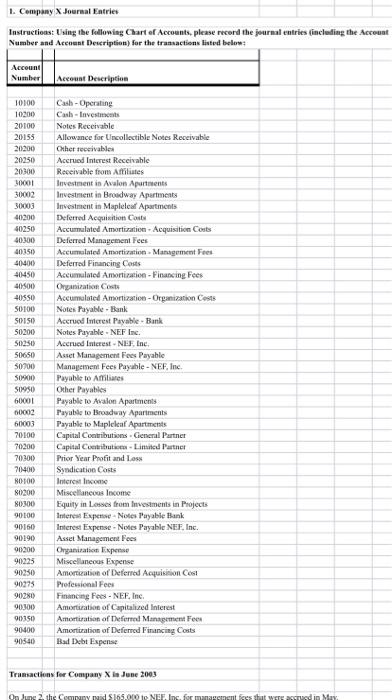

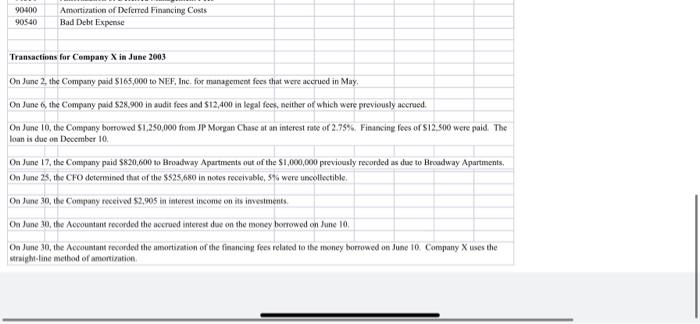

1. Company Journal Entries Instructions: Using the following Chart of Accounts, please record the journal entries including the Account Number and Account Description) for the transactions listed below: Account Number Account Description 10100 10200 20100 20155 20200 20250 20300 30001 30002 30003 40200 50250 40.300 40150 40400 40450 40500 40550 SO100 SOISO 50200 50250 50650 50700 S020 50950 60001 00002 60003 20100 70200 70300 70400 NO100 80200 80300 90100 90160 90190) 00200 90225 90250 90275 9OZNO 90.300) 90350 90400 90540 Cash - Operating Cash-Investments Notes Receivable Allowance for Lincollectible Notes Receivable Other receivables Accrued Interest Receivable Receivable from Afiliates Investment in Avalon Apartments Investment in Broadway Apartments Investment in Mapleleaf Apartments Deferred Acquisition Costi Accumulated Amortization. Acquisition Costs Deferred Management Fees Accumulated Amortization Management Fees Deferred Financing Costs Accumulated Amortization - Financing Fees Organization Costs Accumulated Amortization - Organization Costs Notes Payable - Bank Accrued Interest Payable. Bank Notes Payable - NEF Inc. Accrued Interest - NEF, Inc. Asset Management Fees Payable Management Fees Payable - NEF, Inc. Payable to Amiliares Other Payables Payable to Avalon Apartments Payable to Broadway Apartments Payable to Mapleleaf Apartments Capital Contributions Ciencral Partner Capital Contributors Limited Partner Prior Year Profit and Los Syndication Costs Interest Income Miscellaneous Income Equity in Losses from investments in Projects Interest Expense-Notes Tayable Bank Interest Expense - Notes Payable NEF, Inc. Asset Management Fees Organization perse Miscellaneous Expense Amortization of Deferred Acquisition Coil Professional Fees Financing Fees . NEF, Inc. Amortization of Capitalized interest Amortization of Deferred Management Fees Amortization of Deferred Financing Costs Bad Debt Expense Transactions for Company in June 2003 On June 2. the Couny nad 5165.000 to NEF Inc. for management fees tut were sted in May. 90400 90540 Amortization of Deferred Financing Costs Bad Debt Expense Transactions for Company X in June 2003 On June 2, the Company paid $165,000 to NEF, Inc. for management fees that were accrued in May, On June 6, the Company paid $28.900 in audit foes and 512,400 in legal fees, neither of which were previously necrued. On June 10, the Company borrowed $1,250,000 from JP Morgan Chase at an interest rate of 2.75% Financing fees or S12.500 were paid. The loan is due on December 10 On June 17, the Company paid $820,600 to Broadway Apartments out of the $1,000,000 previously recorded as due to Broadway Apartments, On June 25, the CFO determined that of the $525,680 in notos receivable, 5% were uncollectible. On June 30, the Company received $2,905 in interest income on its investments, On June 30, the Accountant recorded the secrued interest due on the money borrowed on June 10, On June 30, the Accountant recorded the amortization of the financing fees related to the money borrowed on June 10. Company X uses the straight-line method of amortization