Answered step by step

Verified Expert Solution

Question

1 Approved Answer

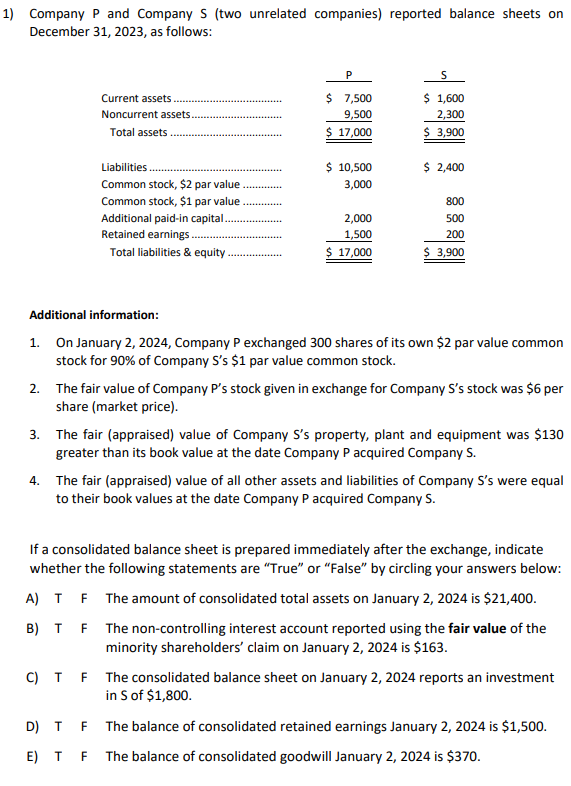

1) Company P and Company S (two unrelated companies) reported balance sheets on December 31, 2023, as follows: Current assets Noncurrent assets Total assets

1) Company P and Company S (two unrelated companies) reported balance sheets on December 31, 2023, as follows: Current assets Noncurrent assets Total assets Liabilities Common stock, $2 par value Common stock, $1 par value Additional paid-in capital... Retained earnings ....... Total liabilities & equity. P $ 7,500 9,500 $ 17,000 $ 10,500 3,000 2,000 1,500 $ 17,000 S $ 1,600 2,300 $ 3,900 D) T F E) T F $ 2,400 800 500 200 $ 3,900 Additional information: 1. On January 2, 2024, Company P exchanged 300 shares of its own $2 par value common stock for 90% of Company S's $1 par value common stock. 2. The fair value of Company P's stock given in exchange for Company S's stock was $6 per share (market price). 3. The fair (appraised) value of Company S's property, plant and equipment was $130 greater than its book value at the date Company P acquired Company S. 4. The fair (appraised) value of all other assets and liabilities of Company S's were equal to their book values at the date Company P acquired Company S. If a consolidated balance sheet is prepared immediately after the exchange, indicate whether the following statements are "True" or "False" by circling your answers below: A) T F The amount of consolidated total assets on January 2, 2024 is $21,400. B) T F The non-controlling interest account reported using the fair value of the minority shareholders' claim on January 2, 2024 is $163. C) T F The consolidated balance sheet on January 2, 2024 reports an investment in S of $1,800. The balance of consolidated retained earnings January 2, 2024 is $1,500. The balance of consolidated goodwill January 2, 2024 is $370.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To determine the truthfulness of the statements provided we first need to make some calculations based on the additional information given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started