Answered step by step

Verified Expert Solution

Question

1 Approved Answer

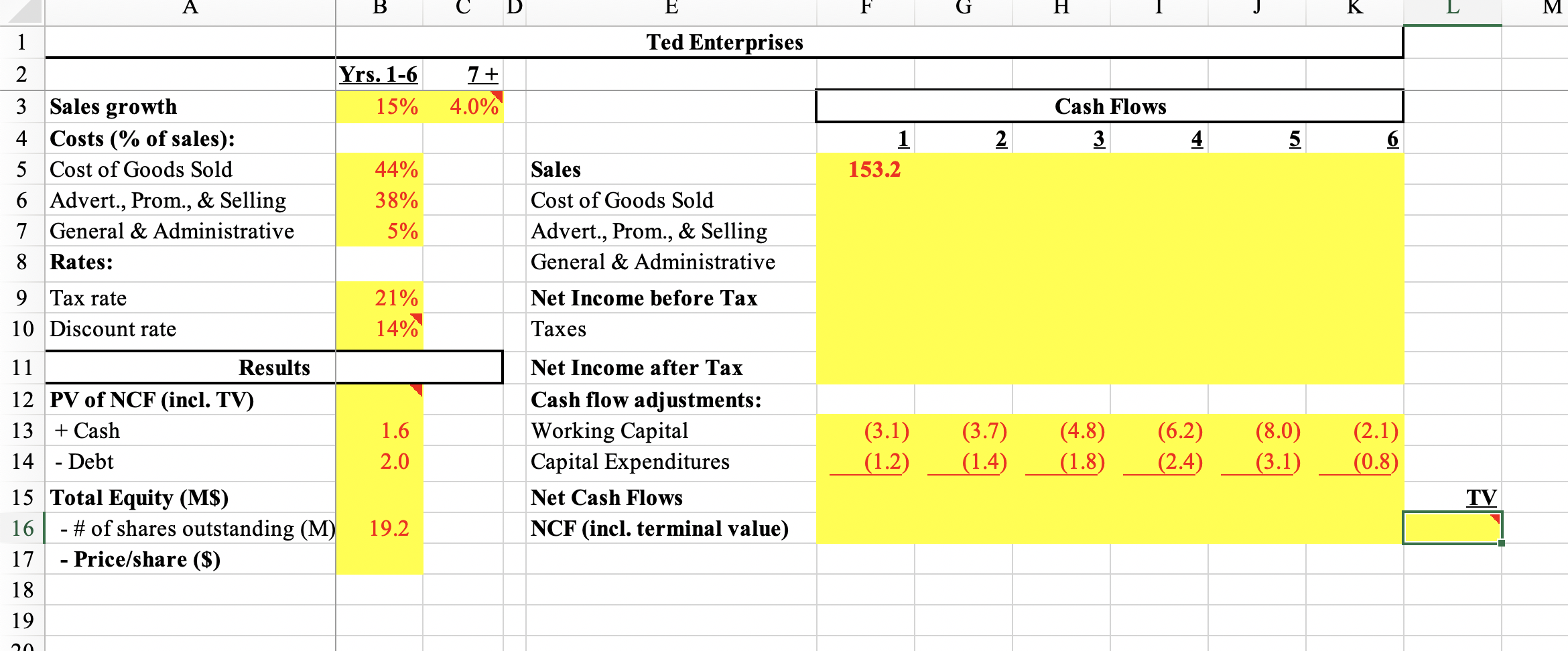

1. Company Valuation Your manager has asked you to value Ted Enterprises, a potential acquisition. To make your life easier, your manager gave you some

1. Company Valuation Your manager has asked you to value Ted Enterprises, a potential acquisition. To make your life easier, your manager gave you some of the numbers in the Excel template file provided. Note that your manager wants the dollar price per share, so you must calculate the dollar value of the equity and then divide by the number of shares outstanding. Please show excel equations used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started