Question

1) Company X has receivables of 128,315 AUD in 9 months. The spot AUDUSD is 0.7708. Forecast indicates that the AUD could either end up

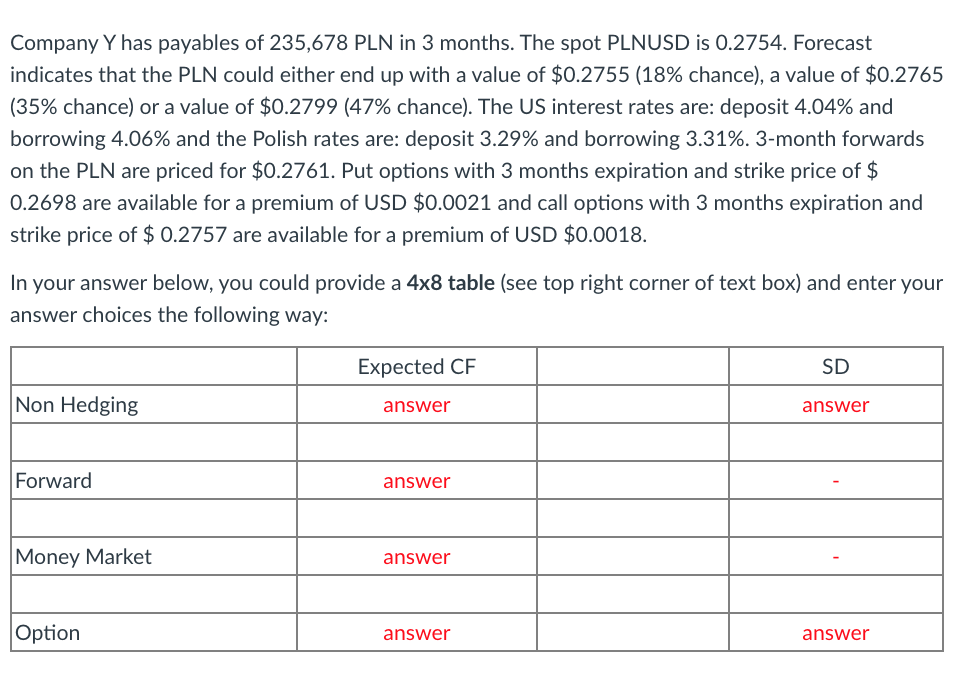

1) Company X has receivables of 128,315 AUD in 9 months. The spot AUDUSD is 0.7708. Forecast indicates that the AUD could either end up with a value of $0.7721 (21% chance), a value of $0.7689 (28% chance) or a value of $0.7619 (51% chance). The US interest rates are: deposit 3.15% and borrowing 3.17%, and the AUD interest rates are: deposit 3.04% and borrowing 3.08%. 9-month forwards on the AUD are priced at 0.7712 USD. Put options with 9 months expiration and strike price of $0.7690 are available for a premium of USD $0.014 and call options with 9 months expiration and strike price of $0.7723 are available for a premium of USD $0.016. In your answer below, you could provide a 4x8 table (see top right corner of text box) and enter your answer choices the following way: 2) Company Y has payables of 235,678 PLN in 3 months. The spot PLNUSD is 0.2754. Forecast indicates that the PLN could either end up with a value of $0.2755 (18% chance), a value of $0.2765 (35% chance) or a value of $0.2799 (47% chance). The US interest rates are: deposit 4.04% and borrowing 4.06% and the Polish rates are: deposit 3.29% and borrowing 3.31%. 3-month forwards on the PLN are priced for $0.2761. Put options with 3 months expiration and strike price of $ 0.2698 are available for a premium of USD $0.0021 and call options with 3 months expiration and strike price of $ 0.2757 are available for a premium of USD $0.0018.

1) Company X has receivables of 128,315 AUD in 9 months. The spot AUDUSD is 0.7708. Forecast indicates that the AUD could either end up with a value of $0.7721 (21% chance), a value of $0.7689 (28% chance) or a value of $0.7619 (51% chance). The US interest rates are: deposit 3.15% and borrowing 3.17%, and the AUD interest rates are: deposit 3.04% and borrowing 3.08%. 9-month forwards on the AUD are priced at 0.7712 USD. Put options with 9 months expiration and strike price of $0.7690 are available for a premium of USD $0.014 and call options with 9 months expiration and strike price of $0.7723 are available for a premium of USD $0.016. In your answer below, you could provide a 4x8 table (see top right corner of text box) and enter your answer choices the following way: 2) Company Y has payables of 235,678 PLN in 3 months. The spot PLNUSD is 0.2754. Forecast indicates that the PLN could either end up with a value of $0.2755 (18% chance), a value of $0.2765 (35% chance) or a value of $0.2799 (47% chance). The US interest rates are: deposit 4.04% and borrowing 4.06% and the Polish rates are: deposit 3.29% and borrowing 3.31%. 3-month forwards on the PLN are priced for $0.2761. Put options with 3 months expiration and strike price of $ 0.2698 are available for a premium of USD $0.0021 and call options with 3 months expiration and strike price of $ 0.2757 are available for a premium of USD $0.0018.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started