Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a pool of home mortgages. Prepayments of mortgages in the pool affect the mortgages' cash flow, so mortgage lenders, servicers, and investors all

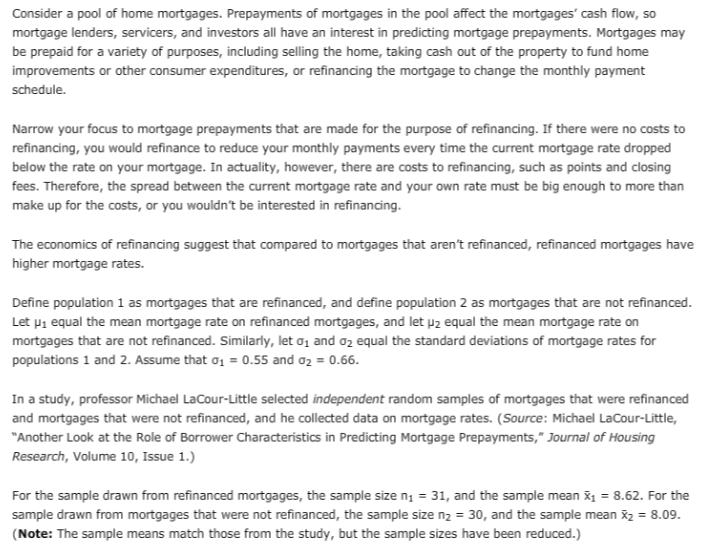

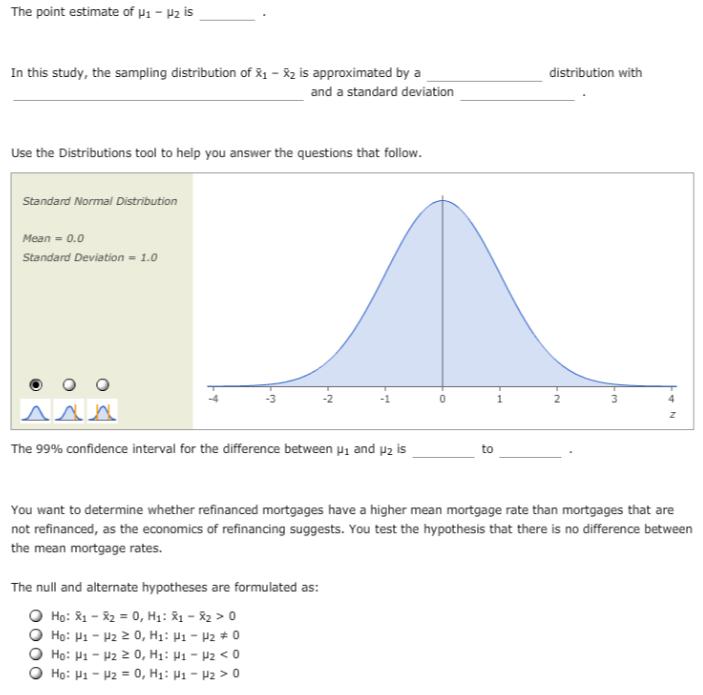

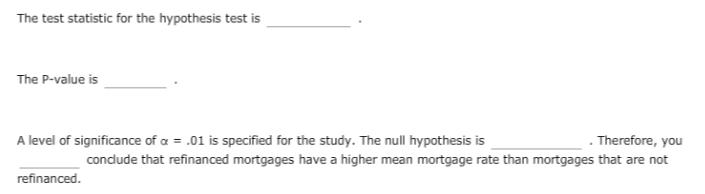

Consider a pool of home mortgages. Prepayments of mortgages in the pool affect the mortgages' cash flow, so mortgage lenders, servicers, and investors all have an interest in predicting mortgage prepayments. Mortgages may be prepaid for a variety of purposes, including selling the home, taking cash out of the property to fund home improvements or other consumer expenditures, or refinancing the mortgage to change the monthly payment schedule. Narrow your focus to mortgage prepayments that are made for the purpose of refinancing. If there were no costs to refinancing, you would refinance to reduce your monthly payments every time the current mortgage rate dropped below the rate on your mortgage. In actuality, however, there are costs to refinancing, such as points and closing fees. Therefore, the spread between the current mortgage rate and your own rate must be big enough to more than make up for the costs, or you wouldn't be interested in refinancing. The economics of refinancing suggest that compared to mortgages that aren't refinanced, refinanced mortgages have higher mortgage rates. Define population 1 as mortgages that are refinanced, and define population 2 as mortgages that are not refinanced. Let pi equal the mean mortgage rate on refinanced mortgages, and let pz equal the mean mortgage rate on mortgages that are not refinanced. Similarly, let o, and oz equal the standard deviations of mortgage rates for populations 1 and 2. Assume that og = 0.55 and o2 = 0.66. In a study, professor Michael LaCour-Little selected independent random samples of mortgages that were refinanced and mortgages that were not refinanced, and he collected data on mortgage rates. (Source: Michael LaCour-Little, "Another Look at the Role of Borrower Characteristics in Predicting Mortgage Prepayments," Journal of Housing Research, Volume 10, Issue 1.) For the sample drawn from refinanced mortgages, the sample size n; = 31, and the sample mean x = 8.62. For the sample drawn from mortgages that were not refinanced, the sample size nz = 30, and the sample mean x2 = 8.09. (Note: The sample means match those from the study, but the sample sizes have been reduced.) The point estimate of p1 - P2 is In this study, the sampling distribution of 1 - 82 is approximated by a distribution with and a standard deviation Use the Distributions tool to help you answer the questions that follow. Standard Normal Distribution Mean = 0.0 Standard Deviation = 1.0 AAA The 99% confidence interval for the difference between ui and pz is to You want to determine whether refinanced mortgages have a higher mean mortgage rate than mortgages that are not refinanced, as the economics of refinancing suggests. You test the hypothesis that there is no difference between the mean mortgage rates. The null and alternate hypotheses are formulated as: H: 81 - 2 = 0, H: 31 - 82 > 0 H: H1 - P2 2 0, H1: P1 - P2 * 0 H: H1 - P2 2 0, H1: H1 - P2 < 0 H: H1 - P2 = 0, H1: P1 - P2 > 0 The test statistic for the hypothesis test is The P-value is A level of significance of a = .01 is specified for the study. The null hypothesis is Therefore, you condude that refinanced mortgages have a higher mean mortgage rate than mortgages that are not refinanced.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Let 4 be the mean FICO score borrowers who refinance their mortgages Let u b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started