Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Complete a current year Federal and Provincial TD1 form for the employee. And use these totals to identify the claim code for Federal

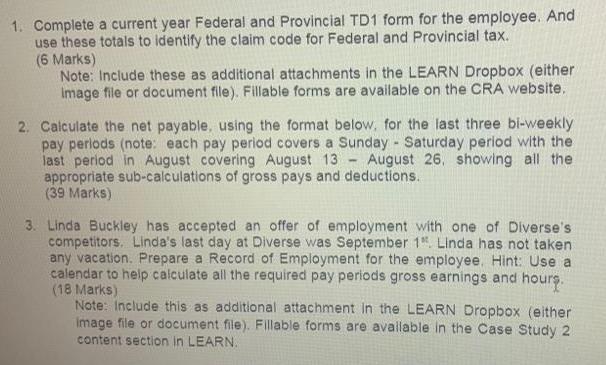

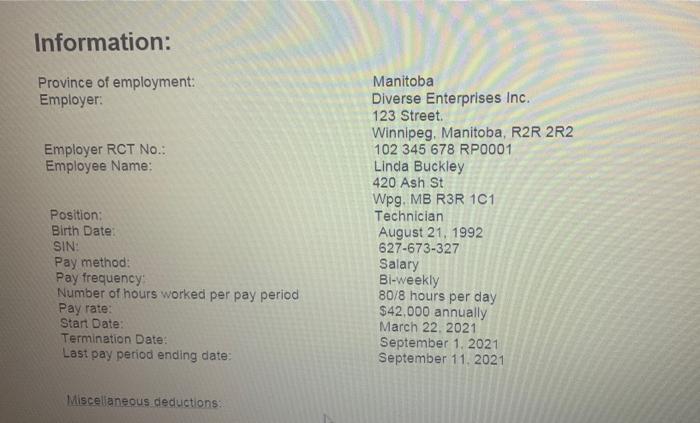

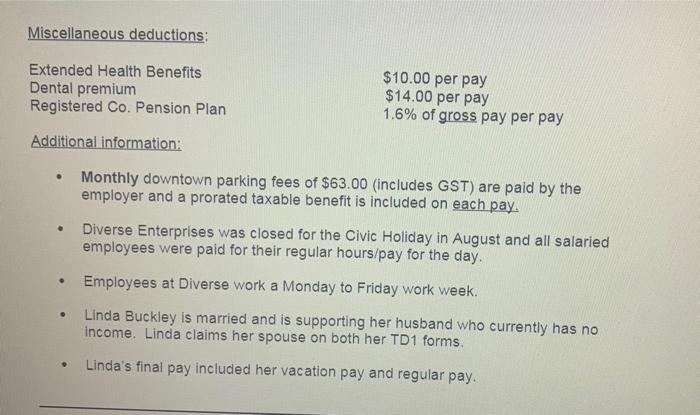

1. Complete a current year Federal and Provincial TD1 form for the employee. And use these totals to identify the claim code for Federal and Provincial tax. (6 Marks) Note: Include these as additional attachments in the LEARN Dropbox (either image file or document file). Fillable forms are available on the CRA website. 2. Calculate the net payable, using the format below, for the last three bi-weekly pay periods (note: each pay period covers a Sunday - Saturday period with the last period in August covering August 13 August 26, showing all the appropriate sub-calculations of gross pays and deductions. (39 Marks) - 3. Linda Buckley has accepted an offer of employment with one of Diverse's competitors. Linda's last day at Diverse was September 1". Linda has not taken any vacation. Prepare a Record of Employment for the employee. Hint: Use a calendar to help calculate all the required pay periods gross earnings and hours. (18 Marks) Note: Include this as additional attachment in the LEARN Dropbox (either Image file or document file). Fillable forms are available in the Case Study 2 content section in LEARN. Information: Province of employment: Employer: Employer RCT No.: Employee Name: Position: Birth Date: SIN: Pay method: Pay frequency: Number of hours worked per pay period Pay rate: Start Date: Termination Date: Last pay period ending date: Miscellaneous deductions: Manitoba Diverse Enterprises Inc. 123 Street. Winnipeg, Manitoba, R2R 2R2 102 345 678 RP0001 Linda Buckley 420 Ash St Wpg. MB R3R 1C1 Technician August 21, 1992 627-673-327 Salary Bi-weekly 80/8 hours per day $42,000 annually March 22, 2021 September 1, 2021 September 11, 2021 Miscellaneous deductions: Extended Health Benefits Dental premium Registered Co. Pension Plan Additional information: . $10.00 per pay $14.00 per pay 1.6% of gross pay per pay Monthly downtown parking fees of $63.00 (includes GST) are paid by the employer and a prorated taxable benefit is included on each pay. Diverse Enterprises was closed for the Civic Holiday in August and all salaried employees were paid for their regular hours/pay for the day. Employees at Diverse work a Monday to Friday work week. Linda Buckley is married and is supporting her husband who currently has no income. Linda claims her spouse on both her TD1 forms. Linda's final pay included her vacation pay and regular pay.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Federal and Provincial TD1 Forms The TD1 form is a Canadian tax form used by employees to determine the amount of tax that needs to be deducted from their salary Employers must complete and submit t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started