Answered step by step

Verified Expert Solution

Question

1 Approved Answer

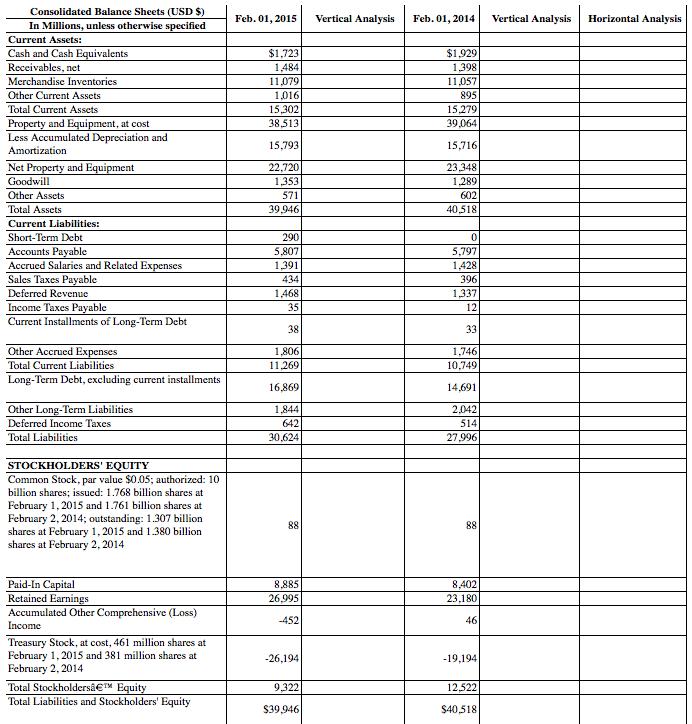

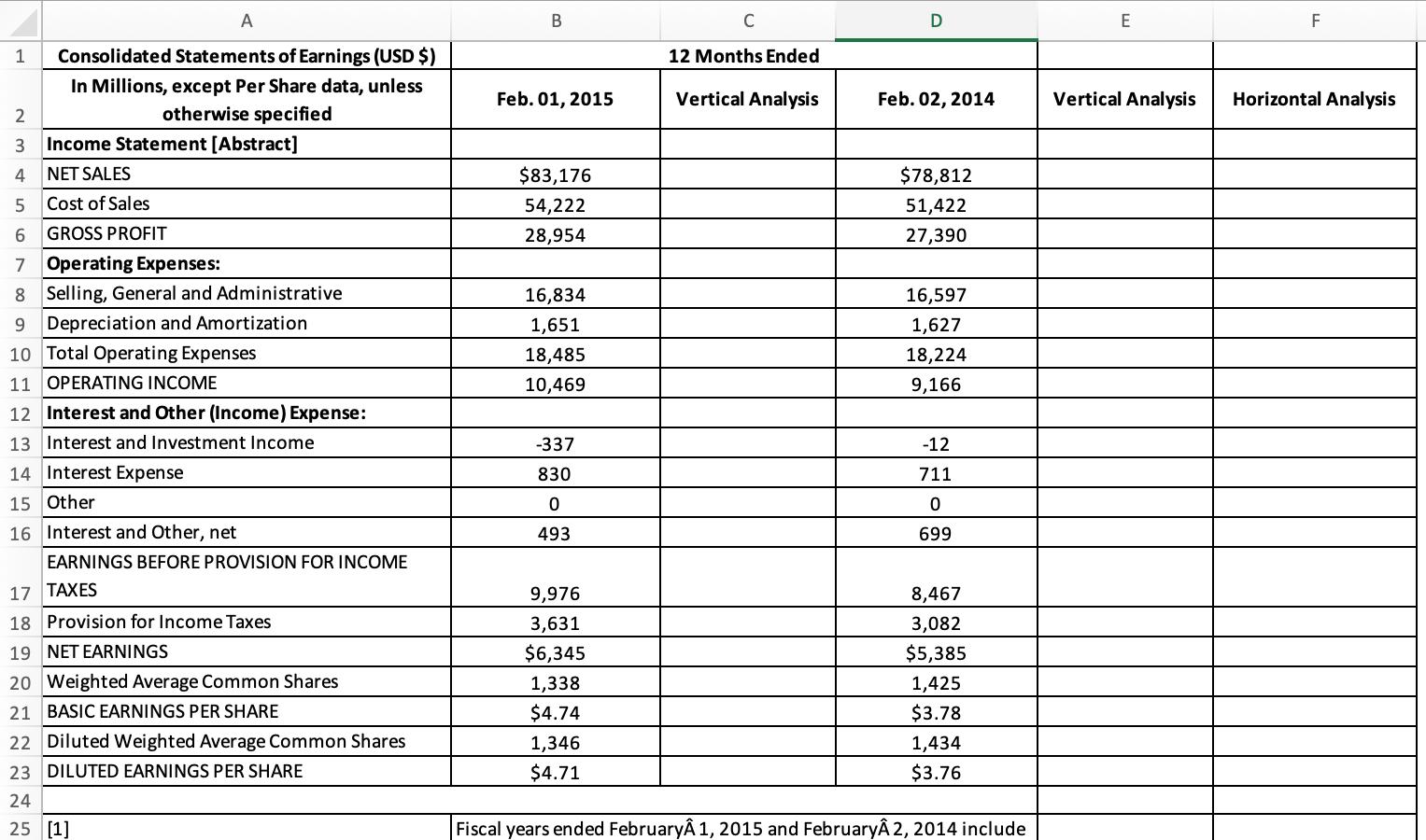

1. Complete a vertical and horizontal analysis on the tabs labeled Balance Sheet and Income Statement, use total assets on the balance sheet and net

1. Complete a vertical and horizontal analysis on the tabs labeled "Balance Sheet" and "Income Statement," use total assets on the balance sheet and net sales on the income statement for your vertical analysis.

2. Using the balance sheet and income statement, complete the ratios on the tab labeled "Ratios."

Consolidated Balance Sheets (USD $) Feb. 01, 2015 Vertical Analysis Feb. 01, 2014 Vertical Analysis Horizontal Analysis In Millions, unless otherwise specified Current Assets: Cash and Cash Equivalents $1,723 $1,929 Receivables, net 1,484 1,398 Merchandise Inventories 11,079 11,057 Other Current Assets 1,016 895 Total Current Assets 15,302 15,279 Property and Equipment, at cost Less Accumulated Depreciation and Amortization 38,513 39,064 15,793 15,716 Net Property and Equipment 22,720 23,348 Goodwill 1,353 1,289 Other Assets 571 602 Total Assets 39,946 40,518 Current Liabilities: Short-Term Debt 290 Accounts Payable Accrued Salaries and Related Expenses Sales Taxes Payable 5,807 5,797 1,391 1428 434 396 Deferred Revenue 1468 1,337 Income Taxes Payable Current Installments of Long-Term Debt 35 12 38 33 Other Accrued Expenses 1,806 11,269 1,746 Total Current Liabilities 10,749 Long-Term Debt, excluding current installments 16,869 14,691 Other Long-Term Liabilities 1,844 2,042 Deferred Income Taxes 642 514 Total Liabilitices 30,624 27,996 STOCKHOLDERS' EQUITY Common Stock, par value $0.05; authorized: 10 billion shares; issued: 1.768 billion shares at February 1, 2015 and 1.761 billion shares at February 2, 2014; outstanding: 1.307 billion shares at February 1, 2015 and 1.380 billion shares at February 2, 2014 88 88 Paid-In Capital Retained Earnings Accumulated Other Comprehensive (Loss) 8,885 8,402 26,995 23,180 -452 46 Income Treasury Stock, at cost, 461 million shares at February 1, 2015 and 381 million shares at February 2, 2014 -26,194 -19,194 9,322 Total StockholdersTM Equity Total Liabilities and Stockholders' Equity 12,522 $39,946 $40,518

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Vertical Analys...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started