Question

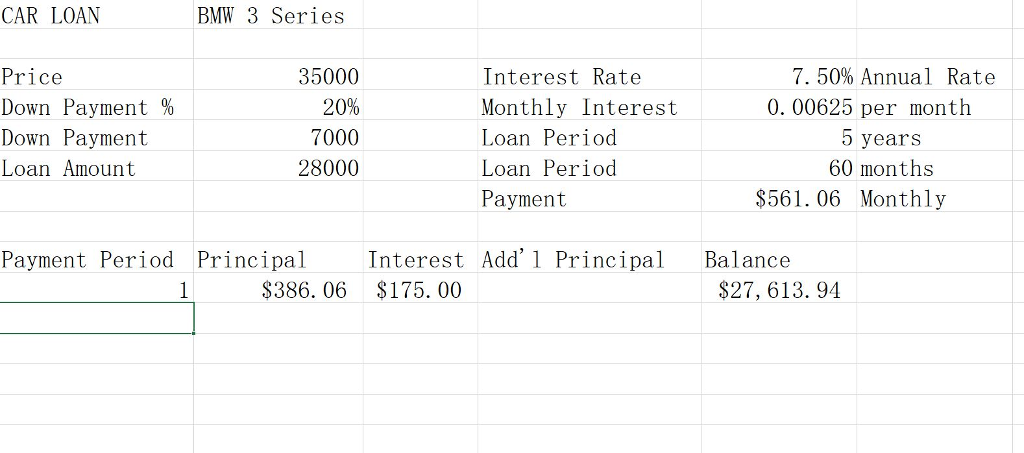

1. Complete all 60 payments with the correct formulas, then check to see if toward the end of the 60 th payment, if the loan

1. Complete all 60 payments with the correct formulas, then check to see if toward the end of the 60th payment, if the loan balance is zero

2. Input any numbers (for example: 1000 on payment #5 on the "Extra Payment" column, and you will notice that you will pay off your loan earlier than 60 payments, and you will start seeing negative balance in color red. Use IF statement to figure out which payment is the last payment, then once you are done with that last payment, the loan balance is zero. Once the loan has been paid off, do not show any more payment number following that row.

3. Design the correct IF statement formulas to allow users to change one cell on the How Long? Cell, and your IF statement will add or remove columns to reflect the correct payment numbers. For example: our sample file on the blackboard showed 5 years, 60 payments. If your bonus project is done correctly, then by changing 5 years to 4 years, you should show only 4 years x 12 months = 48 months and 48 payments will be calculated automatically, and the ending balance of the 48th payment will be zero. Same thing with adding more years; for example: By changing 5 years to 6 years, 6 years x 12 months = 72 months and 72 payments will be calculated automatically, and when you scroll down the screen, you should see all 72 payments listed and toward the end of the 72ndmonths, the loan balance will be zero

Want to know the IF statements in order to solve the Question 2 and 3

CAR LOAN BMW 3 Series Price Down Payment % Down Payment Loan Amount 35000 20% 7000 28000 7.50% Annual Rate 0. 00625 per month Interest Kate Monthly Interest Loan Period Loan Period Payment o yearS 60 months $561. 06 Monthly Interest Add 1 Principal Balance $175. 00 Payment Period Principal $386. 06 $27, 613. 94 CAR LOAN BMW 3 Series Price Down Payment % Down Payment Loan Amount 35000 20% 7000 28000 7.50% Annual Rate 0. 00625 per month Interest Kate Monthly Interest Loan Period Loan Period Payment o yearS 60 months $561. 06 Monthly Interest Add 1 Principal Balance $175. 00 Payment Period Principal $386. 06 $27, 613. 94

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started