Question

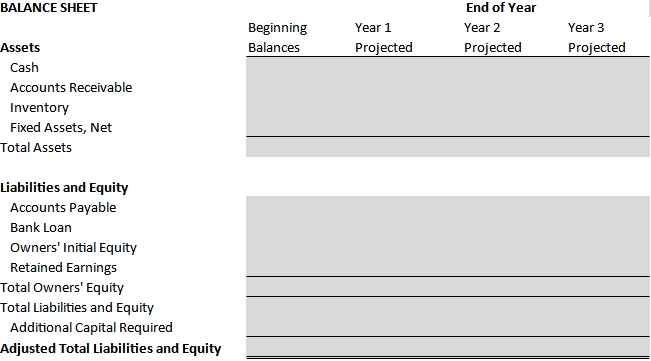

1. Complete Beginning Balances column for the balance sheet. Assume you have cash to invest in your business of $162,000 and are able to raise

1. Complete Beginning Balances column for the balance sheet.

Assume you have cash to invest in your business of $162,000 and are able to raise an additional $200,000 through a bank loan. Before you open for business you purchase $150,000 in Fixed Assets and $70,000 in inventory of which $35,000 is carried by the vendor in Accounts payable.

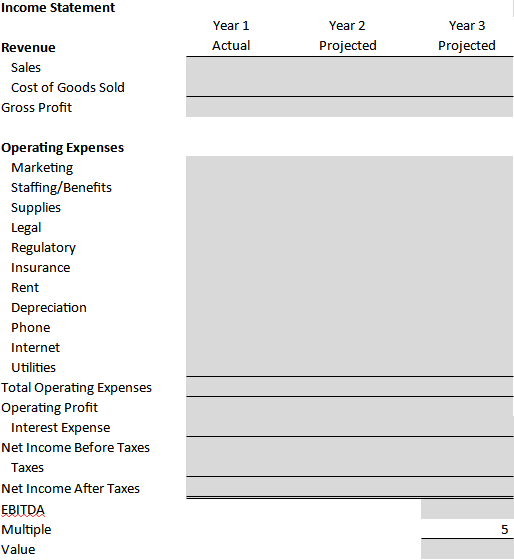

2. Complete the Balance Sheet for years 1 through 3 and the Income Statement & Valuation worksheet. Indicate the estimated value of the business at the end of year 3.

Incorporate the following assumptions into your projections:

Balance Sheet Assumptions:

Your cash balance increases by 5% each year.

The bank charges 7% simple interest on the loan. Along with interest payments, the bank also requires principal payments at the end of year equal to 5% of the beginning year balance.

Inventory increases by 15% each year.

90% of your sales are booked on account and your average collection period is 60 days. Accordingly, your year-end Accounts Receivable balance is 15% of annual revenues (using a 360- day year).

Your Net fixed assets increase 4% each year.

Accounts payable are 50% of inventory.

You do not pay dividends and all earnings are retained.

Owners Equity is the balance between total assets minus liabilities each year. This is a privately held company 100% owner by you and your close partners.

Income Statement Assumptions:

Sales in year 1 are projected to be $450,000 and you expect 15% growth in sales in year 2, and 20% in year 3.

Cost of Goods sold are 55% of sales.

Aggregate Operating Expenses are projected at 35% of sales. You will need to split the aggregate amount under the various operating expense accounts on a reasonable rationale for your type of business.

Taxes are 21% of Net income before taxes.

Valuation Assumptions:

A business of the nature you are proposing is reasonably valued using Earnings Before Taxes Depreciation and Amortization (EBITDA) times a multiple of 5.

BALANCE SHEET Income Statement \begin{tabular}{lccc} & Year1Actual & Year2Projected & Year3Projected \\ \cline { 2 - 4 } & Sales & & \\ Cost of Goods Sold & & & \\ Gross Profit & & & \end{tabular} Operating Expenses Marketing Staffing/Benefits Supplies Legal Regulatory Insurance Rent Depreciation Phone Internet Utilities Total Operating Expenses Operating Profit Interest Expense Net Income Before Taxes Taxes Net Income After Taxes EBITDA Multiple Value

BALANCE SHEET Income Statement \begin{tabular}{lccc} & Year1Actual & Year2Projected & Year3Projected \\ \cline { 2 - 4 } & Sales & & \\ Cost of Goods Sold & & & \\ Gross Profit & & & \end{tabular} Operating Expenses Marketing Staffing/Benefits Supplies Legal Regulatory Insurance Rent Depreciation Phone Internet Utilities Total Operating Expenses Operating Profit Interest Expense Net Income Before Taxes Taxes Net Income After Taxes EBITDA Multiple Value Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started