Question

1. Complete the budget income statement and decide whether or not the company should move forward with the project. BUDGETED INCOME STATEMENT FOR THE YEAR

1. Complete the budget income statement and decide whether or not the company should move forward with the project.

BUDGETED INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31

Sales $

Cost of goods sold

Finished goods inventory, beginning

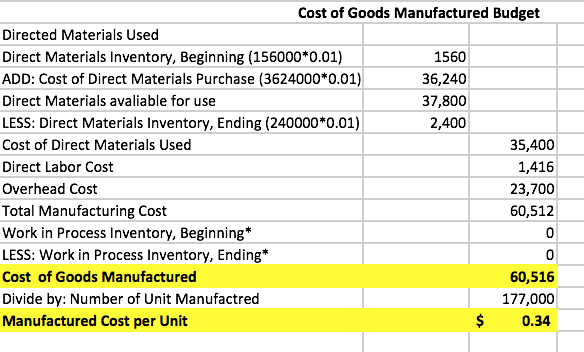

Cost of goods manufactured

Cost of finished goods available for sale

Less finished goods inventory, ending

Cost of goods sold

Gross margin

Selling and administrative expenses

Income from operations

Income taxes expense (30%)*

Net Income (Net Loss)

*The figure in parentheses is the companys income tax rate

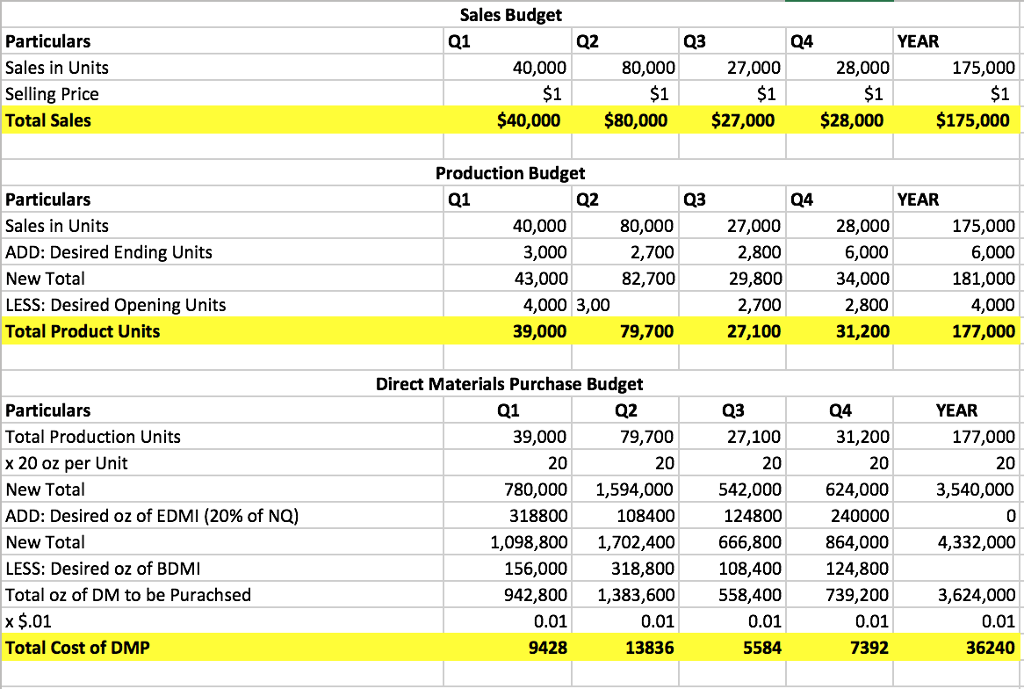

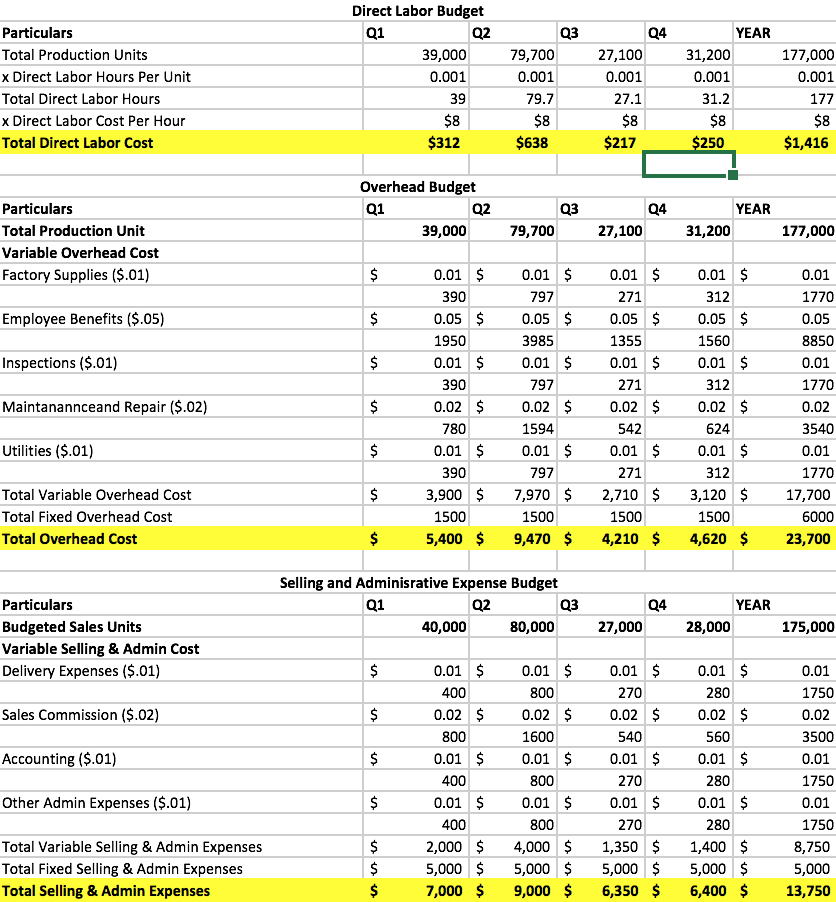

Sales Budget Particulars Sales in Units Selling Price Total Sales Q2 Q3 Q4 YEAR 27,000 40,000 $1 80,000 $1 28,000 $1 175,000 $1 $1 $40,000 $80,000 $27,000 $28,000 $175,000 Production Budget YEAR Particulars Sales in Units ADD: Desired Ending Units New Total LESS: Desired Opening Units Total Product Units Q1 Q2 Q3 40,000 3,000 43,000 80,000 2,700 82,700 27,000 2,800 29,800 2,700 27,100 28,000 6,000 34,000 2,800 31,200 175,000 6,000 181,000 4,000 177,000 4,000 3,00 39,000 79,700 Direct Materials Purchase Budget Q1 Particulars Total Production Units x 20 oz per Unit New Total ADD: Desired oz of EDMI (20% of NQ) New Total LESS: Desired oz of BDMI Total oz of DM to be Purachsed x $.01 Total Cost of DMP Q2 YEAR 31,200 20 624,000 240000 864,000 124,800 739,200 0.01 7392 39,000 20 79,700 20 780,0001,594,000 108400 1,098,800 1,702,400 318,800 942,8001,383,600 0.01 13836 27,100 20 542,000 124800 666,800 108,400 558,400 0.01 5584 177,000 20 3,540,000 0 4,332,000 318800 156,000 0.01 9428 3,624,000 0.01 36240 Direct Labor Budget YEAR Particulars Total Production Units x Direct Labor Hours Per Unit Total Direct Labor Hours x Direct Labor Cost Per Hour Total Direct Labor Cost Q3 39,000 0.001 79,700 0.001 27,100 0.001 31,200 0.001 177,000 0.001 $8 $8 $217 $8 250 $8 $312 Overhead Budget YEAR Particulars Total Production Unit Variable Overhead Cost Factory Supplies ($.01) Q3 39,000 79,700 27,100 31,200 177,000 390 271 1770 Employee Benefits ($.05) Inspections ($.01) Maintanannceand Repair ($.02) Utilities ($.01) 1950 3985 1355 8850 390 271 1770 1594 624 3540 271 3,900 $ 7,970 2,710$3,120$17,700 1500 5,400 $ 9,470 4,210 $ 4,620 $ 23,700 390 1770 Total Variable Overhead Cost Total Fixed Overhead Cost Total Overhead Cost 1500 1500 1500 6000 Selling and Adminisrative Expense Budget YEAR Particulars Budgeted Sales Units Variable Selling & Admin Cost Delivery Expenses ($.01) Q3 40,000 80,000 27,000 28,000 175,000 270 1750 Sales Commission ($.02) Accounting ($.01) Other Admin Expenses ($.01) 800 1600 3500 270 1750 1750 8,750 5,000 7,000 9,000 6,350$ 6,400 13,750 Total Variable Selling & Admin Expenses Total Fixed Selling & Admin Expenses Total Selling & Admin Expenses 800 2,000$ 4,000 5,000$ 5,000 270 $ 1,350 1,400 5,000 $5,000 $ Cost of Goods Manufactured Budget Directed Materials Used Direct Materials Inventory, Beginning (156000*0.01) ADD: Cost of Direct Materials Purchase (3624000*0.01) Direct Materials avaliable for use LESS: Direct Materials Inventory, Ending (240000*0.01) Cost of Direct Materials Used Direct Labor Cost Overhead Cost Total Manufacturing Cost Work in Process Inventory, Beginning* LESS: Work in Process Inventory, Ending* Cost of Goods Manufactured Divide by: Number of Unit Manufactred Manufactured Cost per Unit 1560 36,240 37,800 2,400 35,400 1,416 23,700 60,512 60,516 177,000 $0.34

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started