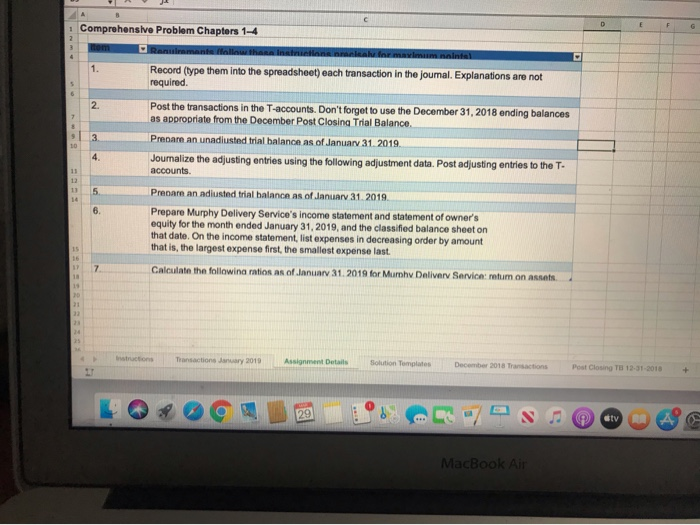

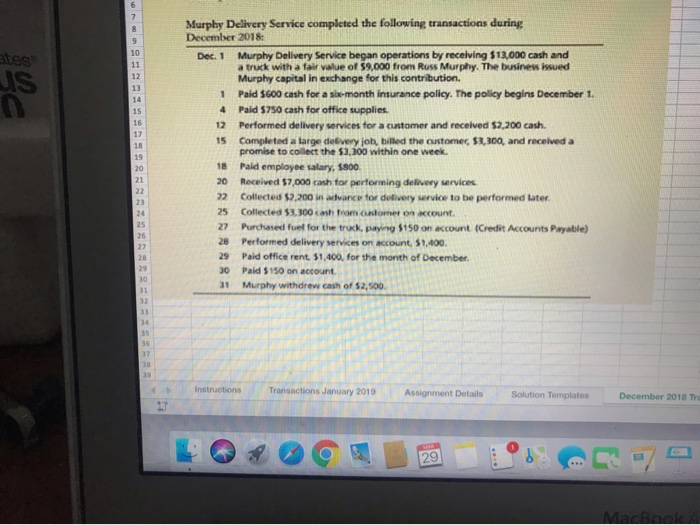

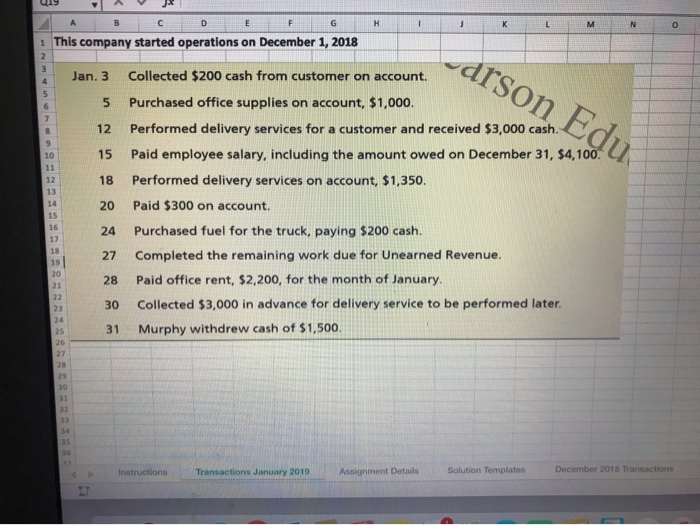

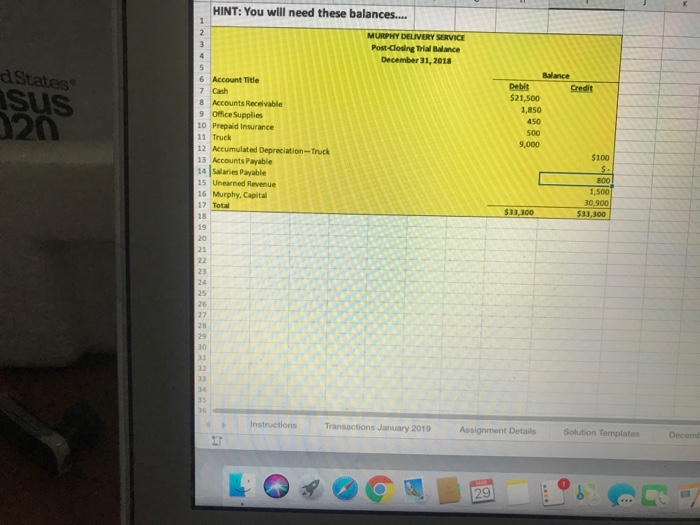

1 Comprehensive Problem Chapters 1-4 samante fill there inaintenance in mlmm nintel Record (type them into the spreadsheet) each transaction in the journal. Explanations are not required. Post the transactions in the T-accounts. Don't forget to use the December 31, 2018 ending balances as appropriate from the December Post Closing Trial Balance Prepare an unadiusted trial balance as of January 31, 2019 Joumalize the adjusting entries using the following adjustment data. Post adjusting entries to the T. accounts Prepare an adlusted trial balance as of January 31, 2019 Prepare Murphy Delivery Service's income statement and statement of owner's equity for the month ended January 31, 2019, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount that is, the largest expense first, the smallest expense last. Calculate the followina ration as of January 31, 2019 for Murphy Delivery Service mtum on assets Assignment Details Solution Templates December 2018 Transactions Post Closing TB 12-01-2018 + MacBook Air ates Murphy Delivery Service completed the following transactions during December 2018 Dec. 1 Murphy Delivery Service began operations by receiving $13,000 cash and a truck with a fair value of $9,000 from Russ Murphy. The business issued Murphy capital in exchange for this contribution. Paid 5600 cash for a si-month insurance policy. The policy begins December 1. Paid 5750 cash for office supplies. 12 Performed delivery services for a customer and received $2,200 cash. 15 Completed a large delivery job, billed the customer $3,300, and received a promise to collect the 53,300 within one week 18 Paid employee salary, 5800 20 Received $7,000 cash for performing delivery services 22 Collected $7.200 is advance for delivery service to be performed later 25 Collected $3,300 cash from customer on account. 27 Purchased fuel for the truck, paying 5150 on account (Credit Accounts Payable) 28 Performed delivery services or account 51,400 29 Paid office rent $1,400, for the month of December 30 Paid $150 on account 31 Murphy withdrew cash of $2,500 Instructions Transactions January 2019 Assignment Details Solution Templates December 2018 T AVX H A B C D E F G 1 This company started operations on December 1, 2018 drson Edu Jan. 3 Collected $200 cash from customer on account. 5 Purchased office supplies on account, $1,000. 12 Performed delivery services for a customer and received $3,000 cash 15 Paid employee salary, including the amount owed on December 31, $4,100. 18 Performed delivery services on account, $1,350. 20 Paid $300 on account. 24 Purchased fuel for the truck, paying $200 cash. Completed the remaining work due for Unearned Revenue. 28 Paid office rent, $2,200, for the month of January 30 Collected $3,000 in advance for delivery service to be performed later. 31 Murphy withdrew cash of $1,500. Instructions Transactions January 2019 Assignment Details Solution Templates December 2018 Transactions HINT: You will need these balances.... MURPHY DELIVERY SERVICE Post-Closing Trial Balance December 31, 2018 a States Balance Debit $21.500 sus 320 1,850 Account Tits Cash Accounts Receivable Office Supplies 10 Prepaid Insurance 11 Truck 12 Accumulated Depreciation-Truck 13 Accounts Payable 14 Salaries Payable 15 Unearned Revenue 16 Murphy, Capital 17 Total 9,000 $100 8001 1,500 30,900 $33,300 Instructions Transactions January 2010 Assignment Details Solution Templates Decemt