1. Computation for the Financial Rations of Nike Company for the Year 2014-2015 such as the Current ratio, Acid-test ratio, Accounts receivable turnover, Inventory turnover, Days Sales in receivables, Days Sales in inventories, Working Capital, Days Purchases in Accounts Payable, Average Net Trade Cycle, Cash Provided by operations to average current liabilities, Total debt to equity, Total Liabilities/Total Assets, Long-term Debt/Total Assets, Financial Leverage Ratios, Financial Leverage Index, Altman Z-Score, Earnings to fixed charges, Cash flow to fixed Charges, Gross Profit Margin, Operating Profit Margin, Net profit margin, , Return on Assets, Return on Common Equity, Adjusted Profit Margin, Asset turnover, Financial Leverage Ratio

2. Analysis on the Financial Activities such as the Financing, Operating and Investing activities of the Nike Company and the increase (decrease) for the year 2-14 and 2015.

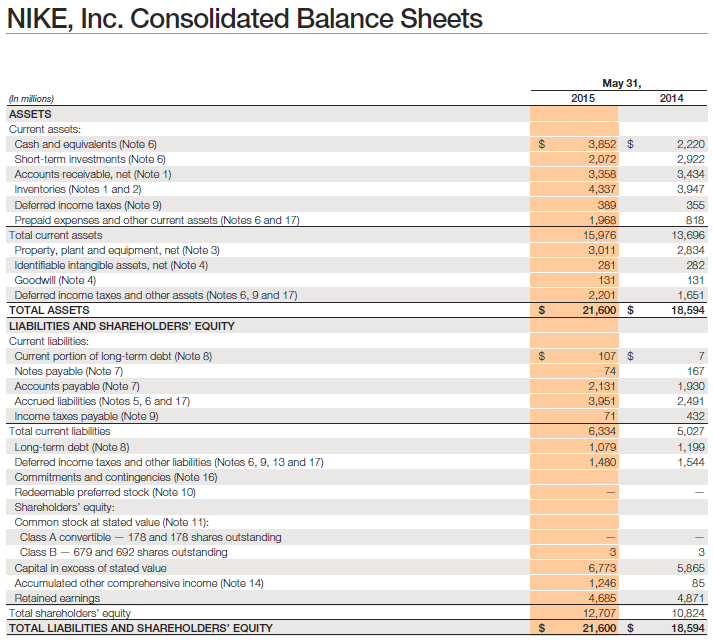

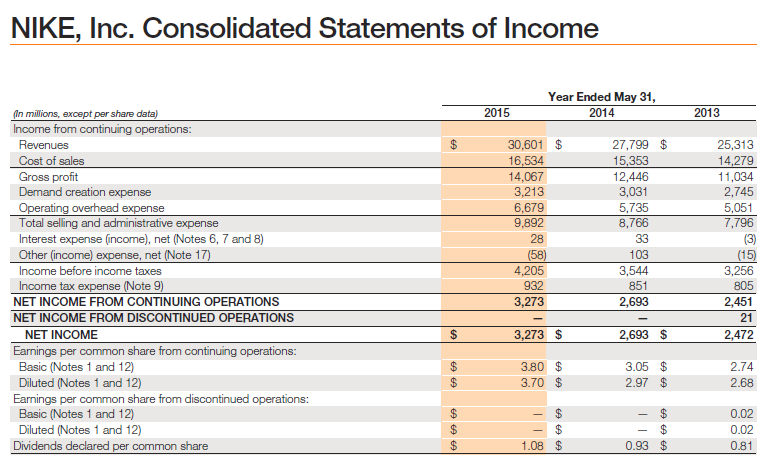

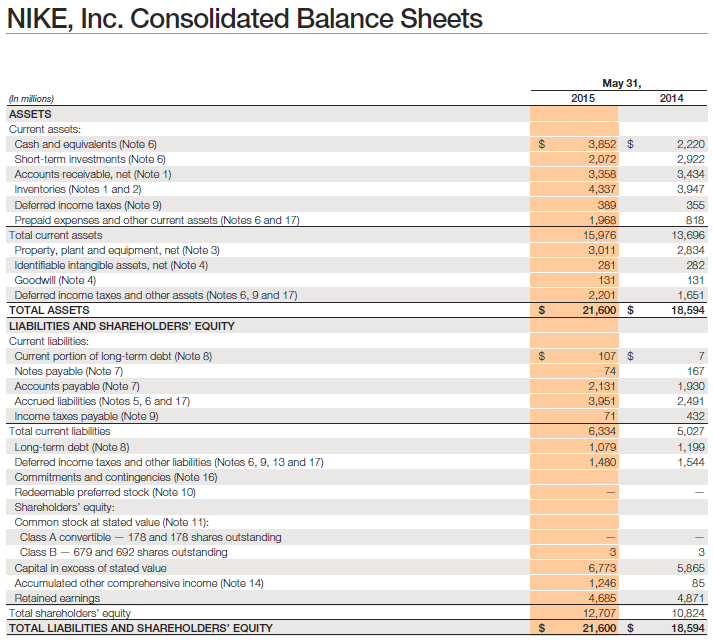

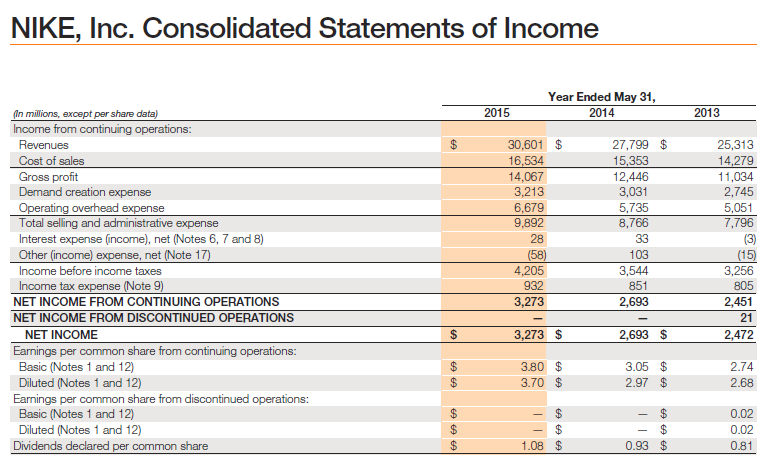

NIKE, Inc. Consolidated Balance Sheets May 31, 2015 2014 $ 3,852 $ 2,072 3,358 4,337 389 1,968 15,976 2,220 2,922 3,434 3,947 355 818 13,696 2,834 282 131 1,651 18,594 3,011 281 131 2,201 21,600 $ $ (in Millions) ASSETS Current assets: Cash and equivalents (Note 6) Short-term investments (Note 6) Accounts receivable, net (Note 1) Inventories (Notes 1 and 2) Deferred income taxes (Note 9) Prepaid expenses and other current assets (Notes 6 and 17) Total current assets Property, plant and equipment, net (Note 3) Identifiable intangible assets, net (Note 4) Goodwill (Note 4) Deferred income taxes and other assets (Notes 6, 9 and 17) TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt (Note 8) Notes payable (Note 7) Accounts payable (Note 7 Accrued liabilities (Notes 5, 6 and 17) Income taxes payable (Note 9) Total current liabilities Long-term debt (Note 8) Deferred income taxes and other liabilities (Notes 6, 9, 13 and 17) Commitments and contingencies (Note 16) Redeemable preferred stock (Note 10) Shareholders' oquity: Common stock at stated value (Note 11): Class A convertible 178 and 178 shares outstanding Class B - 679 and 692 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (Note 14) Retained earnings Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 107 $ 74 2,131 3,951 71 6,334 1,079 1,480 7 167 1,930 2,491 432 5,027 1,199 1,544 3 6,773 1,246 4,685 12,707 21,600 $ 3 5,865 85 4,871 10.824 18,594 $ NIKE, Inc. Consolidated Statements of Income Year Ended May 31, 2014 2015 2013 In millions, except per share data) Income from continuing operations: Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net (Notes 6, 7 and 8) Other (income) expense, net (Note 17) Income before income taxes Income tax expense (Note 9) NET INCOME FROM CONTINUING OPERATIONS NET INCOME FROM DISCONTINUED OPERATIONS NET INCOME Earnings per common share from continuing operations: Basic (Notes 1 and 12) Diluted (Notes 1 and 12) Earnings per common share from discontinued operations: Basic (Notes 1 and 12) Diluted (Notes 1 and 12) Dividends declared per common share 30,601 $ 16,534 14,067 3,213 6,679 9,892 28 (58) 4,205 932 3,273 27,799 $ 15,353 12.446 3,031 5,735 8.766 33 103 3,544 851 2,693 25,313 14,279 11,034 2,745 5,051 7,796 (3) (15) 3,256 805 2,451 21 2,472 $ 3,273 $ 2,693 $ $ $ 3.80 $ 3.70 $ 3.05 $ 2.97 $ 2.74 2.68 $ A A A | 18 0.02 0.02 0.81 $ 1.08 $ 0.93 $