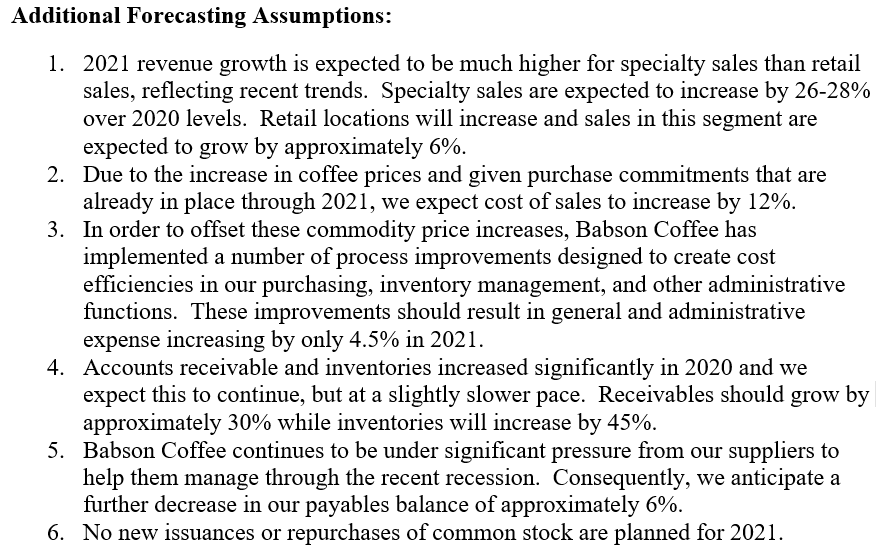

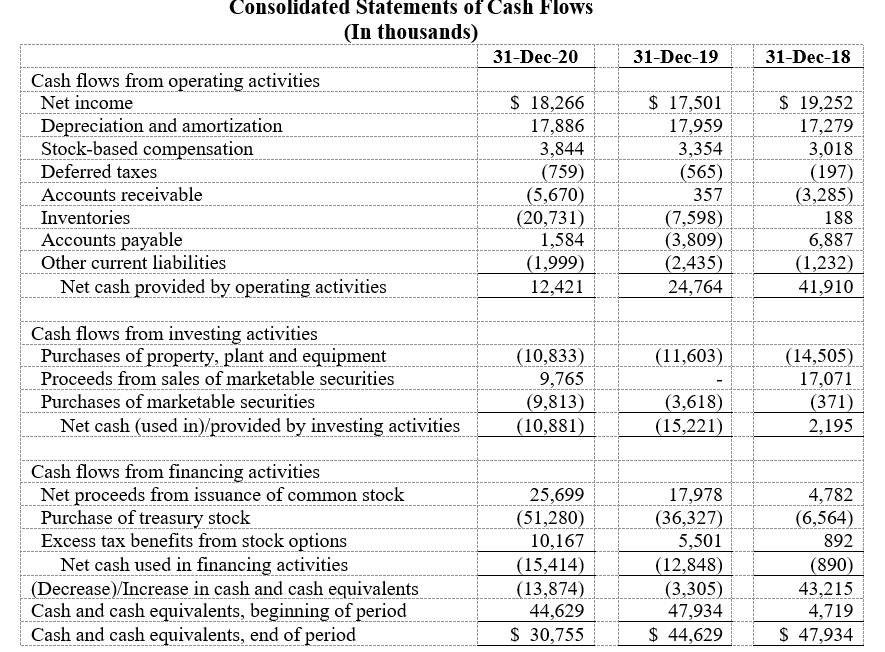

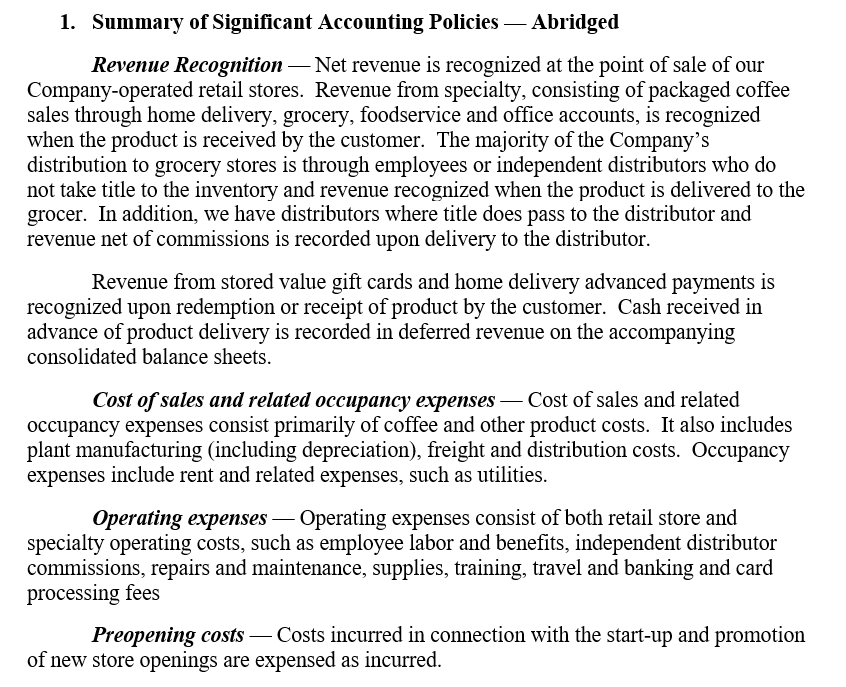

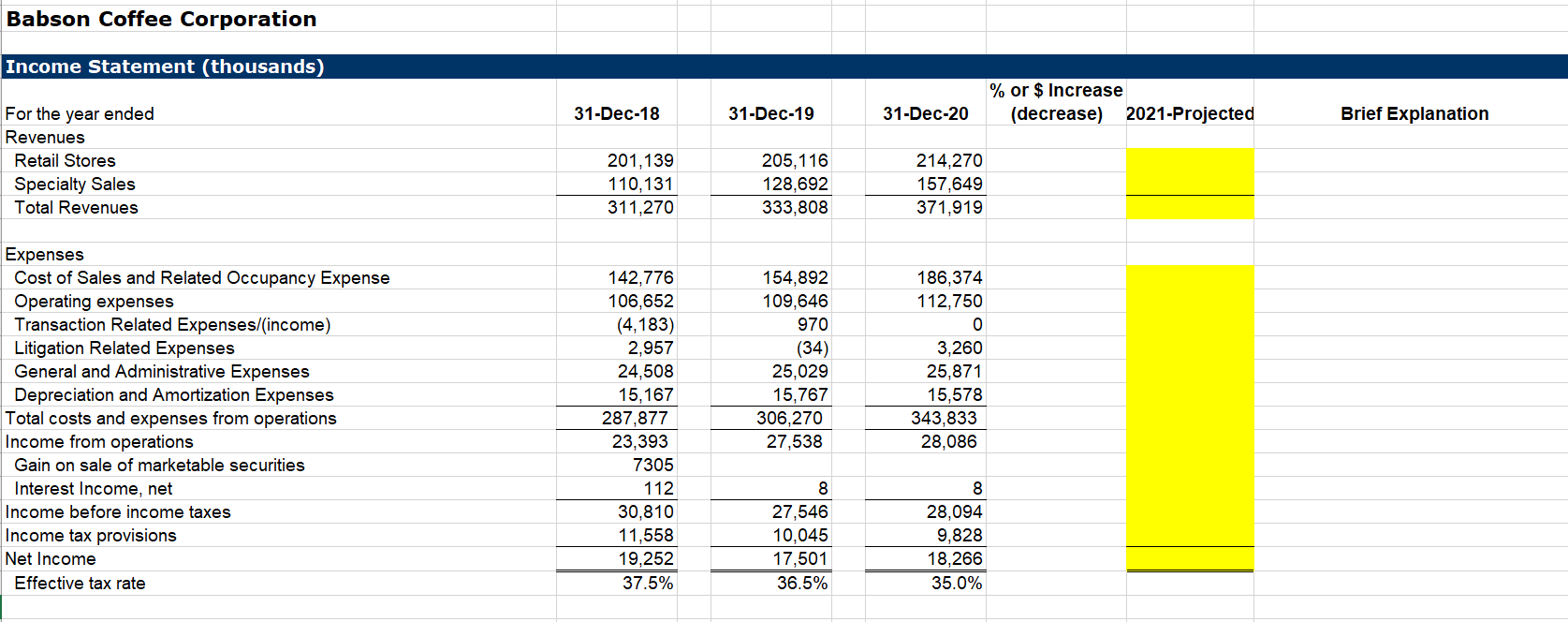

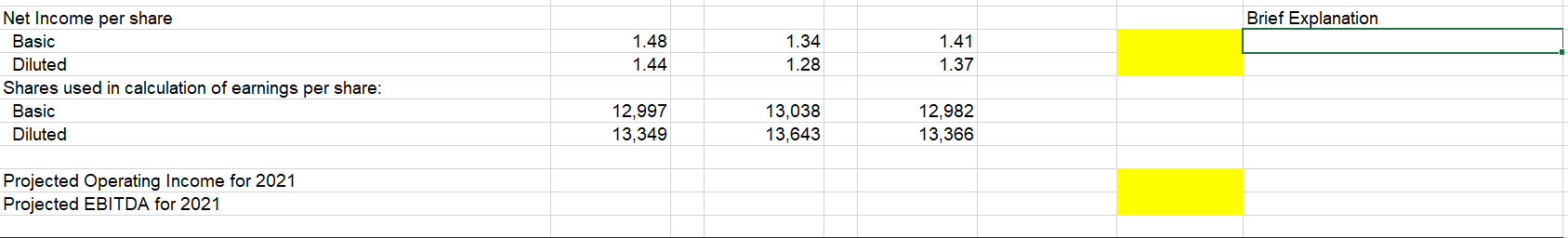

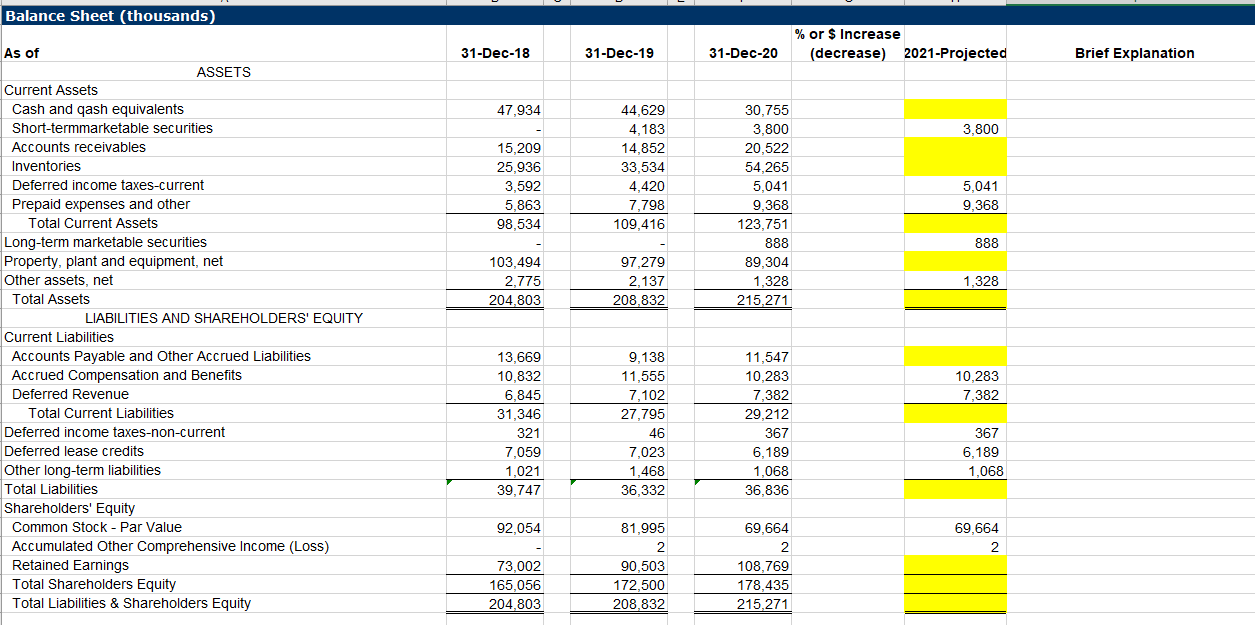

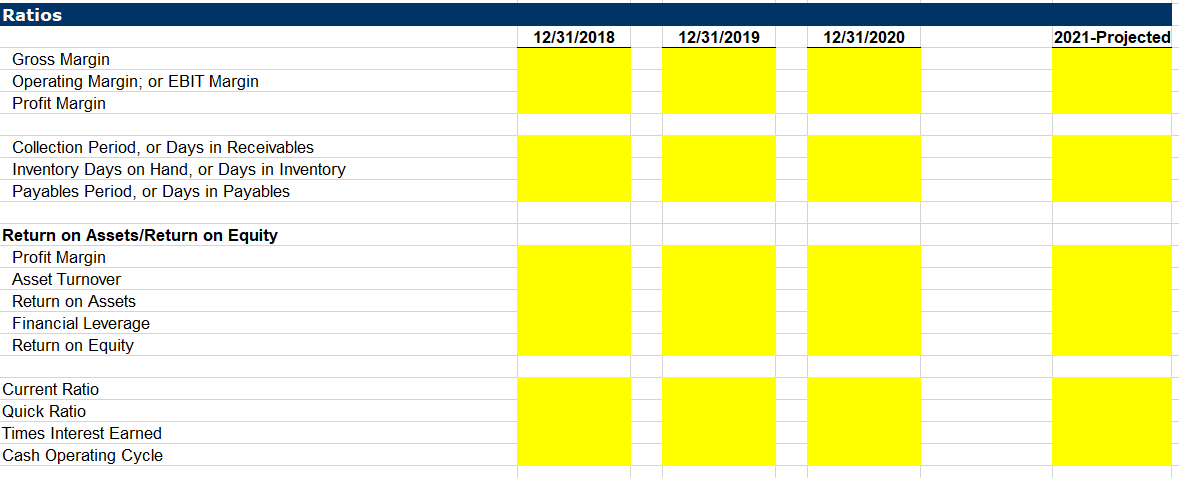

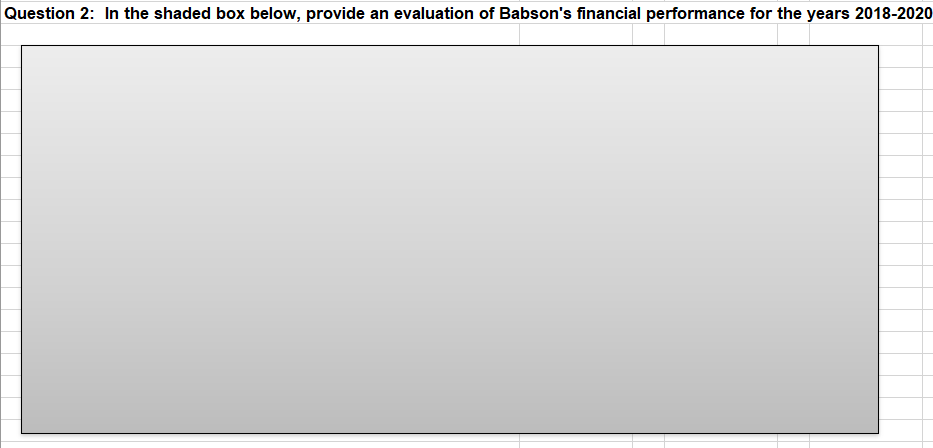

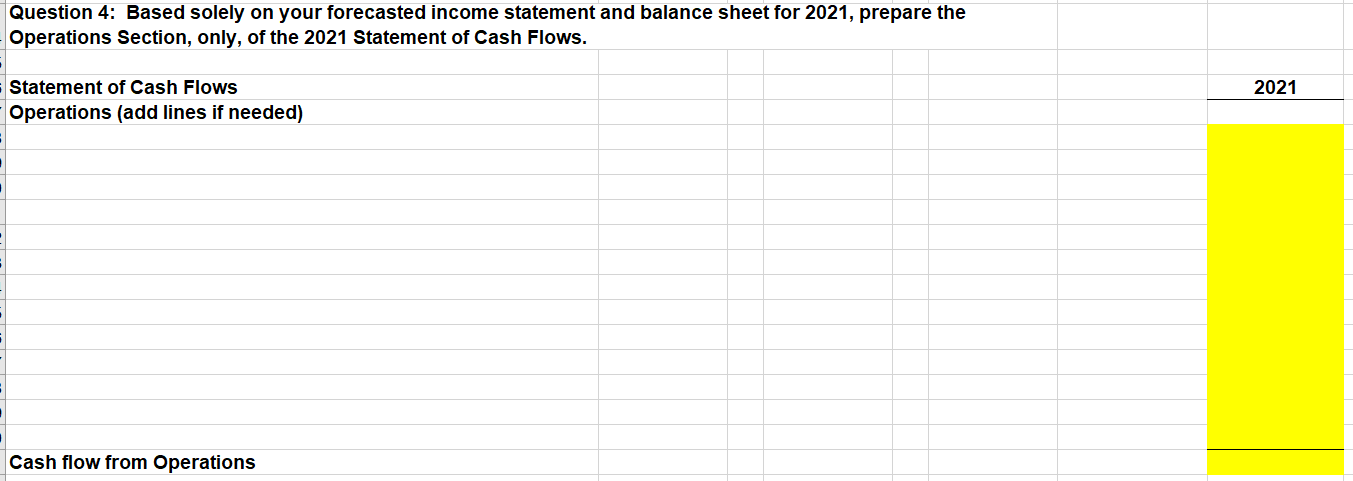

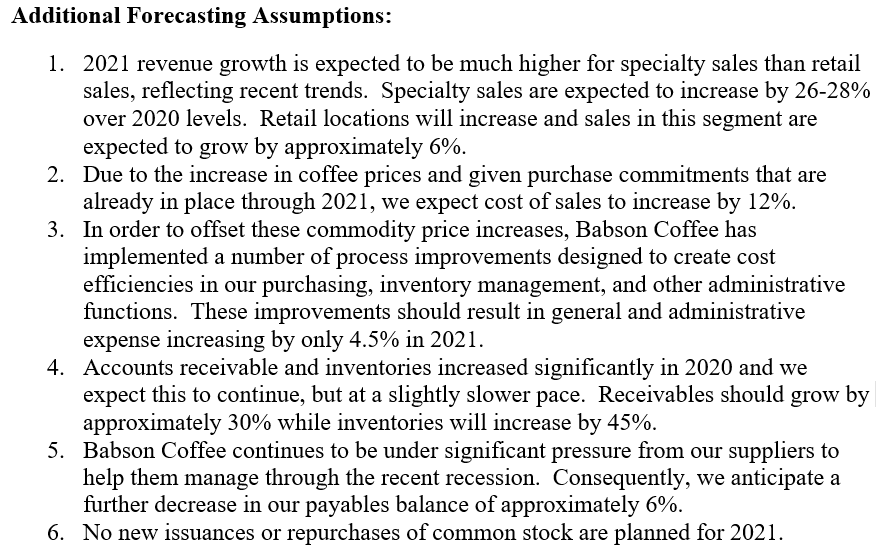

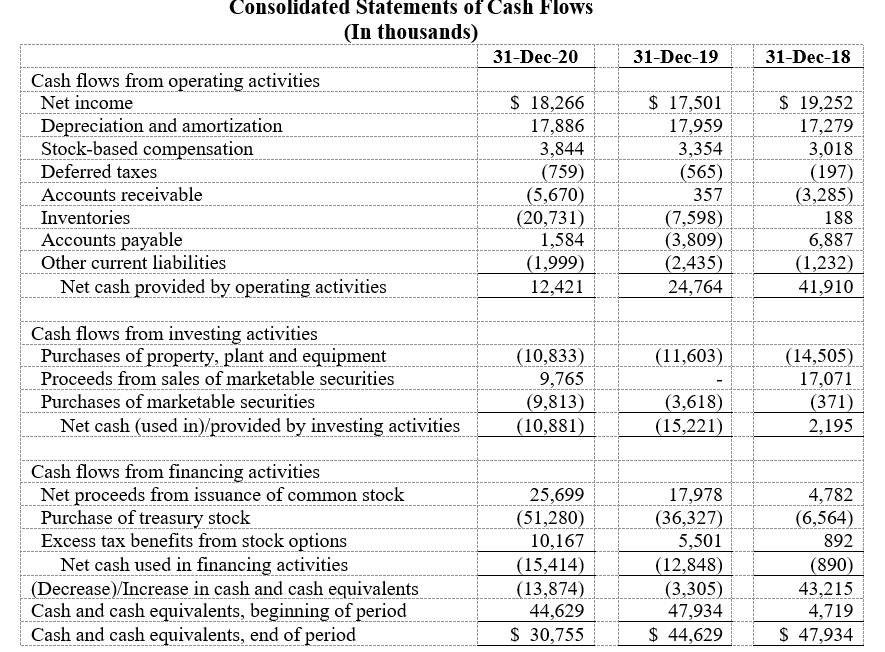

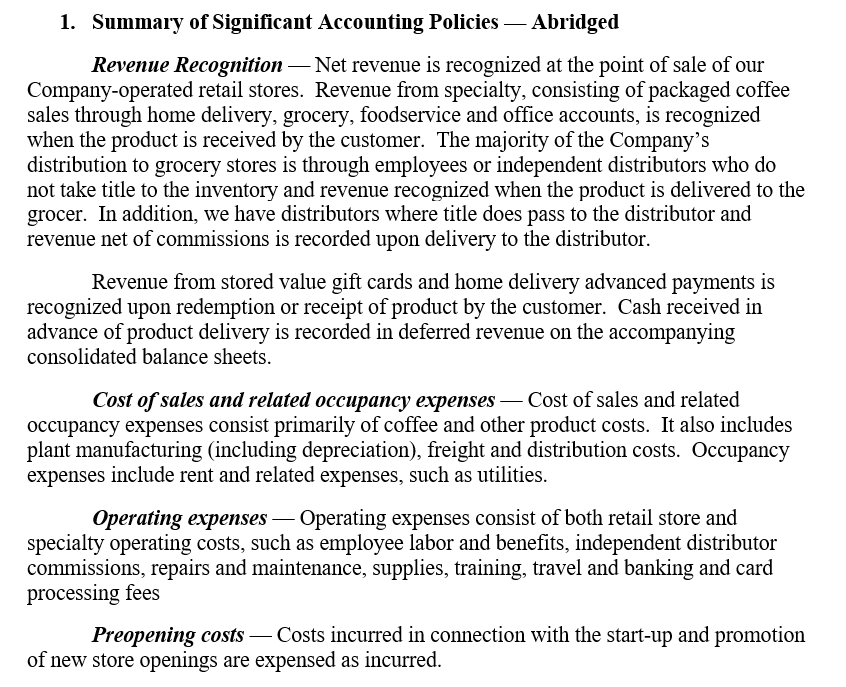

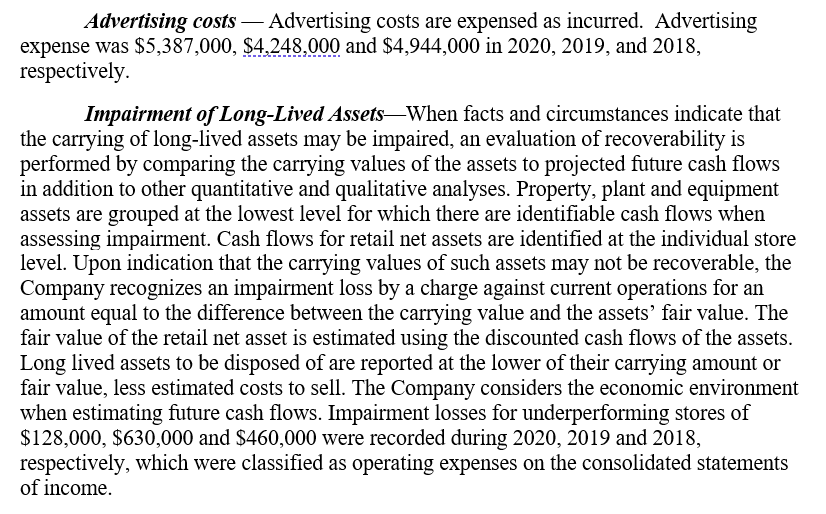

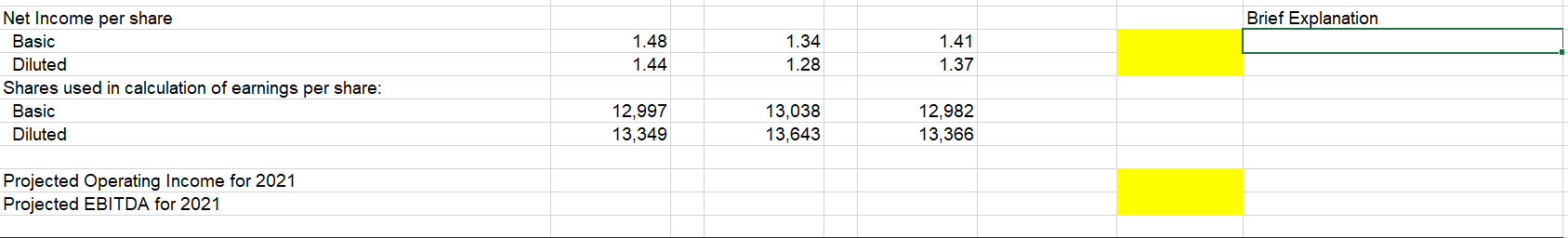

1. Compute financial ratios for Babson Coffee for the years 2018-2020 in the space provided in the spreadsheet. You may insert any additional ratios you feel are necessary to evaluate Babson's financial performance (Question \#2). 2. Provide an evaluation of Babson Coffee's financial performance for the years 2018-2020. Use the shaded box within the same spreadsheet. 3. Using the information contained in the excerpts from Babson Coffee's 10-K as well as your analysis of trends over the past three years, forecast the highlighted (in yellow) amounts on the Income Statement and Balance Sheet for 2021. 4. Based solely on your forecasted income statement and balance sheet for 2021, prepare the Operations Section, only, of the 2021 Statement of Cash Flows. We expect the specialty coffee industry, fueled by continued consumer interest in high-quality coffee and related products, to continue to grow. We believe that growth opportunities exist in all. of our distribution channels and that our specialty segment can expand to geographies where we do not have a retail presence. In retail, we expect to continue to open new retail stores in strategic west coast locations that meet our demographic profile. In grocery, we expect to continue to expand into new markets in addition to the western U.S., eastern seaboard and other selected markets, although the full extent of our penetration will depend upon the growth of the specialty coffee category in those markets. We will continue to work with distributors and companies to expand our presence in the foodservice and office environment.| In the past two years, we have experienced a dramatic increase in the price volatility of Arabica coffee traded on the New York Board of Trade. Since May 2019, commodity coffee prices have been extremely volatile ranging from a low of $1.32 per pound and peaking at $3.05 per pound. While we do not purchase coffee on the commodity markets, price movements in the commodity trading of Arabica coffee beans impact the prices we pay. As a result of this volatility, in 2020 , the price that we paid for our coffee was 41% higher per pound than what we had paid in 2019 and that increased cost negatively affected our profitability as coffee costs as a percent of sales increased from 15% to 21%. We expect the coffee commodity market to continue to be challenging as the market continues to be influenced by worldwide supply and demand, the relative strength of the dollar, speculative trading and weather. In. order to have visibility to our costs for the future, we typically fix the price of our coffee needs for the next six to 12 months by purchasing and holding large inventories of green coffee and utilizing future fixed price purchase commitments. As of January 1, 2021, our inventory and fixed price commitments are sufficient for virtually all of our anticipated 2021 needs at a cost approximately 12% higher per pound than 2020 (with year-over-year increases expected to be higher earlier in the year than later). For 2020, in addition to benefiting from price increases, we also benefited from several cost reduction and growth initiatives that offset most of these coffee cost increases. We have historically raised prices in each of our channels to offset the higher costs and we did increase prices in each channel in 2019 or 2020 . If we are unable to pass along these costs to our customers or find other means to offset coffee or other inflation, our profitability and margins will be negatively affected. Additionally, if prices of commodity coffee fall dramatically, we will be required to fulfill our commitments for our future contracts that may result in us purchasing coffee at prices substantially above the market price which could negatively impact our competitiveness in the marketplace and our profitability. We will continue to monitor these markets and take actions we feel are appropriate to minimize the impact on us in the short and long-term. 1. 2021 revenue growth is expected to be much higher for specialty sales than retail sales, reflecting recent trends. Specialty sales are expected to increase by 2628% over 2020 levels. Retail locations will increase and sales in this segment are expected to grow by approximately 6%. 2. Due to the increase in coffee prices and given purchase commitments that are already in place through 2021 , we expect cost of sales to increase by 12%. 3. In order to offset these commodity price increases, Babson Coffee has implemented a number of process improvements designed to create cost efficiencies in our purchasing, inventory management, and other administrative functions. These improvements should result in general and administrative expense increasing by only 4.5% in 2021 . 4. Accounts receivable and inventories increased significantly in 2020 and we expect this to continue, but at a slightly slower pace. Receivables should grow by approximately 30% while inventories will increase by 45%. 5. Babson Coffee continues to be under significant pressure from our suppliers to help them manage through the recent recession. Consequently, we anticipate a further decrease in our payables balance of approximately 6%. Consolidated Statements of Cash Flows 1. Summary of Significant Accounting Policies _Abridged Revenue Recognition - Net revenue is recognized at the point of sale of our Company-operated retail stores. Revenue from specialty, consisting of packaged coffee sales through home delivery, grocery, foodservice and office accounts, is recognized when the product is received by the customer. The majority of the Company's distribution to grocery stores is through employees or independent distributors who do not take title to the inventory and revenue recognized when the product is delivered to the grocer. In addition, we have distributors where title does pass to the distributor and revenue net of commissions is recorded upon delivery to the distributor. Revenue from stored value gift cards and home delivery advanced payments is recognized upon redemption or receipt of product by the customer. Cash received in advance of product delivery is recorded in deferred revenue on the accompanying consolidated balance sheets. Cost of sales and related occupancy expenses - Cost of sales and related occupancy expenses consist primarily of coffee and other product costs. It also includes plant manufacturing (including depreciation), freight and distribution costs. Occupancy expenses include rent and related expenses, such as utilities. Operating expenses - Operating expenses consist of both retail store and specialty operating costs, such as employee labor and benefits, independent distributor commissions, repairs and maintenance, supplies, training, travel and banking and card processing fees Preopening costs - Costs incurred in connection with the start-up and promotion of new store openings are expensed as incurred. Advertising costs - Advertising costs are expensed as incurred. Advertising expense was $5,387,000, $4,248,000 and $4,944,000 in 2020,2019 , and 2018, respectively. Impairment of Long-Lived Assets - When facts and circumstances indicate that the carrying of long-lived assets may be impaired, an evaluation of recoverability is performed by comparing the carrying values of the assets to projected future cash flows in addition to other quantitative and qualitative analyses. Property, plant and equipment assets are grouped at the lowest level for which there are identifiable cash flows when assessing impairment. Cash flows for retail net assets are identified at the individual store level. Upon indication that the carrying values of such assets may not be recoverable, the Company recognizes an impairment loss by a charge against current operations for an amount equal to the difference between the carrying value and the assets' fair value. The fair value of the retail net asset is estimated using the discounted cash flows of the assets. Long lived assets to be disposed of are reported at the lower of their carrying amount or fair value, less estimated costs to sell. The Company considers the economic environment when estimating future cash flows. Impairment losses for underperforming stores of $128,000, $630,000 and $460,000 were recorded during 2020, 2019 and 2018, respectively, which were classified as operating expenses on the consolidated statements of income. 1. Property, Plant and Equipment Property, plant and equipment consist of the following at year-end 2020 and 2019 (in thousands): Depreciation expense was $17,871,000 in 2020, $17,926,000 in 2019 , and $17,194,000 in 2018. Construction in progress includes retail stores under construction and related fixtures, manufacturing plant equipment, and other capital projects not yet placed in service. 2. Store Closures The Company closed four underperforming retail locations in December, 2020. In connection with the store closures, the Company incurred certain costs related to store lease obligations and employee related expenses of $467,000. There is no balance for closed store reserves as of December 31, 2019. The Company incurred the following costs in connection with the December 31, 2020 store closures: As a result of the December 2020 store closures, the Company recorded a non-cash fixed asset write-off of $885,000, which is classified in operating expense in the accompanying consolidated statements of income. The employee related expenses and lease obligation costs included in the table above are classified in operating expenses and cost of sales and related occupancy expenses, respectively, in the accompanying consolidated statements of income. 3. Transaction-related Expenses/(Income) In 2018, the Company terminated a definitive agreement to acquire Olin Coffee. In 2019 the Company responded to a subpoena it received from the Federal Trade Commission (FTC) in connection with the FTC's anti-trust review of the acquisition of Olin Coffee by White Mountain Coffee Roasters. As a result, in 2019 the Company incurred $1.0 million of external professional and fees related to the FTC's anti-trust review. In 2018 the Company recorded transaction income of an $8.5 million break-up fee, net of $4.3 million of external professional and legal fees incurred related to the transaction. No transaction-related expenses/(income) were recorded in fiscal 2020. 4. Commitments and Contingencies Litigation-related expenses (income) Litigation-related expenses in 2020 reflect $3.3 million of expenses incurred or accrued in connection with a class action lawsuit filed against the Company in the first quarter of 2019. In 2019, litigation-related expenses consist of $59,000 of expenses related to the class action lawsuit filed in the first quarter of 2019 , offset by a $93,000 expense reduction based on the difference between the previously recorded liability and the final settlement payment from a class action lawsuit filed against the Company in the third quarter of 2017. We currently are subject to two lawsuits related to Massachusetts Retail Food Code section 35249.5 and a lawsuit alleging breach of contract. At this time, it is not feasible to predict the outcome of or range of loss, should a loss occur, from these proceedings or the expenses we will incur in 2021 to defend these proceedings. Babson Coffee Corporation Income Statement (thousands) Expenses Cost of Sales and Related Occupancy Expense Operating expenses Transaction Related Expenses/(income) Litigation Related Expenses General and Administrative Expenses Depreciation and Amortization Expenses Total costs and expenses from operations Income from operations Gain on sale of marketable securities Interest Income, net Income before income taxes Income tax provisions Net Income Effective tax rate Net Income per share Basic Diluted Shares used in calculation of earnings per share: Projected Operating Income for 2021 Projected EBITDA for 2021 Balance Sheet (thousands) Ratios Gross Margin Operating Margin; or EBIT Margin Profit Margin Collection Period, or Days in Receivables Inventory Days on Hand, or Days in Inventory Payables Period, or Days in Payables Return on Assets/Return on Equity Profit Margin Asset Turnover Return on Assets Financial Leverage Return on Equity Current Ratio Quick Ratio Times Interest Earned Cash Operating Cycle Question 2: In the shaded box below, provide an evaluation of Babson's financial performance for the years 20182020 Question 4: Based solely on your forecasted income statement and balance sheet for 2021, prepare the Operations Section, only, of the 2021 Statement of Cash Flows. Statement of Cash Flows Operations (add lines if needed) Cash flow from Operations 1. Compute financial ratios for Babson Coffee for the years 2018-2020 in the space provided in the spreadsheet. You may insert any additional ratios you feel are necessary to evaluate Babson's financial performance (Question \#2). 2. Provide an evaluation of Babson Coffee's financial performance for the years 2018-2020. Use the shaded box within the same spreadsheet. 3. Using the information contained in the excerpts from Babson Coffee's 10-K as well as your analysis of trends over the past three years, forecast the highlighted (in yellow) amounts on the Income Statement and Balance Sheet for 2021. 4. Based solely on your forecasted income statement and balance sheet for 2021, prepare the Operations Section, only, of the 2021 Statement of Cash Flows. We expect the specialty coffee industry, fueled by continued consumer interest in high-quality coffee and related products, to continue to grow. We believe that growth opportunities exist in all. of our distribution channels and that our specialty segment can expand to geographies where we do not have a retail presence. In retail, we expect to continue to open new retail stores in strategic west coast locations that meet our demographic profile. In grocery, we expect to continue to expand into new markets in addition to the western U.S., eastern seaboard and other selected markets, although the full extent of our penetration will depend upon the growth of the specialty coffee category in those markets. We will continue to work with distributors and companies to expand our presence in the foodservice and office environment.| In the past two years, we have experienced a dramatic increase in the price volatility of Arabica coffee traded on the New York Board of Trade. Since May 2019, commodity coffee prices have been extremely volatile ranging from a low of $1.32 per pound and peaking at $3.05 per pound. While we do not purchase coffee on the commodity markets, price movements in the commodity trading of Arabica coffee beans impact the prices we pay. As a result of this volatility, in 2020 , the price that we paid for our coffee was 41% higher per pound than what we had paid in 2019 and that increased cost negatively affected our profitability as coffee costs as a percent of sales increased from 15% to 21%. We expect the coffee commodity market to continue to be challenging as the market continues to be influenced by worldwide supply and demand, the relative strength of the dollar, speculative trading and weather. In. order to have visibility to our costs for the future, we typically fix the price of our coffee needs for the next six to 12 months by purchasing and holding large inventories of green coffee and utilizing future fixed price purchase commitments. As of January 1, 2021, our inventory and fixed price commitments are sufficient for virtually all of our anticipated 2021 needs at a cost approximately 12% higher per pound than 2020 (with year-over-year increases expected to be higher earlier in the year than later). For 2020, in addition to benefiting from price increases, we also benefited from several cost reduction and growth initiatives that offset most of these coffee cost increases. We have historically raised prices in each of our channels to offset the higher costs and we did increase prices in each channel in 2019 or 2020 . If we are unable to pass along these costs to our customers or find other means to offset coffee or other inflation, our profitability and margins will be negatively affected. Additionally, if prices of commodity coffee fall dramatically, we will be required to fulfill our commitments for our future contracts that may result in us purchasing coffee at prices substantially above the market price which could negatively impact our competitiveness in the marketplace and our profitability. We will continue to monitor these markets and take actions we feel are appropriate to minimize the impact on us in the short and long-term. 1. 2021 revenue growth is expected to be much higher for specialty sales than retail sales, reflecting recent trends. Specialty sales are expected to increase by 2628% over 2020 levels. Retail locations will increase and sales in this segment are expected to grow by approximately 6%. 2. Due to the increase in coffee prices and given purchase commitments that are already in place through 2021 , we expect cost of sales to increase by 12%. 3. In order to offset these commodity price increases, Babson Coffee has implemented a number of process improvements designed to create cost efficiencies in our purchasing, inventory management, and other administrative functions. These improvements should result in general and administrative expense increasing by only 4.5% in 2021 . 4. Accounts receivable and inventories increased significantly in 2020 and we expect this to continue, but at a slightly slower pace. Receivables should grow by approximately 30% while inventories will increase by 45%. 5. Babson Coffee continues to be under significant pressure from our suppliers to help them manage through the recent recession. Consequently, we anticipate a further decrease in our payables balance of approximately 6%. Consolidated Statements of Cash Flows 1. Summary of Significant Accounting Policies _Abridged Revenue Recognition - Net revenue is recognized at the point of sale of our Company-operated retail stores. Revenue from specialty, consisting of packaged coffee sales through home delivery, grocery, foodservice and office accounts, is recognized when the product is received by the customer. The majority of the Company's distribution to grocery stores is through employees or independent distributors who do not take title to the inventory and revenue recognized when the product is delivered to the grocer. In addition, we have distributors where title does pass to the distributor and revenue net of commissions is recorded upon delivery to the distributor. Revenue from stored value gift cards and home delivery advanced payments is recognized upon redemption or receipt of product by the customer. Cash received in advance of product delivery is recorded in deferred revenue on the accompanying consolidated balance sheets. Cost of sales and related occupancy expenses - Cost of sales and related occupancy expenses consist primarily of coffee and other product costs. It also includes plant manufacturing (including depreciation), freight and distribution costs. Occupancy expenses include rent and related expenses, such as utilities. Operating expenses - Operating expenses consist of both retail store and specialty operating costs, such as employee labor and benefits, independent distributor commissions, repairs and maintenance, supplies, training, travel and banking and card processing fees Preopening costs - Costs incurred in connection with the start-up and promotion of new store openings are expensed as incurred. Advertising costs - Advertising costs are expensed as incurred. Advertising expense was $5,387,000, $4,248,000 and $4,944,000 in 2020,2019 , and 2018, respectively. Impairment of Long-Lived Assets - When facts and circumstances indicate that the carrying of long-lived assets may be impaired, an evaluation of recoverability is performed by comparing the carrying values of the assets to projected future cash flows in addition to other quantitative and qualitative analyses. Property, plant and equipment assets are grouped at the lowest level for which there are identifiable cash flows when assessing impairment. Cash flows for retail net assets are identified at the individual store level. Upon indication that the carrying values of such assets may not be recoverable, the Company recognizes an impairment loss by a charge against current operations for an amount equal to the difference between the carrying value and the assets' fair value. The fair value of the retail net asset is estimated using the discounted cash flows of the assets. Long lived assets to be disposed of are reported at the lower of their carrying amount or fair value, less estimated costs to sell. The Company considers the economic environment when estimating future cash flows. Impairment losses for underperforming stores of $128,000, $630,000 and $460,000 were recorded during 2020, 2019 and 2018, respectively, which were classified as operating expenses on the consolidated statements of income. 1. Property, Plant and Equipment Property, plant and equipment consist of the following at year-end 2020 and 2019 (in thousands): Depreciation expense was $17,871,000 in 2020, $17,926,000 in 2019 , and $17,194,000 in 2018. Construction in progress includes retail stores under construction and related fixtures, manufacturing plant equipment, and other capital projects not yet placed in service. 2. Store Closures The Company closed four underperforming retail locations in December, 2020. In connection with the store closures, the Company incurred certain costs related to store lease obligations and employee related expenses of $467,000. There is no balance for closed store reserves as of December 31, 2019. The Company incurred the following costs in connection with the December 31, 2020 store closures: As a result of the December 2020 store closures, the Company recorded a non-cash fixed asset write-off of $885,000, which is classified in operating expense in the accompanying consolidated statements of income. The employee related expenses and lease obligation costs included in the table above are classified in operating expenses and cost of sales and related occupancy expenses, respectively, in the accompanying consolidated statements of income. 3. Transaction-related Expenses/(Income) In 2018, the Company terminated a definitive agreement to acquire Olin Coffee. In 2019 the Company responded to a subpoena it received from the Federal Trade Commission (FTC) in connection with the FTC's anti-trust review of the acquisition of Olin Coffee by White Mountain Coffee Roasters. As a result, in 2019 the Company incurred $1.0 million of external professional and fees related to the FTC's anti-trust review. In 2018 the Company recorded transaction income of an $8.5 million break-up fee, net of $4.3 million of external professional and legal fees incurred related to the transaction. No transaction-related expenses/(income) were recorded in fiscal 2020. 4. Commitments and Contingencies Litigation-related expenses (income) Litigation-related expenses in 2020 reflect $3.3 million of expenses incurred or accrued in connection with a class action lawsuit filed against the Company in the first quarter of 2019. In 2019, litigation-related expenses consist of $59,000 of expenses related to the class action lawsuit filed in the first quarter of 2019 , offset by a $93,000 expense reduction based on the difference between the previously recorded liability and the final settlement payment from a class action lawsuit filed against the Company in the third quarter of 2017. We currently are subject to two lawsuits related to Massachusetts Retail Food Code section 35249.5 and a lawsuit alleging breach of contract. At this time, it is not feasible to predict the outcome of or range of loss, should a loss occur, from these proceedings or the expenses we will incur in 2021 to defend these proceedings. Babson Coffee Corporation Income Statement (thousands) Expenses Cost of Sales and Related Occupancy Expense Operating expenses Transaction Related Expenses/(income) Litigation Related Expenses General and Administrative Expenses Depreciation and Amortization Expenses Total costs and expenses from operations Income from operations Gain on sale of marketable securities Interest Income, net Income before income taxes Income tax provisions Net Income Effective tax rate Net Income per share Basic Diluted Shares used in calculation of earnings per share: Projected Operating Income for 2021 Projected EBITDA for 2021 Balance Sheet (thousands) Ratios Gross Margin Operating Margin; or EBIT Margin Profit Margin Collection Period, or Days in Receivables Inventory Days on Hand, or Days in Inventory Payables Period, or Days in Payables Return on Assets/Return on Equity Profit Margin Asset Turnover Return on Assets Financial Leverage Return on Equity Current Ratio Quick Ratio Times Interest Earned Cash Operating Cycle Question 2: In the shaded box below, provide an evaluation of Babson's financial performance for the years 20182020 Question 4: Based solely on your forecasted income statement and balance sheet for 2021, prepare the Operations Section, only, of the 2021 Statement of Cash Flows. Statement of Cash Flows Operations (add lines if needed) Cash flow from Operations