Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1/ Compute Price Variance (Flex Budget Variance) 2/ Compute Quantity Variance (volume Variance) 3/ Compute Static Budget Variance 4/ Compute Mix and Quantity Variance 5/

1/ Compute Price Variance (Flex Budget Variance)

2/ Compute Quantity Variance (volume Variance)

3/ Compute Static Budget Variance

4/ Compute Mix and Quantity Variance

5/ Compute Market size and Market share variance

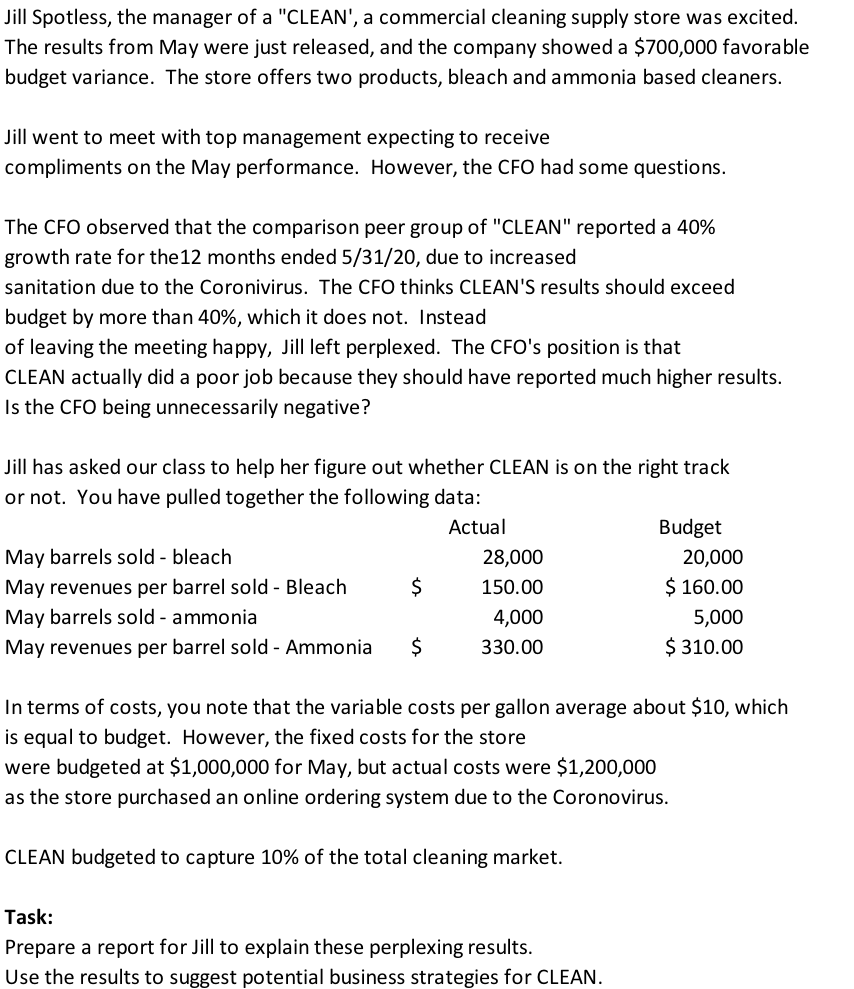

Jill Spotless, the manager of a "CLEAN', a commercial cleaning supply store was excited. The results from May were just released, and the company showed a $700,000 favorable budget variance. The store offers two products, bleach and ammonia based cleaners. Jill went to meet with top management expecting to receive compliments on the May performance. However, the CFO had some questions. The CFO observed that the comparison peer group of "CLEAN" reported a 40% growth rate for the 12 months ended 5/31/20, due to increased sanitation due to the Coronivirus. The CFO thinks CLEAN'S results should exceed budget by more than 40%, which it does not. Instead of leaving the meeting happy, Jill left perplexed. The CFO's position is that CLEAN actually did a poor job because they should have reported much higher results. Is the CFO being unnecessarily negative? Jill has asked our class to help her figure out whether CLEAN is on the right track or not. You have pulled together the following data: Actual Budget May barrels sold - bleach 28,000 20,000 May revenues per barrel sold - Bleach $ 150.00 $ 160.00 May barrels sold - ammonia 4,000 5,000 May revenues per barrel sold - Ammonia $ 330.00 $ 310.00 In terms of costs, you note that the variable costs per gallon average about $10, which is equal to budget. However, the fixed costs for the store were budgeted at $1,000,000 for May, but actual costs were $1,200,000 as the store purchased an online ordering system due to the Coronovirus. CLEAN budgeted to capture 10% of the total cleaning market. Task: Prepare a report for Jill to explain these perplexing results. Use the results to suggest potential business strategies for CLEANStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started