Answered step by step

Verified Expert Solution

Question

1 Approved Answer

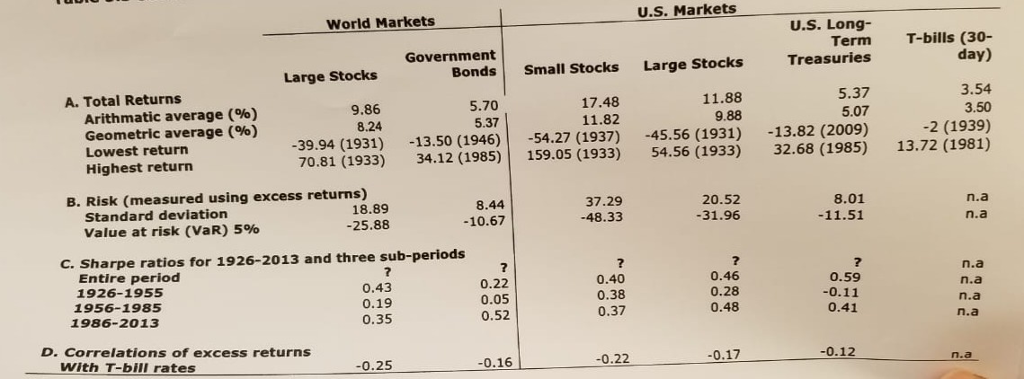

1) compute Sharpe ratios of all assets and rank them 2) based on your ranking, choose an asset class with best risk/ return tradeoff, why?

1) compute Sharpe ratios of all assets and rank them

2) based on your ranking, choose an asset class with best risk/ return tradeoff, why?

World Markets U.S. Markets U.S. Long- Term T-bills (30- day) Government Bonds Small Stocks Large Stocks Treasuries 5.37 5.07 Large Stocks A. Total Returns 3.54 3.50 -2 (1939) 70.81 (1933) 34.12 (1985) 159.05 (1933) 54.56 (1933) 32.68 (1985) 13.72 (1981) 9.86 8.24 5.70 5.37 17.48 11.82 11.88 9.88 Arithmatic average (96) Geometric average (%) Lowest return Highest return -39.94 (1931) 13.50 (1946) 54.27 (1937) 45.56 (1931) -13.82 (2009) B. Risk (measured using excess returns) 18.89 -25.88 8.44 -10.67 37.29 -48.33 20.52 -31.96 Standard deviation Value at risk (VaR) 5% 8.01 -11.51 n.a n.a C. Sharpe ratios for 1926-2013 and three sub-periods Entire period 1926-1955 0.43 0.19 0.35 7 0.22 0.05 0.52 0.40 0.38 0.37 0.46 0.28 0.48 0.59 0.11 0.41 n.a n.a n.a n.a 1956-1985 1986-2013 D. Correlations of excess returns With T-bill rates -0.25 0.16 -0.22 0.17 0.12 n.a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started